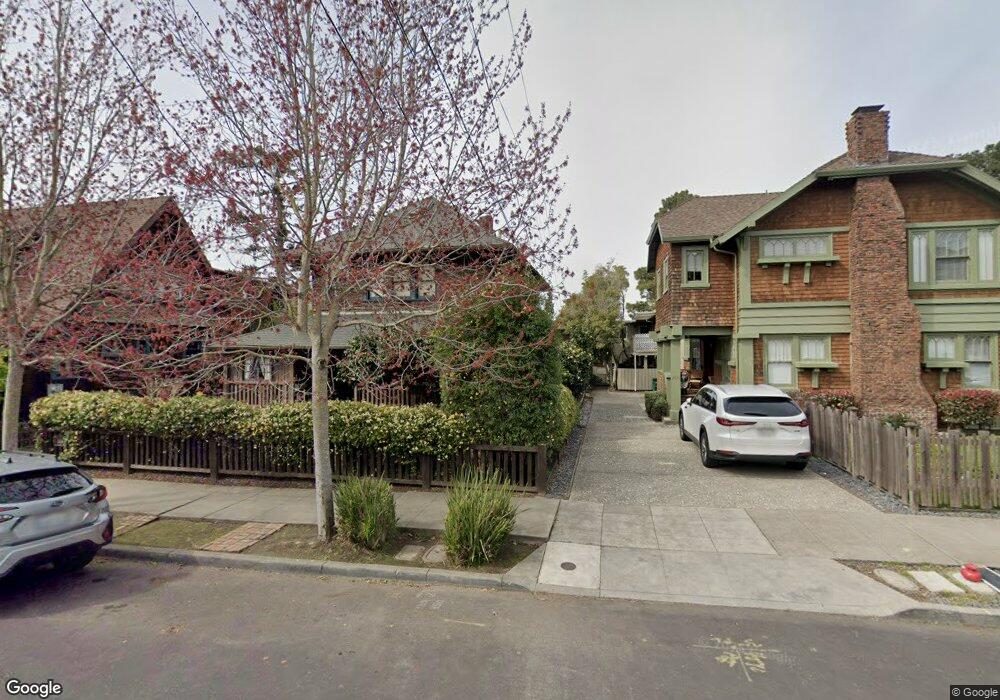

2922 Hillegass Ave Unit D Berkeley, CA 94705

Elmwood NeighborhoodEstimated Value: $502,304 - $744,000

1

Bed

1

Bath

630

Sq Ft

$965/Sq Ft

Est. Value

About This Home

This home is located at 2922 Hillegass Ave Unit D, Berkeley, CA 94705 and is currently estimated at $608,076, approximately $965 per square foot. 2922 Hillegass Ave Unit D is a home located in Alameda County with nearby schools including Emerson Elementary School, John Muir Elementary School, and Malcolm X Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 15, 1996

Sold by

Oreilly William C and Simon Ruth

Bought by

Handley A Lisa

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$7,327

Interest Rate

8.39%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$600,749

Purchase Details

Closed on

Sep 29, 1994

Sold by

Karp Larry S and Smith Mark D

Bought by

Oreilly William C and Simon Ruth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,500

Interest Rate

5.5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Handley A Lisa | $115,000 | First American Title Guarant | |

| Oreilly William C | -- | Old Republic Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Handley A Lisa | $100,000 | |

| Previous Owner | Oreilly William C | $84,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,527 | $180,287 | $56,186 | $131,101 |

| 2024 | $3,527 | $176,615 | $55,084 | $128,531 |

| 2023 | $3,442 | $180,015 | $54,004 | $126,011 |

| 2022 | $3,363 | $169,486 | $52,946 | $123,540 |

| 2021 | $3,355 | $166,026 | $51,908 | $121,118 |

| 2020 | $3,156 | $171,253 | $51,376 | $119,877 |

| 2019 | $3,006 | $167,895 | $50,368 | $117,527 |

| 2018 | $2,945 | $164,604 | $49,381 | $115,223 |

| 2017 | $2,816 | $161,377 | $48,413 | $112,964 |

| 2016 | $2,699 | $158,214 | $47,464 | $110,750 |

| 2015 | $2,659 | $155,838 | $46,751 | $109,087 |

| 2014 | $2,632 | $152,786 | $45,836 | $106,950 |

Source: Public Records

Map

Nearby Homes

- 2477 Prince St

- 6446 Colby St

- 2243 Ashby Ave

- 2951 Linden Ave

- 2702 Dana St

- 2319 Ward St

- 2401 Carleton St

- 2543 Chilton Way

- 2732 Parker St

- 2611 Piedmont Ave Unit 4

- 2550 Dana St Unit 2F

- 2537 Ellsworth St

- 2110 Ashby Ave

- 2316 Blake St Unit D

- 629 66th St

- 2509 Dwight Way

- 3050 Shattuck Ave

- 2057 Emerson St

- 2918 Newbury St

- 6555 Shattuck Ave

- 2924 Hillegass Ave Unit 2924

- 2922 Hillegass Ave Unit C

- 2922 Hillegass Ave Unit B

- 2922 Hillegass Ave Unit A

- 2926 Hillegass Ave

- 2920 Hillegass Ave

- 2928 Hillegass Ave

- 2515 Ashby Ave Unit 1

- 2515 Ashby Ave Unit 3

- 2515 Ashby Ave Unit 4

- 2515 Ashby Ave Unit 2

- 2525 Ashby Ave Unit 3

- 2525 Ashby Ave Unit 4

- 2525 Ashby Ave Unit 2

- 2525 Ashby Ave Unit 1

- 2525 Ashby Ave

- 2511 Ashby Ave

- 2914 Hillegass Ave

- 2921 Regent St

- 2929 Hillegass Ave