2920 Old Oak Tree Way Rocklin, CA 95765

Whitney Oaks NeighborhoodEstimated Value: $622,029 - $734,000

4

Beds

2

Baths

1,806

Sq Ft

$383/Sq Ft

Est. Value

About This Home

This home is located at 2920 Old Oak Tree Way, Rocklin, CA 95765 and is currently estimated at $692,257, approximately $383 per square foot. 2920 Old Oak Tree Way is a home located in Placer County with nearby schools including Valley View Elementary, Granite Oaks Middle, and Rocklin High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 6, 2005

Sold by

Araneta Enrique and Araneta Titania

Bought by

Araneta Enrique G

Current Estimated Value

Purchase Details

Closed on

Apr 7, 2003

Sold by

Piepmeier Jerry Dee and Piepmeier Susan

Bought by

Araneta Enrique

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,600

Outstanding Balance

$103,019

Interest Rate

4.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$589,238

Purchase Details

Closed on

May 18, 2000

Sold by

Lennar Renaissance Inc

Bought by

Piepmeier Jerry Dee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$197,417

Interest Rate

8.22%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Araneta Enrique G | -- | -- | |

| Araneta Enrique | $337,000 | Financial Title Company | |

| Piepmeier Jerry Dee | $247,000 | North American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Araneta Enrique | $269,600 | |

| Previous Owner | Piepmeier Jerry Dee | $197,417 | |

| Closed | Piepmeier Jerry Dee | $37,015 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,645 | $488,066 | $173,788 | $314,278 |

| 2023 | $5,645 | $469,116 | $167,041 | $302,075 |

| 2022 | $5,460 | $459,918 | $163,766 | $296,152 |

| 2021 | $6,454 | $450,901 | $160,555 | $290,346 |

| 2020 | $6,350 | $441,000 | $157,000 | $284,000 |

| 2019 | $6,297 | $437,529 | $155,794 | $281,735 |

| 2018 | $6,119 | $421,000 | $149,900 | $271,100 |

| 2017 | $6,015 | $406,000 | $144,600 | $261,400 |

| 2016 | $5,812 | $394,000 | $140,300 | $253,700 |

| 2015 | $5,746 | $390,000 | $138,900 | $251,100 |

| 2014 | $5,721 | $390,000 | $138,900 | $251,100 |

Source: Public Records

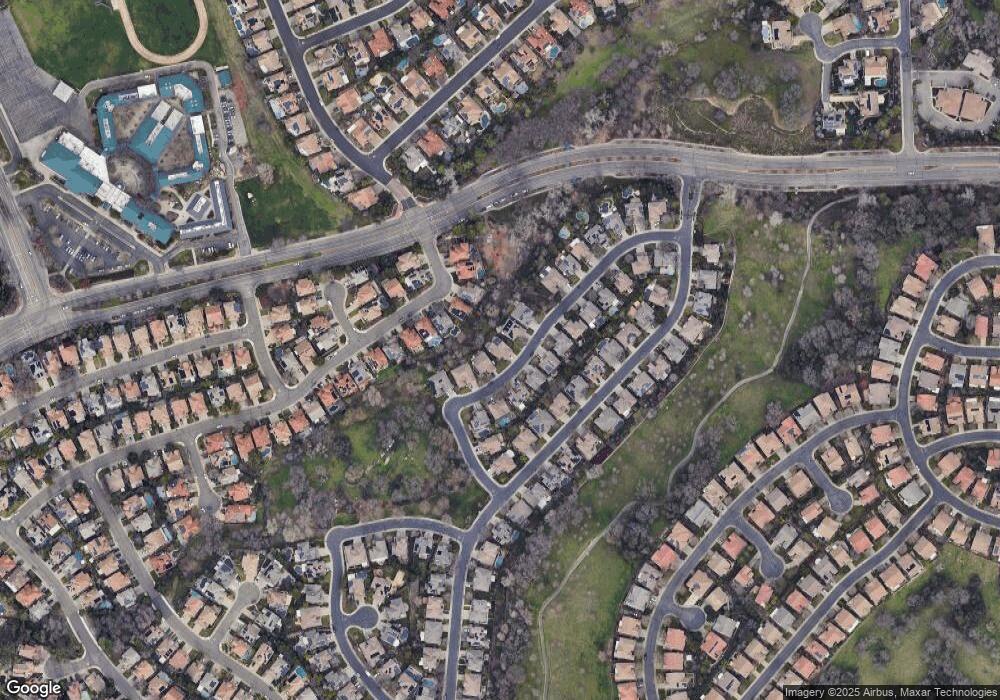

Map

Nearby Homes

- 4834 Blaydon Rd

- 3204 Camelot Dr

- 4811 Hartwick Rd

- 5229 Del Vista Way

- 5217 Del Vista Way

- 2600 Catalina Ct

- 5038 Concord Rd

- 5248 Bay St

- 4022 Legend Dr

- 3203 Thistle Ct

- 4209 Silver Spur Ct

- 3114 Aaron Dr

- 3120 Aaron Dr

- 2601 Wyckford Ct

- 5112 Stratton Ct

- 2596 Clubhouse Dr W

- 3962 Rawhide Rd

- 5362 Delta Dr

- 5013 Bradford Dr

- 5247 Silver Peak Ln

- 2918 Old Oak Tree Way

- 2922 Old Oak Tree Way

- 2916 Old Oak Tree Way

- 2924 Old Oak Tree Way

- 2919 Old Oak Tree Way

- 2921 Old Oak Tree Way

- 2917 Old Oak Tree Way

- 4807 Blaydon Rd

- 2923 Old Oak Tree Way

- 2915 Old Oak Tree Way

- 4809 Blaydon Rd

- 4805 Blaydon Rd

- 2926 Old Oak Tree Way

- 2925 Old Oak Tree Way

- 4811 Blaydon Rd

- 2818 Hillcrest Rd

- 2820 Hillcrest Rd

- 2816 Hillcrest Rd

- 4803 Blaydon Rd

- 2912 Old Oak Tree Way