2915 Sierra Crest Way Hacienda Heights, CA 91745

Estimated Value: $714,885 - $761,000

4

Beds

3

Baths

1,695

Sq Ft

$436/Sq Ft

Est. Value

About This Home

This home is located at 2915 Sierra Crest Way, Hacienda Heights, CA 91745 and is currently estimated at $738,721, approximately $435 per square foot. 2915 Sierra Crest Way is a home located in Los Angeles County with nearby schools including Grazide Elementary School, Mesa Robles School, and Glen A. Wilson High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 19, 2005

Sold by

Park Hyung Mo

Bought by

Dauz Adelina G

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$374,250

Outstanding Balance

$199,305

Interest Rate

5.68%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$539,416

Purchase Details

Closed on

Aug 27, 2001

Sold by

Carlos Armando

Bought by

Park Hyung Mo and Park Hyun Sook

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$202,400

Interest Rate

6.5%

Purchase Details

Closed on

Apr 25, 1997

Sold by

Renfroe Royce

Bought by

Carlos Armando and Carlos Judy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$159,049

Interest Rate

7.94%

Mortgage Type

FHA

Purchase Details

Closed on

Nov 14, 1996

Sold by

Renfroe Royce

Bought by

Renfroe Royce R and The Royce R Renfroe Trust

Purchase Details

Closed on

May 28, 1996

Sold by

Renfroe Linda

Bought by

Renfroe Royce R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dauz Adelina G | $485,000 | Stewart Title | |

| Park Hyung Mo | $253,000 | Chicago Title | |

| Carlos Armando | $162,500 | American Title Ins Co | |

| Renfroe Royce R | -- | -- | |

| Renfroe Royce R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dauz Adelina G | $374,250 | |

| Previous Owner | Park Hyung Mo | $202,400 | |

| Previous Owner | Carlos Armando | $159,049 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,411 | $260,319 | $159,554 | $100,765 |

| 2024 | $3,411 | $255,216 | $156,426 | $98,790 |

| 2023 | $3,330 | $250,212 | $153,359 | $96,853 |

| 2022 | $3,233 | $245,306 | $150,352 | $94,954 |

| 2021 | $3,170 | $240,497 | $147,404 | $93,093 |

| 2019 | $3,078 | $233,366 | $143,033 | $90,333 |

| 2018 | $2,982 | $228,791 | $140,229 | $88,562 |

| 2016 | $2,753 | $219,909 | $134,785 | $85,124 |

| 2015 | $2,703 | $216,607 | $132,761 | $83,846 |

| 2014 | $2,666 | $212,365 | $130,161 | $82,204 |

Source: Public Records

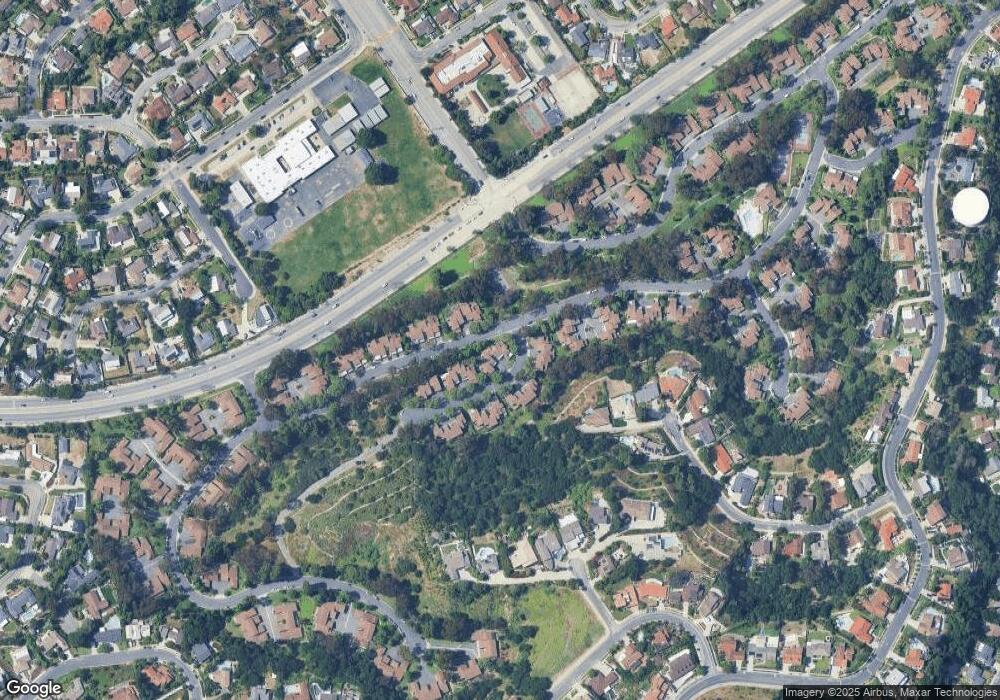

Map

Nearby Homes

- 16182 Sierra Pass Way

- 16311 Sierra Trail Ct

- 16060 Villa Flores Dr

- 16325 Sierra Trail Ct

- 2719 S Stimson Ave

- 2995 Leopold Ave

- 2809 Ilopango Dr

- 2424 Kiska Ave

- 2440 Amelgado Dr

- 15949 Maracaibo Place

- 15813 Lonecrest Dr

- 2082 Salto Dr

- 15751 La Moine St

- 16109 Mesa Robles Dr

- 15712 Los Altos Dr

- 2300 S Hacienda Blvd Unit D11

- 2300 S Hacienda Blvd Unit C2

- 2300 S Hacienda Blvd Unit B2

- 2021 Elderway Dr

- 2521 Mountainview Ct

- 2917 Sierra Crest Way

- 2919 Sierra Crest Way

- 2921 Sierra Crest Way

- 1607 Sierra Pass Way

- 2904 Sierra Crest Way

- 2910 Sierra Crest Way

- 2908 Sierra Crest Way

- 2929 Sierra Crest Way

- 2906 Sierra Crest Way

- 2914 Sierra Crest Way

- 16139 Sierra Pass Way

- 2931 Sierra Crest Way

- 2920 Sierra Crest Way

- 2916 Sierra Crest Way

- 2918 Sierra Crest Way

- 16137 Sierra Pass Way

- 2933 Sierra Crest Way

- 2924 Sierra Crest Way

- 16133 Sierra Pass Way

- 16135 Sierra Pass Way