28750 113th Ave Eagle Bend, MN 56446

Estimated Value: $287,000 - $311,000

3

Beds

--

Bath

812

Sq Ft

$367/Sq Ft

Est. Value

About This Home

This home is located at 28750 113th Ave, Eagle Bend, MN 56446 and is currently estimated at $298,051, approximately $367 per square foot. 28750 113th Ave is a home located in Todd County with nearby schools including John Tartan Elementary School, William & Mary Scherkenbach Elementary School, and Eagle Valley Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 25, 2013

Sold by

Kostelecky Paul R and Kostelecky Kristina M

Bought by

Morrissey Kellen J and Morrissey Felicia B

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,500

Interest Rate

3.51%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 30, 2009

Sold by

Becker Gerald J and Becker Anita M

Bought by

Kostelecky Paul R and Kostelecky Kristina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,500

Interest Rate

5.05%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morrissey Kellen J | $108,500 | Minnewaska Abstract & Title | |

| Kostelecky Paul R | $168,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Morrissey Kellen J | $84,500 | |

| Previous Owner | Kostelecky Paul R | $133,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,474 | $253,500 | $65,000 | $188,500 |

| 2024 | $2,530 | $267,000 | $65,000 | $202,000 |

| 2023 | $2,244 | $258,000 | $65,000 | $193,000 |

| 2022 | $2,248 | $235,300 | $56,000 | $179,300 |

| 2021 | $2,002 | $185,100 | $56,000 | $129,100 |

| 2020 | $2,180 | $169,100 | $44,000 | $125,100 |

| 2019 | $2,186 | $175,500 | $44,000 | $131,500 |

| 2018 | $2,044 | $159,600 | $34,400 | $125,200 |

| 2017 | $1,414 | $152,800 | $34,400 | $118,400 |

| 2016 | $1,652 | $149,500 | $34,400 | $115,100 |

| 2015 | $1,720 | $0 | $0 | $0 |

| 2014 | -- | $0 | $0 | $0 |

Source: Public Records

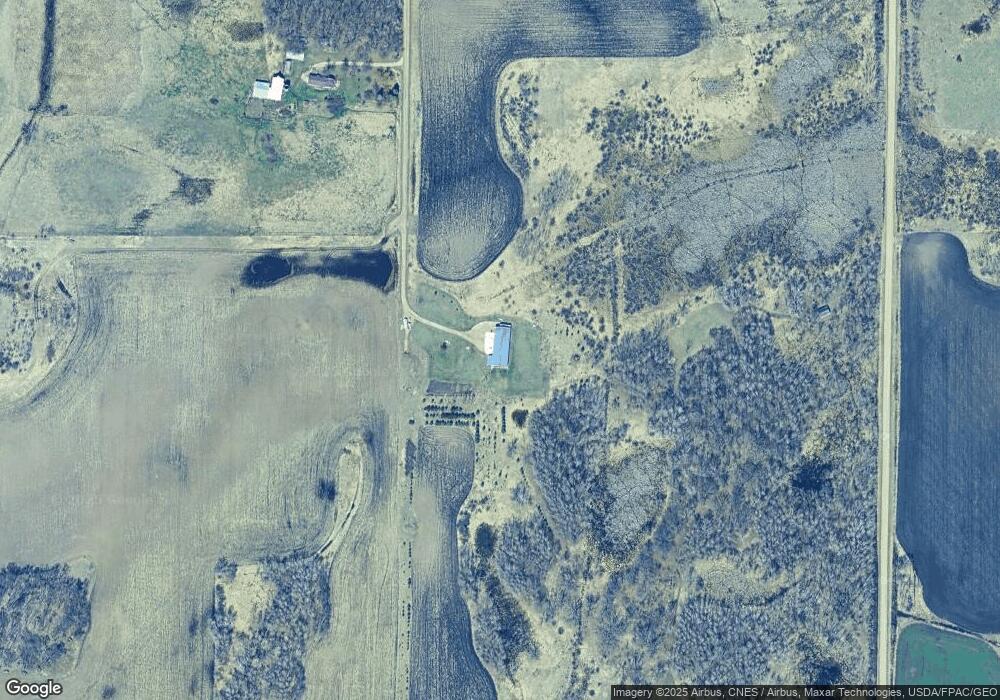

Map

Nearby Homes

- 27154 County 3

- 10929 County Road 14 NE

- Lot 3 County Road 3 NE

- 10061 County Road 5 NE

- Lot 2 Rutten Ln NE

- 16688 248th St

- 22280 County 1

- TBD Sunny Acres Rd NE

- 21204 Ferret Trail

- 486 1st Ave N

- 6432 Botzet Rd NE

- TBD County 1

- XXXX County 1

- 000 Miltona Carlos Rd NE

- 12826 Parview Ln NE

- Lot 2 Buckskin Rd NE

- 18 N Douglas Ave

- 305 South St W

- 200 Central Ave S

- 407 Main Ave