3010 Remington Point Aurora, OH 44202

Estimated Value: $527,347 - $595,000

4

Beds

4

Baths

2,540

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 3010 Remington Point, Aurora, OH 44202 and is currently estimated at $563,587, approximately $221 per square foot. 3010 Remington Point is a home located in Portage County with nearby schools including Crestwood Primary School, Crestwood Intermediate School, and Crestwood Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 16, 2022

Sold by

Yeager Eric A and Yeager Lisa Rowena

Bought by

Yeager Eric A and Yeager Lisa Rowena

Current Estimated Value

Purchase Details

Closed on

Dec 11, 2010

Sold by

Yeager Eric A and Yeager Lisa Rowena

Bought by

Yeager Eric A and Yeager Lisa Rowena

Purchase Details

Closed on

Jul 29, 2000

Sold by

Sandstrom Builders

Bought by

Yeager Eric A and Rowena Yeager L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$267,443

Interest Rate

3.95%

Purchase Details

Closed on

Jan 11, 2000

Sold by

Leslie Joseph F C and Leslie Kimberly A

Bought by

Sandstrom Builders

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$276,200

Interest Rate

7.89%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yeager Eric A | -- | None Listed On Document | |

| Yeager Eric A | -- | None Available | |

| Yeager Eric A | $334,400 | Midland Title Security Inc | |

| Sandstrom Builders | $59,000 | Midland Title Security Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Yeager Eric A | $267,443 | |

| Previous Owner | Sandstrom Builders | $276,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,983 | $153,200 | $21,250 | $131,950 |

| 2023 | $5,275 | $122,780 | $19,600 | $103,180 |

| 2022 | $5,333 | $122,780 | $19,600 | $103,180 |

| 2021 | $5,390 | $122,780 | $19,600 | $103,180 |

| 2020 | $5,043 | $108,540 | $19,600 | $88,940 |

| 2019 | $4,977 | $108,540 | $19,600 | $88,940 |

| 2018 | $4,942 | $101,470 | $22,860 | $78,610 |

| 2017 | $4,789 | $101,470 | $22,860 | $78,610 |

| 2016 | $4,748 | $101,470 | $22,860 | $78,610 |

| 2015 | $4,785 | $101,470 | $22,860 | $78,610 |

| 2014 | $4,885 | $101,470 | $22,860 | $78,610 |

| 2013 | $4,834 | $101,470 | $22,860 | $78,610 |

Source: Public Records

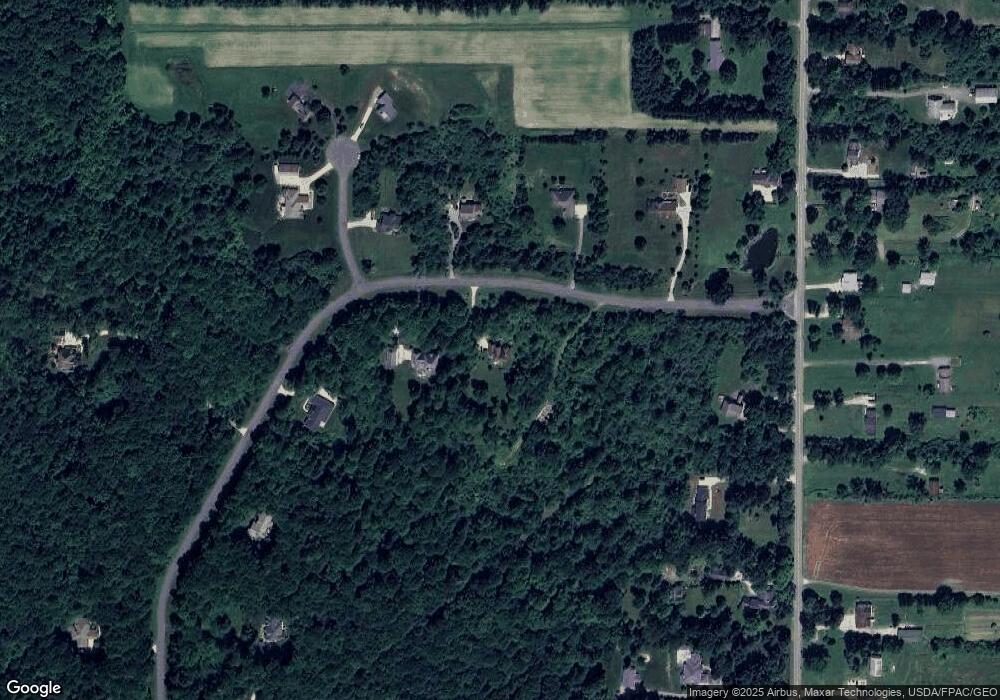

Map

Nearby Homes

- 12298 Chamberlain Rd

- 290 Townline Rd

- 483 Townline Rd

- 200 Greentree Cir

- 679 Deep Woods Dr

- 3444 Winchell Rd

- 12845 Vincent Dr

- 1130 Winchell Rd

- 990 Whisperwood Ln

- 12167 Mantua Center Rd

- 651 Parker Rd

- 11166 Loris Ave

- 831 Meadowbrook Dr

- 8930 Crackel Rd

- V/L Ohio 82

- 9800 North Blvd

- 314 E Pioneer Trail

- 0 Bartholomew Rd Unit 21957397

- 9836 Cleveland Dr

- 159 Royal Oak Dr

- 2986 Remington Point

- 3003 Remington Point

- 3017 Remington Point

- 12194 Devington Ct

- 2932 Remington Point

- 12210 Devington Ct

- 3045 Remington Point

- 12121 Chamberlain Rd

- 12193 Devington Ct

- 12207 Devington Ct

- 12193 Chamberlain Rd

- 12138 Chamberlain Rd

- 12152 Chamberlain Rd

- 12168 Chamberlain Rd

- 12122 Chamberlain Rd

- 12108 Chamberlain Rd

- V/L Chamberlain Rd

- 12184 Chamberlain Rd

- 2846 Remington Point

- 12061 Chamberlain Rd