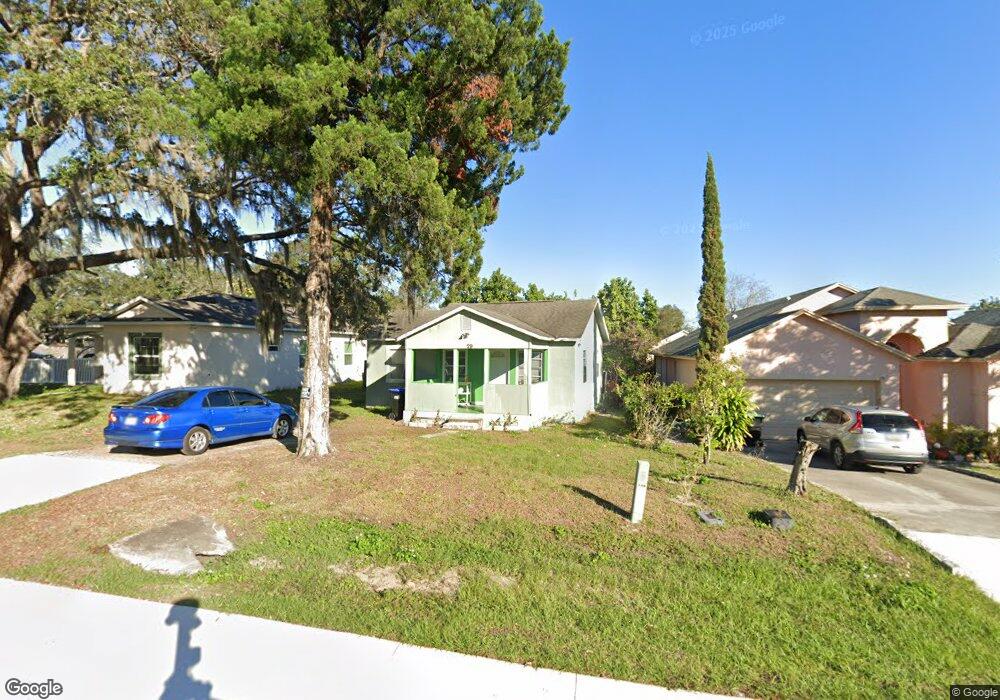

29 N Hart Blvd Orlando, FL 32835

MetroWest NeighborhoodEstimated Value: $144,000 - $211,000

2

Beds

1

Bath

904

Sq Ft

$200/Sq Ft

Est. Value

About This Home

This home is located at 29 N Hart Blvd, Orlando, FL 32835 and is currently estimated at $180,993, approximately $200 per square foot. 29 N Hart Blvd is a home located in Orange County with nearby schools including Oak Hill Elementary, Gotha Middle School, and Olympia High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 6, 2019

Sold by

Deane Louis

Bought by

Deane Louis and Deane Bibi Shakeela

Current Estimated Value

Purchase Details

Closed on

Sep 7, 2010

Sold by

Housing & Neighborhood Devel Services Of

Bought by

Dean Louis

Purchase Details

Closed on

May 4, 2010

Sold by

Us Bank National Association

Bought by

Housing & Neighborhood Development Servi

Purchase Details

Closed on

Jan 22, 2010

Sold by

Rodrigues Wagner and Rodrigues Susana

Bought by

Us Bank Naitonal Association

Purchase Details

Closed on

Jun 13, 2005

Sold by

Garrett Victor and Garrett Monica

Bought by

Rodrigues Wagner and Rodrigues Susana

Purchase Details

Closed on

May 9, 2002

Sold by

Loretta M Thacker I

Bought by

Garret Victor and Garret Monica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$28,000

Interest Rate

7.18%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Deane Louis | -- | None Available | |

| Dean Louis | $12,000 | First Platinum Title Agency | |

| Housing & Neighborhood Development Servi | -- | Rels Title | |

| Us Bank Naitonal Association | -- | Attorney | |

| Rodrigues Wagner | $95,500 | Grace Title Inc | |

| Garret Victor | $30,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Garret Victor | $20,225 | |

| Previous Owner | Garret Victor | $28,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,586 | $53,430 | -- | -- |

| 2024 | $1,478 | $48,573 | -- | -- |

| 2023 | $1,478 | $119,582 | $60,000 | $59,582 |

| 2022 | $1,296 | $101,757 | $52,000 | $49,757 |

| 2021 | $1,056 | $67,797 | $47,000 | $20,797 |

| 2020 | $944 | $60,697 | $39,900 | $20,797 |

| 2019 | $959 | $60,697 | $39,900 | $20,797 |

| 2018 | $785 | $38,338 | $21,750 | $16,588 |

| 2017 | $678 | $28,126 | $12,000 | $16,126 |

| 2016 | $583 | $20,599 | $9,000 | $11,599 |

| 2015 | $588 | $20,043 | $9,000 | $11,043 |

| 2014 | $650 | $20,928 | $7,800 | $13,128 |

Source: Public Records

Map

Nearby Homes

- 0 S Buena Vista Ave Unit MFRO6351745

- 325 N Hart Blvd

- 326 N Lancelot Ave

- 329 N Hart Blvd

- 330 S Lancelot Ave

- 338 S Hart Blvd

- 6227 Melbourne Ave

- 415 S Lancelot Ave

- 310 Parrish Ave

- 230 Lucile Way

- 450 S Buena Vista Ave

- 302 Lucile Way

- 307 S Hiawassee Rd

- 7003 Harbor Point Blvd

- 431 N Hiawassee Rd

- 20 Winter Ridge Cir

- 525 S Buena Vista Ave

- 7237 Harbor Heights Cir

- 6071 Westgate Dr Unit 321

- 5910 Old Winter Garden Rd

- 31 N Hart Blvd

- 25 N Hart Blvd

- 21 N Hart Blvd

- 30 N Buena Vista Ave

- 26 N Buena Vista Ave

- 34 N Buena Vista Ave

- 103 N Hart Blvd

- 32 N Hart Blvd

- 13 N Hart Blvd

- 28 N Hart Blvd

- 107 N Hart Blvd

- 104 N Buena Vista Ave

- 24 N Hart Blvd

- 9 N Hart Blvd

- 16 N Hart Blvd

- 112 N Buena Vista Ave

- 5 N Hart Blvd

- 35 N Lancelot Ave

- 131 N Hart Blvd

- 17 N Hart Blvd