28579 Faircrest Way Escondido, CA 92026

Estimated Value: $997,000 - $1,096,000

3

Beds

2

Baths

2,403

Sq Ft

$433/Sq Ft

Est. Value

About This Home

This home is located at 28579 Faircrest Way, Escondido, CA 92026 and is currently estimated at $1,041,578, approximately $433 per square foot. 28579 Faircrest Way is a home located in San Diego County with nearby schools including Reidy Creek Elementary School, Rincon Middle School, and Escondido High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2005

Sold by

Reeves Charles T and Reeves Patricia G

Bought by

Reeves Charles T and Reeves Patricia G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

5.81%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Sep 14, 2005

Sold by

Reeves Charles T and Reeves Patricia G

Bought by

Reeves Charles T and Reeves Patricia G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$72,000

Interest Rate

5.81%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Feb 24, 2000

Sold by

Reeves Charles T and Reeves Patricia G

Bought by

Reeves Charles T and Reeves Patricia G

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reeves Charles T | -- | Chicago Title Co | |

| Reeves Charles T | -- | Chicago Title Co | |

| Reeves Charles T | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Reeves Charles T | $72,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,631 | $316,953 | $109,706 | $207,247 |

| 2024 | $4,631 | $310,739 | $107,555 | $203,184 |

| 2023 | $4,495 | $304,647 | $105,447 | $199,200 |

| 2022 | $4,416 | $298,675 | $103,380 | $195,295 |

| 2021 | $4,296 | $292,819 | $101,353 | $191,466 |

| 2020 | $4,270 | $289,817 | $100,314 | $189,503 |

| 2019 | $4,168 | $284,136 | $98,348 | $185,788 |

| 2018 | $4,043 | $278,566 | $96,420 | $182,146 |

| 2017 | $3,962 | $273,105 | $94,530 | $178,575 |

| 2016 | $3,882 | $267,751 | $92,677 | $175,074 |

| 2015 | $3,700 | $263,730 | $91,285 | $172,445 |

| 2014 | $3,552 | $258,565 | $89,497 | $169,068 |

Source: Public Records

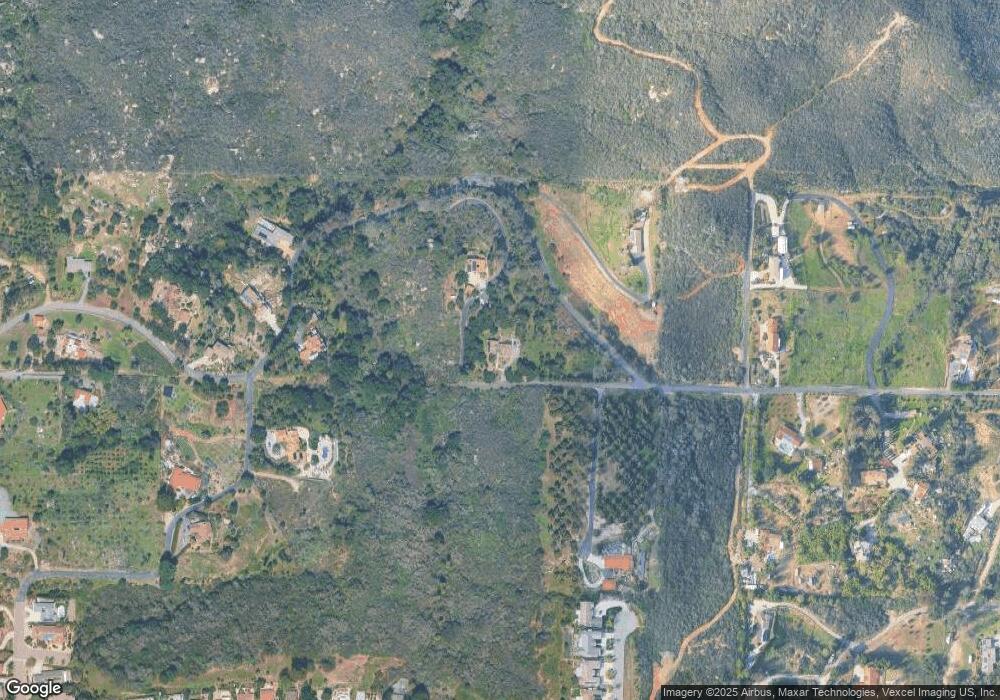

Map

Nearby Homes

- 10700 Meadow Glen Way E

- 0 186-021-39-00 Unit PTP2507126

- Somerset Plan at Wohlford Estates

- Lakemont X Plan at Wohlford Estates

- Concord Plan at Wohlford Estates

- Lakemont Plan at Wohlford Estates

- 10512 Moon View Way

- 10506 Moon View Way

- 28623 Willow Park Rd

- 0 Paseo de Santos Unit 250038471

- 10551 Laurel Path

- 10209 Sage Hill Way

- 10314 Oak Ranch Ln

- 27735 Mountain Meadow Rd Unit 19

- 27725 Mountain Meadow Rd Unit 35

- 11625 Turner Heights Dr

- 28042 Glenmeade Way

- 27636 Mountain Meadow Rd

- 0 Sage Hill Way Unit NDP2510089

- 0 Sage Hill Way Unit NDP2510004

- 28537 Faircrest Way

- 28518 Faircrest Way

- 28405 Faircrest Way

- 28601 Faircrest Way

- 28660 Faircrest Way

- 28377 Faircrest Way

- 28650 Faircrest Way

- 28296 Deep Canyon Dr

- 28371 Faircrest Way

- 28371 Faircrest Way

- 28371 Faircrest Way

- 28371 Faircrest Way

- 28371 Faircrest Way

- 28426 Faircrest Way

- 28450 Faircrest Way

- 28645 Faircrest Way

- 28288 Deep Canyon Dr

- 28633 Faircrest Way

- 28410 Faircrest Way