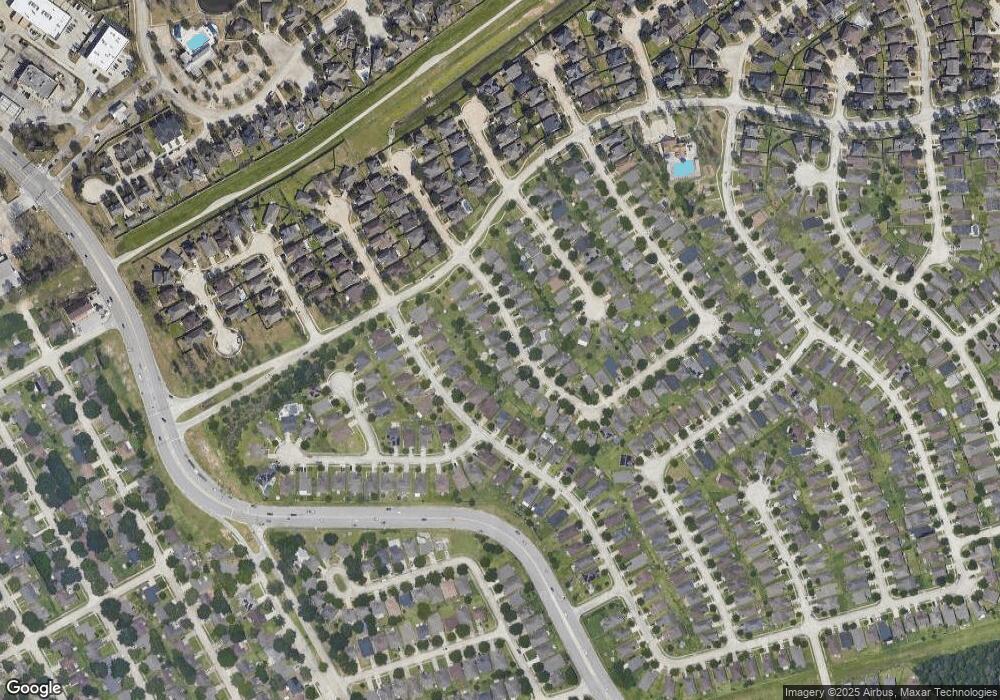

29535 S Legends Bend Dr Spring, TX 77386

Legends Run NeighborhoodEstimated Value: $277,000 - $299,000

3

Beds

3

Baths

2,040

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 29535 S Legends Bend Dr, Spring, TX 77386 and is currently estimated at $287,993, approximately $141 per square foot. 29535 S Legends Bend Dr is a home located in Montgomery County with nearby schools including Bradley Elementary School, York J High School, and Grand Oaks High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 8, 2016

Sold by

Reynolds Robin Diana

Bought by

Guillermo Benjamin R and Guillermo Morgan M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Outstanding Balance

$65,074

Interest Rate

3.98%

Mortgage Type

New Conventional

Estimated Equity

$222,919

Purchase Details

Closed on

Dec 13, 2012

Sold by

Reynolds William

Bought by

Reynolds Robin Diana

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,381

Interest Rate

3.42%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 9, 2004

Sold by

Kb Home Lone Star Lp

Bought by

Reynolds William and Reynolds Robin

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$124,381

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Guillermo Benjamin R | -- | Texas Homeland Title | |

| Reynolds Robin Diana | -- | None Available | |

| Reynolds William | -- | First American Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Guillermo Benjamin R | $153,000 | |

| Previous Owner | Reynolds Robin Diana | $124,381 | |

| Previous Owner | Reynolds William | $124,381 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,050 | $303,525 | $42,500 | $261,025 |

| 2024 | $2,755 | $279,066 | $42,500 | $236,566 |

| 2023 | $2,755 | $260,100 | $42,500 | $254,590 |

| 2022 | $6,254 | $236,450 | $42,500 | $256,840 |

| 2021 | $6,059 | $214,950 | $42,500 | $172,450 |

| 2020 | $6,056 | $205,700 | $26,500 | $181,110 |

| 2019 | $5,637 | $187,000 | $26,500 | $173,640 |

| 2018 | $4,263 | $170,000 | $26,500 | $143,500 |

| 2017 | $5,120 | $170,000 | $26,500 | $143,500 |

| 2016 | $4,570 | $151,750 | $26,500 | $154,460 |

| 2015 | $3,598 | $137,950 | $26,500 | $130,500 |

| 2014 | $3,598 | $125,410 | $26,500 | $98,910 |

Source: Public Records

Map

Nearby Homes

- 29607 Legends Green Dr

- 2810 Legends Knoll Dr

- 29402 Legends Hill Dr

- 2814 Legends Crest Dr

- 3315 Legends Landing Dr

- 29314 Legends Meade Dr

- 29306 Atherstone St

- 29410 Binefield St

- 29514 Loddington St

- 29610 Loddington St

- 29631 Legends Line Dr

- 29310 Loddington St

- 29023 Stone Fox Dr

- 29506 Stapleford St

- 29819 Sparkling Creek Dr

- 30102 Canyon Summer Ln

- 3606 Palomar Valley Dr

- 29118 Raestone St

- 3554 Bennett Trails Dr

- 3603 Palomar Valley Dr

- 29539 S Legends Bend Dr

- 29531 S Legends Bend Dr

- 29543 S Legends Bend Dr

- 29527 S Legends Bend Dr

- 29510 Legends Bluff Dr

- 29514 Legends Bluff Dr

- 29547 S Legends Bend Dr

- 29523 S Legends Bend Dr

- 29506 Legends Bluff Dr

- 29518 Legends Bluff Dr

- 29526 S Legends Bend Dr

- 29530 S Legends Bend Dr

- 29502 Legends Bluff Dr

- 29534 S Legends Bend Dr

- 29522 Legends Bluff Dr

- 29522 S Legends Bend Dr

- 29551 S Legends Bend Dr

- 29519 S Legends Bend Dr

- 29538 S Legends Bend Dr

- 29434 Legends Bluff Dr