284 Mananai Place Unit 3 Honolulu, HI 96818

Aliamanu-Salt Lake NeighborhoodEstimated Value: $597,000 - $631,029

2

Beds

3

Baths

1,005

Sq Ft

$606/Sq Ft

Est. Value

About This Home

This home is located at 284 Mananai Place Unit 3, Honolulu, HI 96818 and is currently estimated at $608,757, approximately $605 per square foot. 284 Mananai Place Unit 3 is a home located in Honolulu County with nearby schools including Makalapa Elementary School, Aliamanu Middle School, and Adm. Arthur W. Radford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2013

Sold by

Yamagata Davd Masaru and Yamagata Jamie Mei Lin

Bought by

Kosasa Patricia Louise Wood and The Silver Linings808 Trust

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$53,185

Interest Rate

4.17%

Mortgage Type

New Conventional

Estimated Equity

$555,572

Purchase Details

Closed on

Jan 22, 2007

Sold by

Association Of Apartment Owners Of Cross

Bought by

Yamagata Dave Masamru and Yamagata Jamie Mei Lin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$330,350

Interest Rate

6.1%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kosasa Patricia Louise Wood | $420,000 | Fam | |

| Kosasa Patricia Louise Wood | $420,000 | Fam | |

| Yamagata Dave Masamru | $65,666 | Tg |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kosasa Patricia Louise Wood | $200,000 | |

| Closed | Kosasa Patricia Louise Wood | $200,000 | |

| Previous Owner | Yamagata Dave Masamru | $330,350 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,171 | $646,300 | $337,300 | $309,000 |

| 2024 | $2,171 | $620,400 | $319,500 | $300,900 |

| 2023 | $1,967 | $631,800 | $319,500 | $312,300 |

| 2022 | $1,967 | $562,100 | $292,900 | $269,200 |

| 2021 | $1,799 | $514,100 | $284,000 | $230,100 |

| 2020 | $1,793 | $512,300 | $284,000 | $228,300 |

| 2019 | $1,827 | $522,100 | $325,200 | $196,900 |

| 2018 | $1,834 | $524,000 | $278,800 | $245,200 |

| 2017 | $1,635 | $467,000 | $227,700 | $239,300 |

| 2016 | $1,689 | $482,700 | $209,100 | $273,600 |

| 2015 | $1,637 | $467,700 | $204,400 | $263,300 |

| 2014 | $1,189 | $461,500 | $195,100 | $266,400 |

Source: Public Records

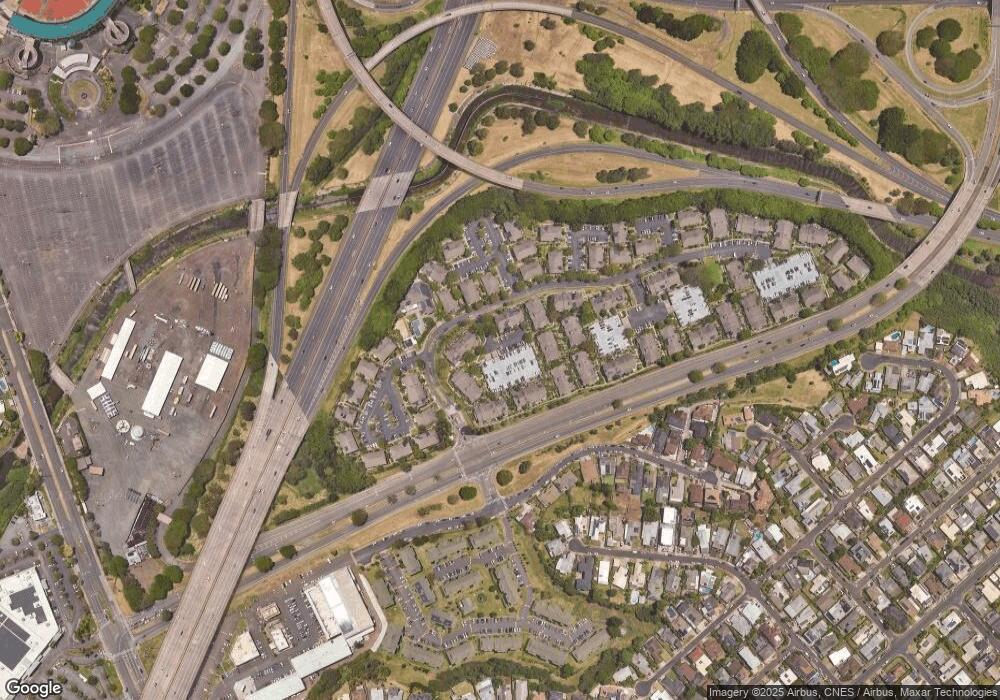

Map

Nearby Homes

- 239 Mananai Place Unit 54

- 432 Mananai Place Unit 18C

- 429 Mananai Place Unit 39U

- 504 Mananai Place Unit 14

- 509 Mananai Place Unit 33

- 1233 Ala Alii St Unit 5

- 585 Mananai Place Unit 26

- 594 Mananai Place Unit 21T

- 626 Mananai Place Unit 626C

- 625 Mananai Place Unit 24A

- 1543 Mahie Place

- 645 Mananai Place Unit 23BD

- 1447 Uila St

- 1238 Molehu Dr

- 1224 Haloa Dr

- 99-535 Opukea St

- 99-530 Halawa Heights Rd Unit A

- 99-633 Hulumanu St

- 99-146 Kulina St

- 4280 Salt Lake Blvd Unit J29

- 284 Mananai Place Unit 3

- 284 Mananai Place Unit B

- 284 Mananai Place Unit R

- 284 Mananai Place Unit W

- 284 Mananai Place Unit G

- 284 Mananai Place Unit S

- 306 Mananai Place Unit 4

- 306 Mananai Place Unit G

- 99-306 Mananai Place Unit W

- 99-306 Mananai Place Unit 4A

- 306 Mananai Place Unit 306U

- 306 Mananai Place Unit R

- 306 Mananai Place Unit E

- 262 Mananai Place Unit 2

- 262 Mananai Place Unit 2

- 262 Mananai Place Unit 2C

- 262 Mananai Place Unit 2

- 262 Mananai Place Unit 2H

- 262 Mananai Place Unit 2A

- 262 Mananai Place Unit 2B