29519 N Legends Bend Dr Spring, TX 77386

Legends Run NeighborhoodEstimated Value: $292,139 - $328,000

5

Beds

3

Baths

2,630

Sq Ft

$119/Sq Ft

Est. Value

About This Home

This home is located at 29519 N Legends Bend Dr, Spring, TX 77386 and is currently estimated at $313,285, approximately $119 per square foot. 29519 N Legends Bend Dr is a home located in Montgomery County with nearby schools including Bradley Elementary School, York J High School, and Grand Oaks High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2014

Sold by

Coburn Andre

Bought by

American Homes 4 Rent Properties Eight L

Current Estimated Value

Purchase Details

Closed on

Sep 16, 2009

Sold by

Secretary Of Housing & Urban Development

Bought by

Coburn Andre

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$122,334

Interest Rate

5.2%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 10, 2009

Sold by

Wells Fargo Bank Na

Bought by

The Secretary Of Housing & Urban Develop

Purchase Details

Closed on

Mar 3, 2009

Sold by

Covington Valerie S and Roberts Reginald

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

Dec 5, 2003

Sold by

Kb Home Lone Star Lp

Bought by

Roberts Reginald and Covington Valerie S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$155,558

Interest Rate

5.94%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| American Homes 4 Rent Properties Eight L | -- | Rtt | |

| Coburn Andre | -- | None Available | |

| The Secretary Of Housing & Urban Develop | -- | None Available | |

| Wells Fargo Bank Na | $208,140 | None Available | |

| Roberts Reginald | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Coburn Andre | $122,334 | |

| Previous Owner | Roberts Reginald | $155,558 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,916 | $308,731 | $42,500 | $266,231 |

| 2024 | $4,916 | $311,248 | $42,500 | $268,748 |

| 2023 | $7,207 | $292,890 | $42,500 | $250,390 |

| 2022 | $7,358 | $278,180 | $42,500 | $235,680 |

| 2021 | $6,033 | $214,020 | $42,500 | $171,520 |

| 2020 | $5,468 | $185,720 | $26,500 | $159,220 |

| 2019 | $5,655 | $187,600 | $26,500 | $161,100 |

| 2018 | $5,366 | $178,000 | $26,500 | $151,500 |

| 2017 | $5,457 | $181,200 | $26,500 | $154,700 |

| 2016 | $5,214 | $173,120 | $26,500 | $146,620 |

| 2015 | $4,570 | $156,700 | $26,500 | $130,200 |

| 2014 | $4,570 | $150,730 | $26,500 | $124,230 |

Source: Public Records

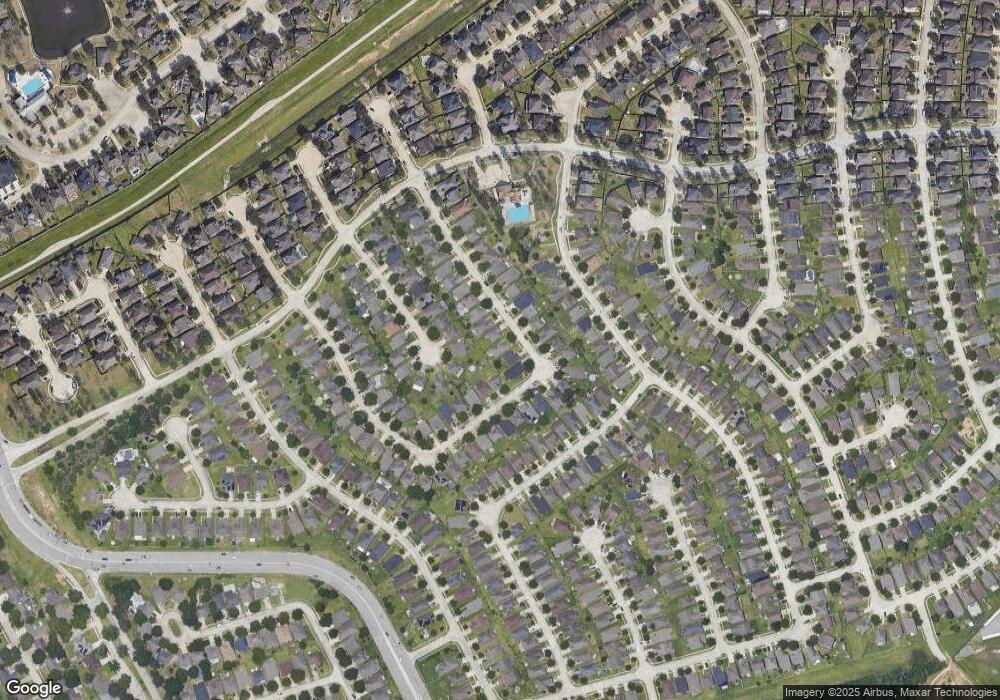

Map

Nearby Homes

- 29607 Legends Green Dr

- 29402 Legends Hill Dr

- 2810 Legends Knoll Dr

- 3315 Legends Landing Dr

- 2814 Legends Crest Dr

- 29314 Legends Meade Dr

- 29306 Atherstone St

- 29410 Binefield St

- 29631 Legends Line Dr

- 29514 Loddington St

- 29610 Loddington St

- 29023 Stone Fox Dr

- 29310 Loddington St

- 3606 Palomar Valley Dr

- 3522 Fuller Bluff Dr

- 3554 Bennett Trails Dr

- 29506 Stapleford St

- 3603 Palomar Valley Dr

- 30102 Canyon Summer Ln

- 3602 Avalon Castle Dr

- 29515 N Legends Bend Dr

- 29523 N Legends Bend Dr

- 29527 N Legends Bend Dr

- 29511 N Legends Bend Dr

- 3035 E Legends Bend Dr

- 29506 Legends Pine Ln

- 29531 N Legends Bend Dr

- 3031 E Legends Bend Dr

- 29502 Legends Pine Ln

- 29518 N Legends Bend Dr

- 29522 N Legends Bend Dr

- 29510 Legends Pine Ln

- 29526 N Legends Bend Dr

- 29535 N Legends Bend Dr

- 3027 E Legends Bend Dr

- 29510 N Legends Bend Dr

- 29530 N Legends Bend Dr

- 29514 Legends Pine Ln

- 29539 N Legends Bend Dr

- 3042 E Legends Bend Dr