29030 143rd St NW Zimmerman, MN 55398

Estimated Value: $516,000 - $599,000

3

Beds

2

Baths

1,380

Sq Ft

$399/Sq Ft

Est. Value

About This Home

This home is located at 29030 143rd St NW, Zimmerman, MN 55398 and is currently estimated at $550,340, approximately $398 per square foot. 29030 143rd St NW is a home located in Sherburne County with nearby schools including Princeton Primary School, Princeton Intermediate School, and Princeton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2011

Sold by

Quiggle Gretchen and Quiggle Scott

Bought by

Koscisinlak Jared and Koscisinlak Shae

Current Estimated Value

Purchase Details

Closed on

Oct 21, 2010

Sold by

Mortgage Electronic Registration Systems

Bought by

Koscielniak Jared and Quiggle Shae

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,874

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

Dec 10, 2004

Sold by

Golden Oaks Construction Inc

Bought by

Leuer Paul F

Purchase Details

Closed on

Aug 19, 2004

Sold by

Cbs Custom Homes Llc

Bought by

Golden Oaks Construction Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Koscisinlak Jared | -- | Patrict Title Agency Llc | |

| Koscielniak Jared | $160,000 | Custom Title Services Llc | |

| Leuer Paul F | $294,590 | -- | |

| Golden Oaks Construction Inc | $69,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Koscielniak Jared | $157,874 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,192 | $539,300 | $132,700 | $406,600 |

| 2024 | $4,146 | $496,000 | $120,900 | $375,100 |

| 2023 | $4,094 | $506,800 | $120,900 | $385,900 |

| 2022 | $3,850 | $492,600 | $108,200 | $384,400 |

| 2020 | $3,492 | $357,700 | $60,200 | $297,500 |

| 2019 | $3,396 | $323,700 | $55,600 | $268,100 |

| 2018 | $3,256 | $307,900 | $51,400 | $256,500 |

| 2017 | $2,902 | $282,200 | $49,900 | $232,300 |

| 2016 | $2,484 | $258,000 | $44,300 | $213,700 |

| 2015 | $2,304 | $203,600 | $39,400 | $164,200 |

| 2014 | $2,010 | $188,100 | $33,700 | $154,400 |

| 2013 | -- | $165,400 | $31,200 | $134,200 |

Source: Public Records

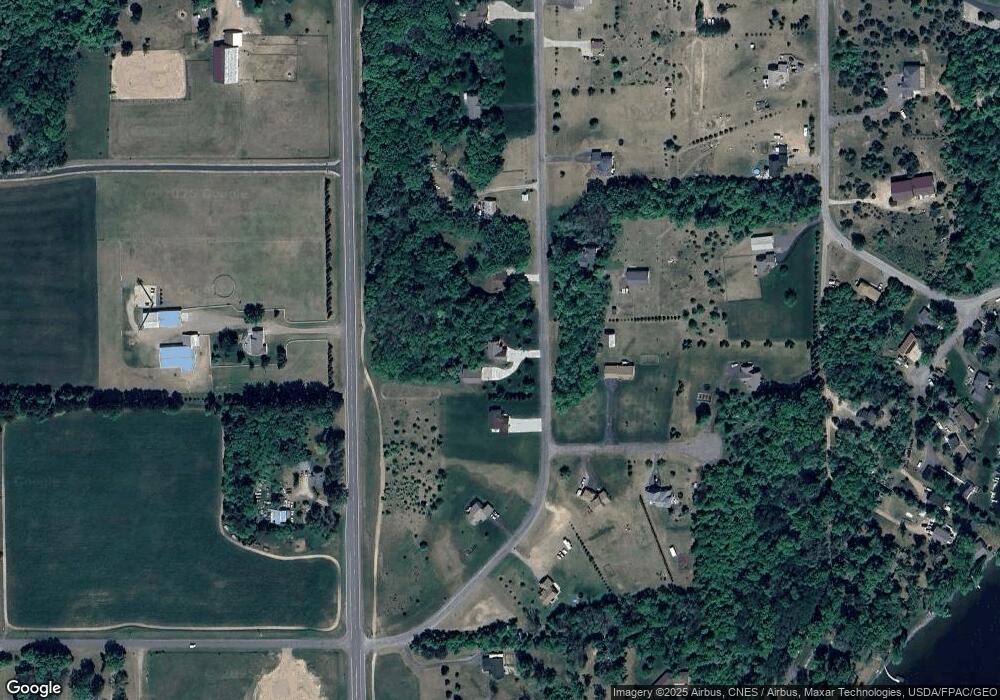

Map

Nearby Homes

- 28510 142nd St NW

- 14320 284th Ave NW

- XXX Lot 3 283rd Ave NW

- 28222 Elk Lake Rd E

- 29441 136th St

- 14941 283rd Ln NW

- XXX 283rd Ave NW

- 28337 134th St NW

- 13940 301st Ave

- 13396 295th Ave NW

- 12901 295th Ave NW

- LOT 2, BLK 4 131st St NW

- TBD 288th Ave NW

- 29708 131st St

- 30668 139th St NW

- 30801 144th St NW

- 28840 Highway 169

- 28308 125th St NW

- 13905 272nd Ave NW

- 12314 283rd Ave NW

- 29006 143rd St NW

- 29046 143rd St NW

- 29088 143rd St NW

- 29059 143rd St NW

- 14338 289th Ave NW

- 14285 290th Ave NW

- 29093 143rd St NW

- 14261 290th Ave NW

- 29093 143rd St NW

- 29122 143rd St NW

- 14341 289th Ave NW

- 14240 290th Ave NW

- 29018 142nd St NW

- 29023 142nd St NW

- 28958 144th St NW

- 29014 144th St NW

- 14375 289th Ave NW

- 29106 142nd St NW

- 29140 143rd St NW

- 14139 290th Ave NW