2961 Ro Ann Way Oroville, CA 95965

Estimated Value: $171,000 - $427,000

2

Beds

1

Bath

983

Sq Ft

$327/Sq Ft

Est. Value

About This Home

This home is located at 2961 Ro Ann Way, Oroville, CA 95965 and is currently estimated at $321,083, approximately $326 per square foot. 2961 Ro Ann Way is a home located in Butte County with nearby schools including Springs Valley Elementary School and Oroville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 30, 2020

Sold by

Stewart Ronald Kelly

Bought by

Sirivath Arkhom

Current Estimated Value

Purchase Details

Closed on

Oct 29, 2014

Sold by

Lentz Katie Colleen

Bought by

Steward Ronald Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$17,000

Interest Rate

4.2%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 6, 2008

Sold by

Manshack Stacy R

Bought by

Lentz Katie Colleen

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

6.07%

Mortgage Type

Small Business Administration

Purchase Details

Closed on

May 3, 2002

Sold by

Getman David C

Bought by

Getman David C

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sirivath Arkhom | $25,000 | None Available | |

| Steward Ronald Kelly | $195,000 | Mid Valley Title & Escrow Co | |

| Lentz Katie Colleen | $180,000 | Mid Valley Title & Escrow Co | |

| Getman David C | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Steward Ronald Kelly | $17,000 | |

| Previous Owner | Lentz Katie Colleen | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $613 | $64,945 | $64,945 | -- |

| 2024 | $613 | $63,672 | $63,672 | $0 |

| 2023 | $603 | $62,424 | $62,424 | $0 |

| 2022 | $583 | $61,200 | $61,200 | $0 |

| 2021 | $571 | $60,000 | $60,000 | $0 |

| 2020 | $819 | $82,418 | $82,418 | $0 |

| 2019 | $804 | $80,802 | $80,802 | $0 |

| 2018 | $2,173 | $205,969 | $79,218 | $126,751 |

| 2017 | $2,115 | $201,931 | $77,665 | $124,266 |

| 2016 | $2,061 | $197,973 | $76,143 | $121,830 |

| 2015 | $1,984 | $195,000 | $75,000 | $120,000 |

| 2014 | $1,379 | $135,000 | $65,000 | $70,000 |

Source: Public Records

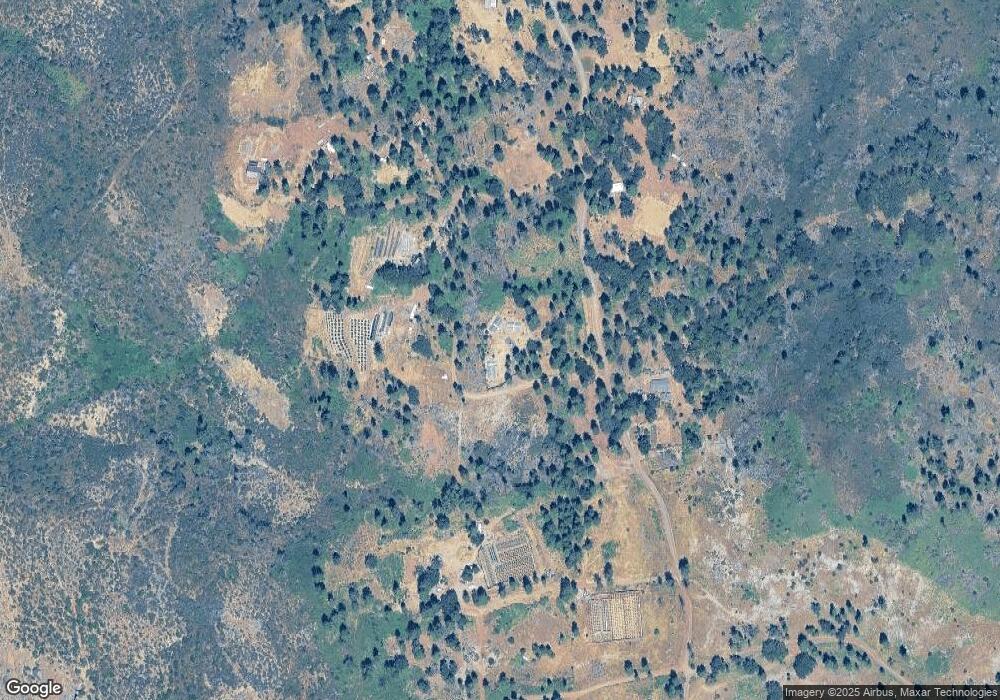

Map

Nearby Homes

- 2395 Stearns Rd

- 5278 Country Club Dr

- 5446 Jensen Ct

- 2381 Clearview Dr

- 5510 Feather River Place

- 1932 Crandall Way

- 5200 Country Club Dr

- 1915 Crandall Way

- 1910 Crandall Way

- 1906 Crandall Way

- 1906 Feather River Place

- 5610 Feather River Place

- 1905 Crandall Way

- 2331 Stearns Rd

- 5768 Pentz Rd

- 2363 Josephs Ct

- 1890 Arrowhead Dr

- 5620 Salida Cir

- 2395 Tokay Ct

- 2388 Tokay Ct

- 2961 Ro-Ann Way

- 12322 Granite Ridge Rd

- 2949 Ro Ann Way

- 12360 Granite Ridge Rd

- 2965 Madre de Oro Place

- 2931 Los Amigos Ln

- 0 Granite Ridge Unit PA201030154

- 0 Granite Ridge Unit PA14019482

- 0 Granite Ridge Rd Unit CH14258389

- 0 Granite Ridge Unit PA15046417

- 0 Granite Ridge Rd Unit CROR24039970

- 0 Granite Ridge Rd Unit OR24039970

- 0 Granite Ridge Rd Unit OR23133531

- 0 Granite Ridge Rd Unit OR22208360

- 0 Granite Ridge Rd Unit 201403140

- 0 Granite Ridge Unit 200602281

- 0 Granite Ridge Unit 201000454

- 2922 Lost Ridge Way

- 12220 Granite Ridge Rd

- 0 Ro-Ann Way Unit PA13059384