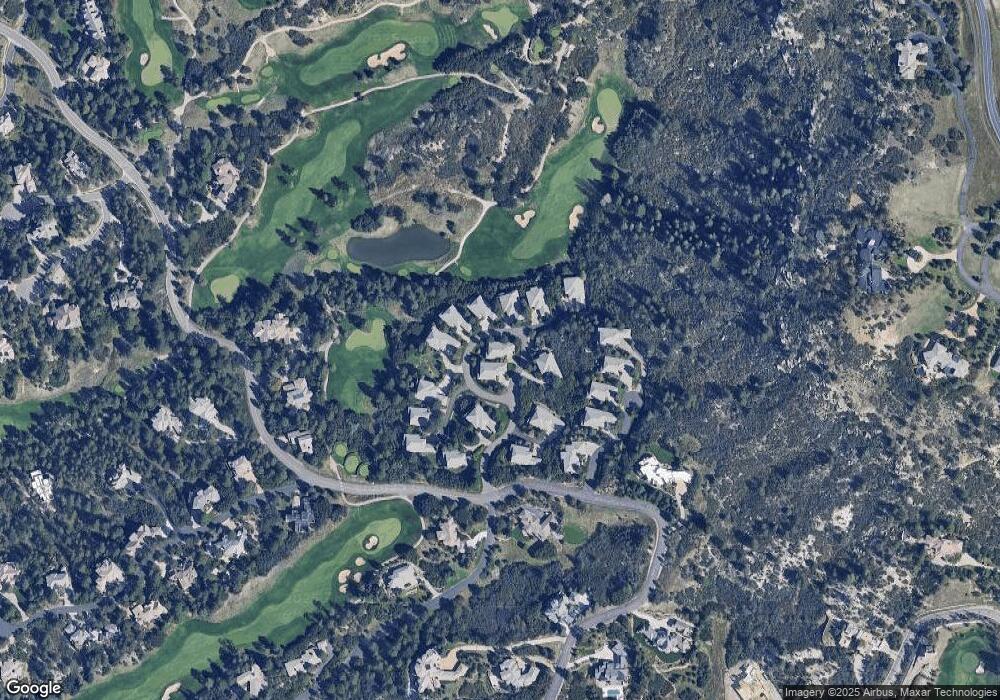

2906 Fairway View Ct Castle Rock, CO 80108

Estimated Value: $1,155,799 - $1,740,000

1

Bed

2

Baths

2,200

Sq Ft

$668/Sq Ft

Est. Value

About This Home

This home is located at 2906 Fairway View Ct, Castle Rock, CO 80108 and is currently estimated at $1,469,450, approximately $667 per square foot. 2906 Fairway View Ct is a home located in Douglas County with nearby schools including Buffalo Ridge Elementary School, Rocky Heights Middle School, and Rock Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2010

Sold by

Gritzmacher Richard Grey

Bought by

Gritzmacher Richard O and Hayes Carolyn L

Current Estimated Value

Purchase Details

Closed on

Dec 22, 1998

Sold by

Oakwood/Harvard Communities

Bought by

Remainder Trust

Purchase Details

Closed on

Sep 28, 1998

Sold by

Oakwood/Harvard Communities Llc

Bought by

Ladonna B Gritzmacher Remainder Trust

Purchase Details

Closed on

Apr 22, 1998

Sold by

Fidelity Castle Pines Ltd

Bought by

Oakwood Harvard Communities Llc

Purchase Details

Closed on

Apr 8, 1998

Sold by

Fidelity Castle Pines

Bought by

Oakwood Harvard Communities Co

Purchase Details

Closed on

Jan 1, 1997

Sold by

Castle Pines Fidelity Assoc

Bought by

Fidelity Castle Pines

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gritzmacher Richard O | -- | None Available | |

| Remainder Trust | -- | -- | |

| Ladonna B Gritzmacher Remainder Trust | $534,735 | Land Title | |

| Oakwood Harvard Communities Llc | $150,000 | -- | |

| Oakwood Harvard Communities Co | $150,000 | -- | |

| Fidelity Castle Pines | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,698 | $84,730 | $22,160 | $62,570 |

| 2023 | $8,767 | $84,730 | $22,160 | $62,570 |

| 2022 | $6,203 | $61,310 | $14,560 | $46,750 |

| 2021 | $6,439 | $61,310 | $14,560 | $46,750 |

| 2020 | $6,466 | $63,130 | $12,120 | $51,010 |

| 2019 | $6,485 | $63,130 | $12,120 | $51,010 |

| 2018 | $6,290 | $60,830 | $8,850 | $51,980 |

| 2017 | $5,957 | $60,830 | $8,850 | $51,980 |

| 2016 | $5,239 | $54,450 | $9,660 | $44,790 |

| 2015 | $5,331 | $56,590 | $9,660 | $46,930 |

| 2014 | $6,307 | $52,290 | $15,920 | $36,370 |

Source: Public Records

Map

Nearby Homes

- 910 Equinox Dr

- 218 Hidden Valley Ln

- 811 Moffat Ct

- 122 Silver Leaf Way

- Residence 4 Plan at The Village at Castle Pines - The Summit at Castle Pines

- Residence 1 Plan at The Village at Castle Pines - The Summit at Castle Pines

- Residence 3 Plan at The Village at Castle Pines - The Summit at Castle Pines

- Residence 2 Plan at The Village at Castle Pines - The Summit at Castle Pines

- 6186 Oxford Peak Ln

- 6188 Oxford Peak Ln

- 15 Castle Pines Dr N

- 1009 Hummingbird Dr Unit B2

- 3311 Klondike Place

- 6192 Oxford Peak Ln

- 937 Aztec Dr

- 6194 Oxford Peak Ln

- 99 Coulter Place

- 6196 Oxford Peak Ln

- 3122 Ramshorn Dr

- 6190 Massive Peak Cir

- 2913 Fairway View Ct

- 2914 Fairway View Ct

- 2905 Fairway View Ct

- 2912 Fairway View Ct

- 2911 Fairway View Ct

- 2902 Fairway View Ct

- 2915 Fairway View Ct

- 2910 Fairway View Ct

- 2904 Fairway View Ct

- 2916 Fairway View Ct

- 2909 Fairway View Ct

- 2903 Fairway View Ct

- 2901 Fairway View Ct

- 2919 Cliffside Ct

- 2908 Fairway View Ct

- 2921 Cliffside Ct

- 2920 Cliffside Ct

- 2917 Cliffside Ct

- 135 Capulin Place

- 136 Capulin Place