28206 Islet Trail Bonita Springs, FL 34135

Estimated Value: $453,000 - $501,000

2

Beds

2

Baths

1,534

Sq Ft

$311/Sq Ft

Est. Value

About This Home

This home is located at 28206 Islet Trail, Bonita Springs, FL 34135 and is currently estimated at $476,827, approximately $310 per square foot. 28206 Islet Trail is a home located in Lee County with nearby schools including Bonita Springs Elementary School, Spring Creek Elementary School, and Pinewoods Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 15, 2025

Sold by

Judge John P and Judge Rosemary

Bought by

Judge John P and Judge Rosemary

Current Estimated Value

Purchase Details

Closed on

Jun 21, 2013

Sold by

Peters Terry L and Peters Brenda S

Bought by

Judge John P and Judge Rosemary

Purchase Details

Closed on

Mar 31, 2011

Sold by

Federal National Mortgage Association

Bought by

Peters Terry L and Peters Brenda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,400

Interest Rate

4.92%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 18, 2010

Sold by

Bilow Patricia A

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Apr 28, 2005

Sold by

Divosta Homes Lp

Bought by

Bilow Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$217,520

Interest Rate

5.98%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Judge John P | -- | None Listed On Document | |

| Judge John P | $205,000 | Winged Foot Title Llc | |

| Peters Terry L | $148,000 | Attorney | |

| Federal National Mortgage Association | $203,600 | Attorney | |

| Bilow Patricia | $271,900 | American Title Of The Palm B |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peters Terry L | $118,400 | |

| Previous Owner | Bilow Patricia | $217,520 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,530 | $250,417 | -- | -- |

| 2024 | $3,530 | $243,360 | -- | -- |

| 2023 | $3,455 | $236,272 | $0 | $0 |

| 2022 | $3,483 | $229,390 | $0 | $0 |

| 2021 | $3,488 | $234,153 | $47,130 | $187,023 |

| 2020 | $3,520 | $219,634 | $46,250 | $173,384 |

| 2019 | $3,560 | $221,256 | $43,000 | $178,256 |

| 2018 | $3,600 | $222,870 | $43,000 | $179,870 |

| 2017 | $3,453 | $208,203 | $0 | $0 |

| 2016 | $3,432 | $203,921 | $39,100 | $164,821 |

| 2015 | $3,670 | $184,606 | $38,300 | $146,306 |

| 2014 | -- | $180,101 | $38,000 | $142,101 |

| 2013 | -- | $158,111 | $34,100 | $124,011 |

Source: Public Records

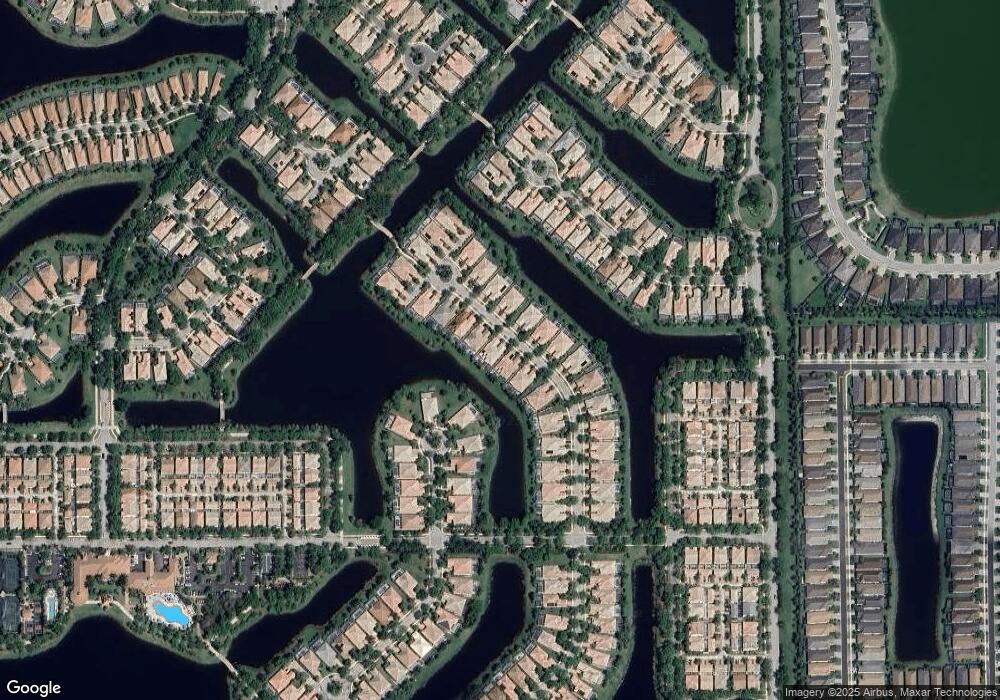

Map

Nearby Homes

- 28263 Koi Way

- 28283 Koi Way

- 28169 Herring Way

- 15395 Laughing Gull Ln

- 28058 Dorado Dr

- 15586 Latitude Dr

- 15330 Bonefish Trail

- 15326 Bonefish Trail

- 28422 Capraia Dr

- 28260 Villagewalk Cir

- 28467 Villagewalk Blvd

- 15282 Sea Star Ln

- 28485 Capraia Dr

- 16391 Bonita Landing Cir

- 16061 Starglazer Place

- 16019 Marche Place

- 28202 Islet Trail

- 28212 Islet Trail

- 28198 Islet Trail

- 28216 Islet Trail

- 28194 Islet Trail

- 28220 Islet Trail

- 28190 Islet Trail

- 28224 Islet Trail

- 28186 Islet Trail

- 28207 Islet Trail

- 28228 Islet Trail

- 28203 Islet Trail

- 28213 Islet Trail

- 28199 Islet Trail

- 28217 Islet Trail

- 28195 Islet Trail

- 28182 Islet Trail

- 28221 Islet Trail

- 28191 Islet Trail

- 28236 Islet Trail