2879 17b Trail Tippecanoe, IN 46570

Estimated Value: $136,000

3

Beds

3

Baths

1,408

Sq Ft

$97/Sq Ft

Est. Value

About This Home

This home is located at 2879 17b Trail, Tippecanoe, IN 46570 and is currently estimated at $136,000, approximately $96 per square foot. 2879 17b Trail is a home located in Marshall County with nearby schools including Triton Elementary School and Triton Junior-Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 24, 2020

Sold by

Schmucker Phillip J and Schmucker Carrie R

Bought by

Sneed Jeffrey and Soriano Anilyn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,323

Outstanding Balance

$245,826

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

-$109,826

Purchase Details

Closed on

Nov 8, 2018

Sold by

Kreft Hunter and Kreft Ana Carla

Bought by

Schmucker Philip J and Schmucker Carrie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$214,700

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jan 13, 2017

Sold by

Irvine Edward D and Irvine Chet A

Bought by

Kreft Hunter and Kreft Ana Carla

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sneed Jeffrey | -- | None Available | |

| Schmucker Philip J | -- | Metropolitan Title In Llc | |

| Kreft Hunter | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sneed Jeffrey | $277,323 | |

| Previous Owner | Schmucker Philip J | $214,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $205 | $23,500 | $21,000 | $2,500 |

| 2022 | $205 | $20,000 | $17,700 | $2,300 |

| 2021 | $155 | $15,400 | $15,400 | $0 |

| 2020 | $144 | $14,800 | $14,800 | $0 |

| 2019 | $192 | $14,000 | $14,000 | $0 |

| 2018 | $53 | $3,800 | $3,800 | $0 |

| 2017 | $217 | $59,800 | $17,800 | $42,000 |

| 2016 | $215 | $61,200 | $18,200 | $43,000 |

| 2014 | $687 | $125,600 | $17,800 | $107,800 |

Source: Public Records

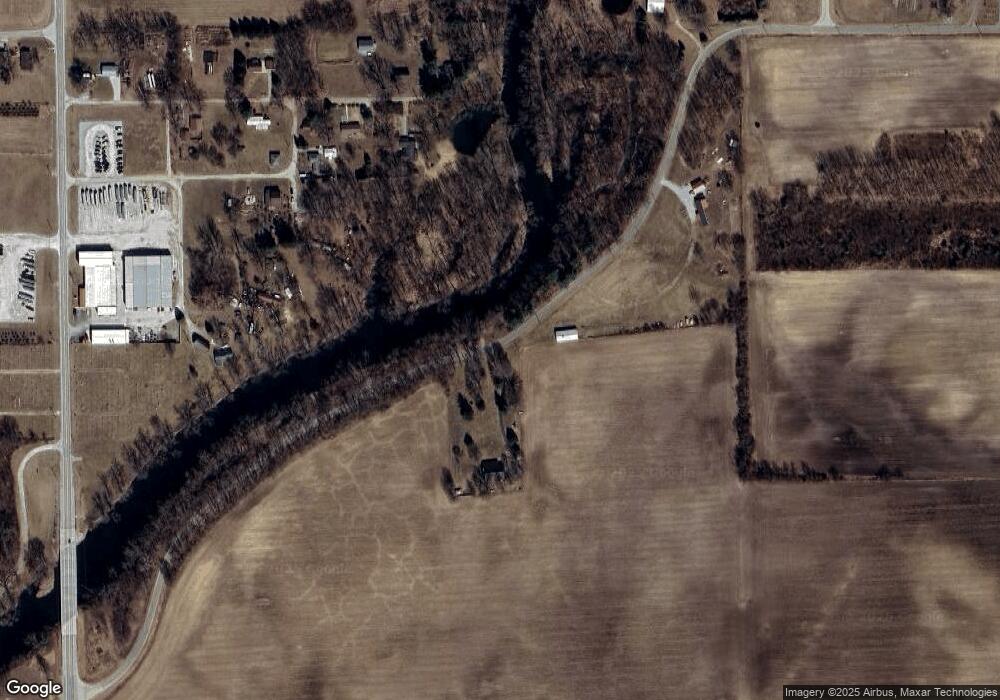

Map

Nearby Homes

- 18448 State Road 331

- 838 17th Rd

- 1350 Route 19

- 10396 W 100 S

- 16855 Hickory Rd

- 519 N Tucker St

- 5226 E 700 N

- 408 W Harrison St

- 206 N Tucker St

- 121 S Pearl St

- 968 Route 19

- 202 W Center St

- 415 N 950 W

- 301 E North St

- 7697 20th Rd

- 203 N Thompson St

- 407 N Harris St

- 106 W Liberty Ave

- 505 Lincoln St

- 7270 Indiana 110