29818 Sunwillow Creek Dr Spring, TX 77386

Legends Ranch NeighborhoodEstimated Value: $285,708 - $327,000

3

Beds

2

Baths

2,092

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 29818 Sunwillow Creek Dr, Spring, TX 77386 and is currently estimated at $307,927, approximately $147 per square foot. 29818 Sunwillow Creek Dr is a home located in Montgomery County with nearby schools including Birnham Woods Elementary School, Cox Intermediate School, and York J High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 9, 2010

Sold by

Thomas Jonathan Paul

Bought by

Garcia Thomas Michelle Allison

Current Estimated Value

Purchase Details

Closed on

Oct 13, 2006

Sold by

Barta Candee S and Barta Troy V

Bought by

Thomas Michelle Allison Garcia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,000

Outstanding Balance

$85,928

Interest Rate

6.46%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$221,999

Purchase Details

Closed on

Sep 23, 2004

Sold by

Pulte Homes Of Texas Lp

Bought by

Barta Troy Vinson and Barta Candee Sue

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,530

Interest Rate

7.87%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Dec 29, 2003

Sold by

Land Tejas Development

Bought by

Thomas Michelle Allison Garcia

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garcia Thomas Michelle Allison | -- | None Available | |

| Thomas Michelle Allison Garcia | -- | -- | |

| Thomas Jonathan | -- | Vanguard Title Co | |

| Barta Troy Vinson | -- | First American Title | |

| Thomas Michelle Allison Garcia | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomas Jonathan | $144,000 | |

| Previous Owner | Barta Troy Vinson | $133,530 | |

| Closed | Garcia Thomas Michelle Allison | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,778 | $309,728 | $29,500 | $280,228 |

| 2024 | $4,328 | $285,923 | -- | -- |

| 2023 | $4,328 | $259,930 | $29,500 | $273,230 |

| 2022 | $5,612 | $236,300 | $29,500 | $249,370 |

| 2021 | $5,497 | $214,820 | $29,500 | $185,320 |

| 2020 | $5,678 | $207,280 | $29,500 | $177,780 |

| 2019 | $5,468 | $192,930 | $29,500 | $163,430 |

| 2018 | $4,814 | $189,000 | $29,500 | $159,500 |

| 2017 | $5,591 | $192,930 | $29,500 | $163,430 |

| 2016 | $5,554 | $191,650 | $29,500 | $166,870 |

| 2015 | $4,691 | $174,230 | $29,500 | $153,300 |

| 2014 | $4,691 | $158,390 | $29,500 | $128,890 |

Source: Public Records

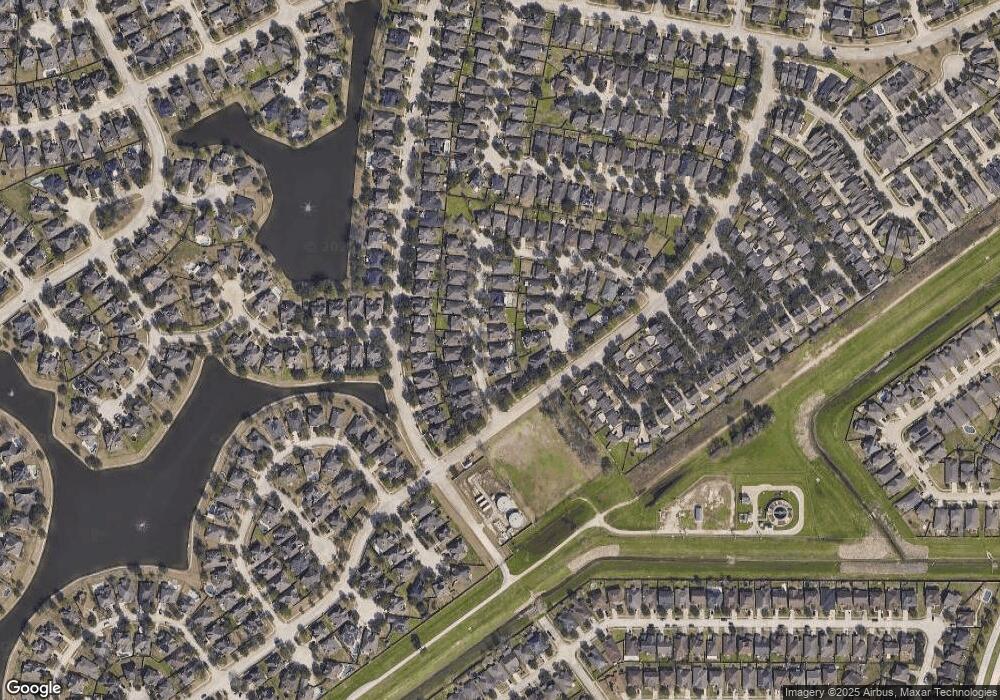

Map

Nearby Homes

- 3507 Palomar Valley Dr

- 3410 Azalea Sands Dr

- 30214 Vinebriar Dr

- 3606 Palomar Valley Dr

- 3603 Palomar Valley Dr

- 3535 Cactus Creek Dr

- 3526 Azalea Sands Dr

- 3131 Rustic Gardens Dr

- 30206 Mesa Valley Dr

- 30102 Canyon Summer Ln

- 3607 Cedar Flats Ln

- 3554 Bennett Trails Dr

- 3518 Leaf Vines Dr

- 3011 Rustic Gardens Dr

- 30303 Castle Forest Dr

- 30302 Castle Forest Dr

- 29607 Legends Green Dr

- 3215 Legends Mist Dr

- 29501 Salem Fields Dr

- 29631 Legends Line Dr

- 29822 Sunwillow Creek Dr

- 29810 Sunwillow Creek Dr

- 29810 Sun Willow Creek Dr

- 29907 Hanover Hollow Ln

- 29902 Sunwillow Creek Dr

- 29802 Sunwillow Creek Dr

- 29903 Hanover Hollow Ln

- 29911 Hanover Hollow Ln

- 29819 Sunwillow Creek Dr

- 29823 Sunwillow Creek Dr

- 29823 29823 Sun Willow Creek Dr

- 29815 Sunwillow Creek Dr

- 29910 Sunwillow Creek Dr

- 29903 Sunwillow Creek Dr

- 29811 Sunwillow Creek Dr

- 29915 Hanover Hollow Ln

- 29907 Sunwillow Creek Dr

- 29807 Sunwillow Creek Dr

- 29914 Sunwillow Creek Dr

- 29911 Sunwillow Creek Dr