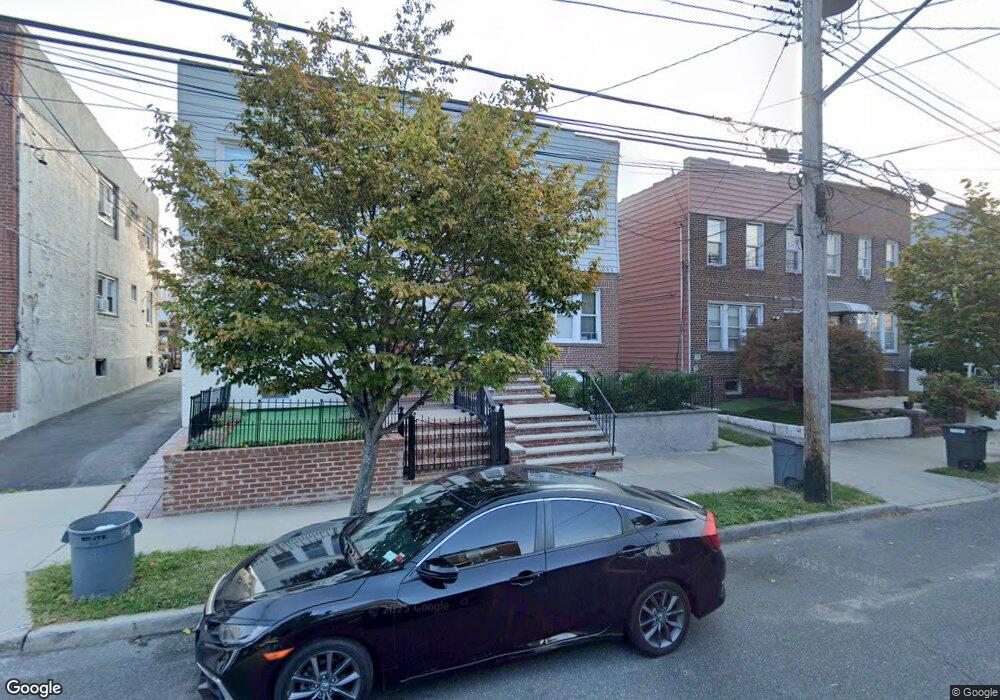

282 Calhoun Ave Unit 2 Bronx, NY 10465

Throgs Neck-Edgewater Park NeighborhoodEstimated Value: $659,554 - $854,000

3

Beds

1

Bath

1,000

Sq Ft

$796/Sq Ft

Est. Value

About This Home

This home is located at 282 Calhoun Ave Unit 2, Bronx, NY 10465 and is currently estimated at $796,139, approximately $796 per square foot. 282 Calhoun Ave Unit 2 is a home located in Bronx County with nearby schools including P.S. 72 - Dr. William Dorney, Herbert H Lehman High School, and St. Frances de Chantal School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 20, 2021

Sold by

Pirraglia Edward

Bought by

Estevez Ramona

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$714,285

Outstanding Balance

$647,539

Interest Rate

2.7%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$148,600

Purchase Details

Closed on

Apr 2, 2019

Sold by

282 Calhoun Llc

Bought by

Pirraglia Edward

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$435,000

Interest Rate

4.3%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 16, 2016

Sold by

Pirraglia Edward

Bought by

282 Calhoun Llc

Purchase Details

Closed on

Oct 11, 2001

Sold by

Caiola Benny and Caiola Mary

Bought by

Pirraglia Edward and Pirraglia Lisa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,750

Interest Rate

6.64%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Estevez Ramona | $740,000 | -- | |

| Pirraglia Edward | -- | -- | |

| 282 Calhoun Llc | -- | -- | |

| Pirraglia Edward | -- | -- | |

| Pirraglia Edward | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Estevez Ramona | $714,285 | |

| Previous Owner | Pirraglia Edward | $435,000 | |

| Previous Owner | Pirraglia Edward | $215,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,115 | $36,634 | $8,028 | $28,606 |

| 2024 | $7,115 | $35,424 | $8,304 | $27,120 |

| 2023 | $6,787 | $33,420 | $6,735 | $26,685 |

| 2022 | $6,672 | $44,400 | $9,480 | $34,920 |

| 2021 | $6,810 | $37,380 | $9,480 | $27,900 |

| 2020 | $6,462 | $37,680 | $9,480 | $28,200 |

| 2019 | $6,175 | $36,900 | $9,480 | $27,420 |

| 2018 | $5,677 | $27,850 | $8,561 | $19,289 |

| 2017 | $5,677 | $27,850 | $8,030 | $19,820 |

| 2016 | $5,391 | $26,966 | $8,989 | $17,977 |

| 2015 | $2,949 | $25,440 | $10,500 | $14,940 |

| 2014 | $2,949 | $24,600 | $9,965 | $14,635 |

Source: Public Records

Map

Nearby Homes

- 4190 E Tremont Ave

- 249 Calhoun Ave

- 244 Revere Ave

- 285 Logan Ave

- 227 Calhoun Ave

- 238 Swinton Ave

- 416 Revere Ave

- 346 Brinsmade Ave

- 4246 E Tremont Ave

- 426 Calhoun Ave

- 2780 Sampson Ave

- 2832 Harding Ave

- 310 Huntington Ave

- 239 Brinsmade Ave

- 2819 Collis Place

- 449 Revere Ave

- 2976 Lawton Ave

- 2738 Miles Ave

- 2816 Collis Place

- 2866 Dewey Ave

- 282 Calhoun Ave

- 286 Calhoun Ave

- 280 Calhoun Ave

- 280 Calhoun Ave

- 280 Calhoun Ave Unit B

- 280 Calhoun Ave Unit 2

- 288 Calhoun Ave

- 278 Calhoun Ave

- 276 Calhoun Ave

- 290 Calhoun Ave

- 272 Calhoun Ave

- 283 Revere Ave

- 287 Revere Ave Unit 2

- 287 Revere Ave

- 281 Revere Ave

- 281 Revere Ave Unit 2

- 281 Revere Ave Unit 1

- 281 Revere Ave Unit Building

- 289 Revere Ave

- 279 Revere Ave

Your Personal Tour Guide

Ask me questions while you tour the home.