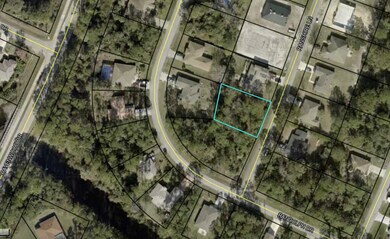

3 Ranshire Ln Palm Coast, FL 32164

Estimated payment $504/month

Total Views

2,079

0.23

Acre

$364,891

Price per Acre

10,019

Sq Ft Lot

About This Lot

Prime Vacant Lot in Palm Coast – No HOA, Versatile Zoning! Discover the perfect opportunity to build your dream home or investment property on this spacious 10,254 sq ft, 0.23 +/- acre lot in a well-established Palm Coast neighborhood! No HOA restrictions provide flexibility, and the SF-R2 zoning potentially allows for single-family homes, duplexes, and short-term rentals, making it an excellent choice for homeowners and investors alike. Public utilities are available at the street.

Property Details

Property Type

- Land

Est. Annual Taxes

- $476

Lot Details

- 10,019 Sq Ft Lot

- Property is zoned SFR-2

Listing and Financial Details

- Assessor Parcel Number 07-11-31-7030-00560-0020

Map

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $456 | $44,000 | $44,000 | -- |

| 2023 | $456 | $16,831 | $0 | $0 |

| 2022 | $453 | $44,500 | $44,500 | $0 |

| 2021 | $312 | $21,000 | $21,000 | $0 |

| 2020 | $270 | $16,000 | $16,000 | $0 |

| 2019 | $249 | $14,500 | $14,500 | $0 |

| 2018 | $220 | $11,500 | $11,500 | $0 |

| 2017 | $194 | $9,500 | $9,500 | $0 |

| 2016 | $184 | $9,000 | $0 | $0 |

| 2015 | $175 | $8,250 | $0 | $0 |

| 2014 | $156 | $7,500 | $0 | $0 |

Source: Public Records

Property History

| Date | Event | Price | Change | Sq Ft Price |

|---|---|---|---|---|

| 07/15/2025 07/15/25 | For Sale | $83,925 | -85.6% | -- |

| 07/11/2025 07/11/25 | For Sale | $583,925 | -- | $253 / Sq Ft |

Source: St. Augustine and St. Johns County Board of REALTORS®

Purchase History

| Date | Type | Sale Price | Title Company |

|---|---|---|---|

| Interfamily Deed Transfer | -- | Attorney |

Source: Public Records

Source: St. Augustine and St. Johns County Board of REALTORS®

MLS Number: 251610

APN: 07-11-31-7030-00560-0020

Nearby Homes

- 3 Ranger Place

- 14 Ralph Place

- 18 White Hurst Ln

- 16 Ramrock Ln

- 24 Riverdale Ln

- 60 Raleigh Dr

- 65 White Star Dr

- 173 Ryan Dr

- 33 Riverview Dr

- 3 Riverdale Ln

- 11 Riviera Estates Ct

- 94 Rolling Sands Dr

- 123 Rae Dr Unit B

- 3b Rainstone Ln Unit B

- 9 Rymshaw Place

- 52 Richmond Dr

- 34 Richmond Dr

- 1 Wheel Place Unit A

- 3 Wheeler Place Unit A

- 145 Rae Dr