2912 Everglow Ct San Jose, CA 95127

Ryan NeighborhoodEstimated Value: $583,305 - $779,000

3

Beds

1

Bath

1,000

Sq Ft

$659/Sq Ft

Est. Value

About This Home

This home is located at 2912 Everglow Ct, San Jose, CA 95127 and is currently estimated at $659,076, approximately $659 per square foot. 2912 Everglow Ct is a home located in Santa Clara County with nearby schools including Thomas P. Ryan Elementary School, Ocala Middle School, and James Lick High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2002

Sold by

Hernandez Joe P and Escobar Taylor

Bought by

Monterrosas Edilberto and Monterrosas Martha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,000

Interest Rate

6.12%

Mortgage Type

Balloon

Purchase Details

Closed on

Sep 8, 1999

Sold by

Mendez David V and Mendez Paula

Bought by

Hernandez Joe P and Escobar Taylor

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,414

Interest Rate

7.89%

Mortgage Type

FHA

Purchase Details

Closed on

Jan 26, 1995

Sold by

Deguia Flora S and Elgincolin Leticia S

Bought by

Mendez David V and Mendez Paula

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$126,750

Interest Rate

9.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monterrosas Edilberto | $285,000 | Alliance Title Company | |

| Hernandez Joe P | $194,000 | Fidelity National Title Co | |

| Mendez David V | $133,500 | First American Title Guarant | |

| Paraiso Helen S | -- | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Monterrosas Edilberto | $228,000 | |

| Previous Owner | Hernandez Joe P | $192,414 | |

| Previous Owner | Mendez David V | $126,750 | |

| Closed | Monterrosas Edilberto | $42,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,808 | $412,752 | $165,098 | $247,654 |

| 2024 | $6,808 | $404,660 | $161,861 | $242,799 |

| 2023 | $6,808 | $396,727 | $158,688 | $238,039 |

| 2022 | $6,529 | $388,949 | $155,577 | $233,372 |

| 2021 | $6,292 | $381,324 | $152,527 | $228,797 |

| 2020 | $6,149 | $377,415 | $150,964 | $226,451 |

| 2019 | $5,973 | $370,015 | $148,004 | $222,011 |

| 2018 | $5,886 | $362,760 | $145,102 | $217,658 |

| 2017 | $5,895 | $355,648 | $142,257 | $213,391 |

| 2016 | $5,565 | $348,675 | $139,468 | $209,207 |

| 2015 | $5,553 | $343,439 | $137,374 | $206,065 |

| 2014 | $3,924 | $249,000 | $99,600 | $149,400 |

Source: Public Records

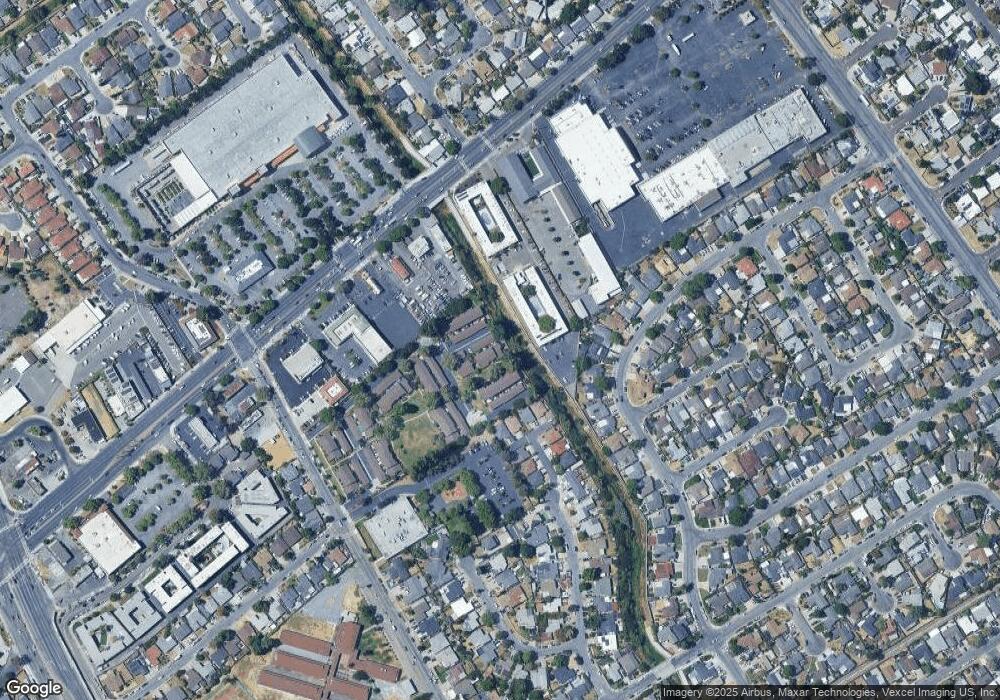

Map

Nearby Homes

- 10281 Murtha Dr

- 10230 Griffith St

- 567 Nordyke Dr

- 1651 Estates Ct

- 1122 Lancelot Ln

- 3253 Arthur Ave

- 13612 Emilie Dr

- 3305 Hickerson Dr

- 2428 Barlow Ave

- 769 Peter Pan Ave

- 3341 Hickerson Dr

- 3014 Florence Ave

- 14440 Victoria Ct

- 2925 Florence Ave Unit 82

- 2925 Florence Ave Unit 67

- 2925 Florence Ave Unit 17

- 1310 Park Pleasant Cir

- 1701 S Capitol Ave

- 2493 Alfred Way

- 10150 Clayton Rd

- 2910 Everglow Ct

- 2908 Everglow Ct

- 2906 Everglow Ct

- 2904 Everglow Ct

- 2891 Singing Rain Place

- 2885 Singing Rain Place

- 2889 Singing Rain Place

- 2887 Singing Rain Place

- 2911 Everglow Ct

- 2902 Everglow Ct

- 2909 Everglow Ct

- 2883 Singing Rain Place

- 2907 Everglow Ct

- 2905 Everglow Ct

- 2903 Everglow Ct

- 2881 Singing Rain Place

- 2901 Everglow Ct

- 2856 Singing Rain Place

- 1177 Sundown Ln

- 1181 Sundown Ln