29711 Platanus Dr Escondido, CA 92026

Estimated Value: $710,744 - $798,000

3

Beds

3

Baths

1,582

Sq Ft

$471/Sq Ft

Est. Value

About This Home

This home is located at 29711 Platanus Dr, Escondido, CA 92026 and is currently estimated at $744,936, approximately $470 per square foot. 29711 Platanus Dr is a home located in San Diego County with nearby schools including Lilac, Valley Center Middle School, and Valley Center High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2010

Sold by

Poutre Gina

Bought by

Poutre Michael L and Poutre Gina L

Current Estimated Value

Purchase Details

Closed on

Dec 29, 2009

Sold by

Poutre Gina

Bought by

Poutre Gina

Purchase Details

Closed on

Mar 1, 2005

Sold by

Alvarado Steve and Alvarado April

Bought by

Johnston Robert B and Johnston Evalyn J

Purchase Details

Closed on

Oct 30, 2002

Sold by

Alvarado Steve and Recame April A

Bought by

Alvarado Steve

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$236,000

Interest Rate

6.15%

Purchase Details

Closed on

May 3, 1999

Sold by

Capstones Treasure L L C

Bought by

Alvarado Steve and Recame April A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$189,219

Interest Rate

6.92%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Poutre Michael L | -- | None Available | |

| Poutre Gina | -- | None Available | |

| Johnston Robert B | $465,000 | Commerce Title Company | |

| Alvarado Steve | -- | Commonwealth Land Title Co | |

| Alvarado Steve | $190,500 | Commonwealth Land Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Alvarado Steve | $236,000 | |

| Previous Owner | Alvarado Steve | $189,219 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,229 | $426,879 | $137,913 | $288,966 |

| 2024 | $5,229 | $418,509 | $135,209 | $283,300 |

| 2023 | $5,097 | $410,304 | $132,558 | $277,746 |

| 2022 | $5,008 | $402,259 | $129,959 | $272,300 |

| 2021 | $4,891 | $394,372 | $127,411 | $266,961 |

| 2020 | $4,850 | $390,329 | $126,105 | $264,224 |

| 2019 | $4,861 | $382,677 | $123,633 | $259,044 |

| 2018 | $4,724 | $375,174 | $121,209 | $253,965 |

| 2017 | $4,619 | $367,819 | $118,833 | $248,986 |

| 2016 | $4,620 | $360,607 | $116,503 | $244,104 |

| 2015 | $5,234 | $355,192 | $114,754 | $240,438 |

| 2014 | $5,102 | $345,000 | $110,000 | $235,000 |

Source: Public Records

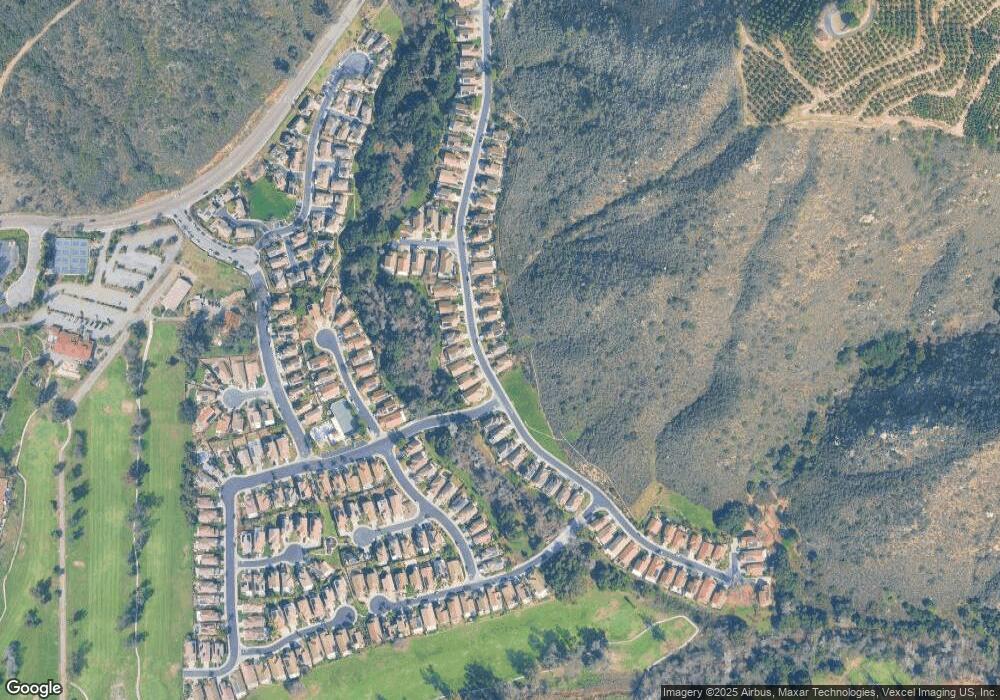

Map

Nearby Homes

- 29825 Platanus Dr

- 29711 Williams Valley Ct

- 29818 Hillside View Ct

- 8925 Circle r View Ln

- 8949 Circle r View Ln

- 9168 Old Castle Rd

- 8539 Circle r Valley Ln

- 0 Ridge Creek Rd Unit NDP2508679

- 0 Circle r Dr

- 15 Circle r Dr

- 0 Circle r Dr

- 30015 Ridge Creek Rd

- 0 Captains Ct

- 30508 Circle r Ln

- Lot 92 Welk Highland Ln

- 30427 Circle r Ln

- 1411 Wild Acres Rd

- 9698 Welk View Dr

- 945 El Paseo

- 8310 Nelson Way Unit 98

- 29703 Platanus Dr

- 29723 Platanus Dr

- 29718 Platanus Dr

- 29712 Platanus Dr

- 29722 Platanus Dr

- 29704 Platanus Dr

- 29727 Platanus Dr

- 29702 Platanus Dr

- 29724 Platanus Dr

- 29726 Platanus Dr

- 29735 Platanus Dr

- 29668 Platanus Dr

- 29734 Platanus Dr

- 29743 Platanus Dr

- 29658 Platanus Dr

- 8975 Platanus Place

- 29751 Platanus Dr

- 29650 Platanus Dr

- 8957 Platanus Place

- 29759 Platanus Dr