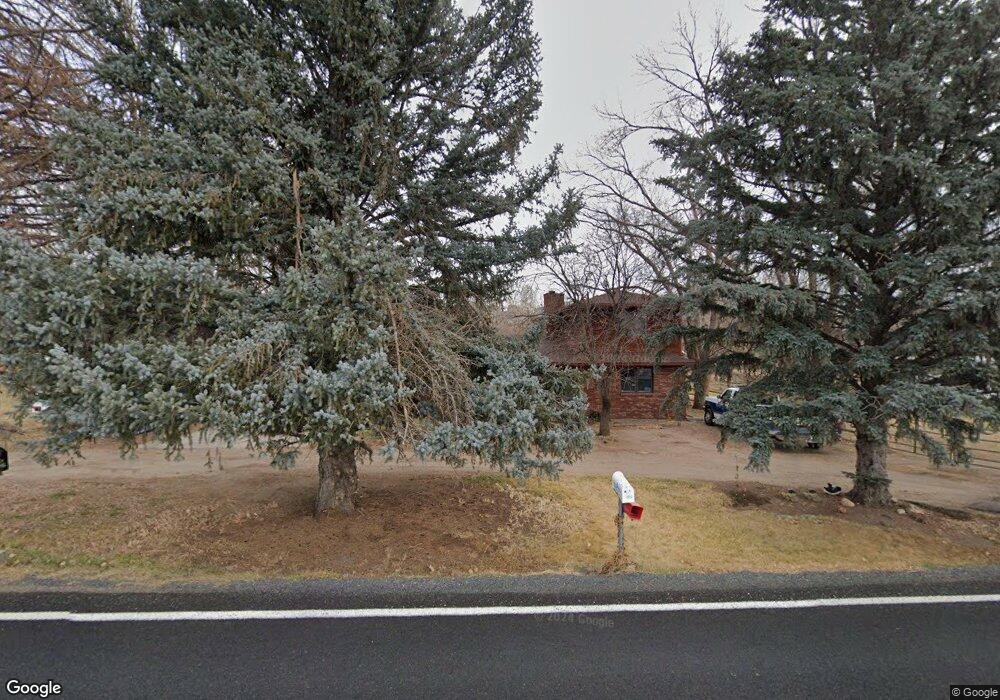

3020 Glade Rd Loveland, CO 80538

Estimated Value: $748,163 - $966,000

5

Beds

4

Baths

2,309

Sq Ft

$366/Sq Ft

Est. Value

About This Home

This home is located at 3020 Glade Rd, Loveland, CO 80538 and is currently estimated at $844,041, approximately $365 per square foot. 3020 Glade Rd is a home located in Larimer County with nearby schools including Big Thompson Elementary School, Walt Clark Middle School, and Thompson Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 1993

Sold by

Barr Donald D and Moore Sharon L

Bought by

Barr Donald D and Moore Barr Sharon L

Current Estimated Value

Purchase Details

Closed on

Jun 21, 1979

Sold by

Reed Charles E Virginia B

Bought by

Barr Donald D and Moore Sharon L

Purchase Details

Closed on

Jun 19, 1979

Sold by

Horne Lowell P and Horne Sara J

Bought by

Barr Donald D and Moore Barr Sharon L

Purchase Details

Closed on

Feb 25, 1976

Sold by

Breyer Louise A and Kay Louise

Bought by

Horne Lowell P and Horne Sara J

Purchase Details

Closed on

Sep 23, 1974

Sold by

Eastglade Development Company

Bought by

Goebel Lile R and Goebel Faye

Purchase Details

Closed on

Jan 22, 1966

Sold by

Osborn Harlan E and Osborn Lois A

Bought by

Eastglade Development Company

Purchase Details

Closed on

Sep 2, 1933

Sold by

Barr Donald D and Moore Sharon L

Bought by

Barr Donald D and Barr Sharon L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barr Donald D | -- | -- | |

| Barr Donald D | $3,500 | -- | |

| Barr Donald D | $56,400 | -- | |

| Horne Lowell P | $29,000 | -- | |

| Goebel Lile R | -- | -- | |

| Eastglade Development Company | $1,000 | -- | |

| Barr Donald D | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,028 | $47,570 | $8,710 | $38,860 |

| 2024 | $2,922 | $47,570 | $8,710 | $38,860 |

| 2022 | $2,220 | $35,111 | $16,958 | $18,153 |

| 2021 | $2,279 | $36,122 | $17,446 | $18,676 |

| 2020 | $2,485 | $38,746 | $17,446 | $21,300 |

| 2019 | $2,443 | $38,746 | $17,446 | $21,300 |

| 2018 | $1,699 | $28,051 | $7,200 | $20,851 |

| 2017 | $1,462 | $28,051 | $7,200 | $20,851 |

| 2016 | $1,083 | $22,893 | $7,960 | $14,933 |

| 2015 | $1,074 | $22,890 | $7,960 | $14,930 |

| 2014 | $1,568 | $21,090 | $7,960 | $13,130 |

Source: Public Records

Map

Nearby Homes

- 3604 Glade Rd

- 3064 Wildes Rd

- 7467 W Us Highway 34

- 1703 N County Road 23h

- 7831 W Us Highway 34

- 5417 W US Highway 34

- 1828 N County Road 29

- 0 Soaring Eagle Unit 1024864

- 4033 Backbone Dr

- 712 Colt Dr

- 5925 Sacajawea Way

- 512 Mustang Dr

- 7864 Heart J Trail

- 240 Garnet Valley Ct

- 3005 N County Road 29

- 2301 Juniper Ln

- 1701 Firerock Ct

- 5272 Fox Hollow Ct

- 5801 Norwood Ave

- 1913 Skyrock Rd

- 3004 Glade Rd

- 2920 Glade Rd

- 3105 Rocky View Rd

- 3105 Rocky View Rd

- 3013 Rocky View Rd

- 2914 Glade Rd

- 3003 Rocky View Rd

- 2910 Glade Rd

- 2913 Glade Rd

- 6609 W 32nd St

- 2860 Glade Rd

- 2906 Glade Rd

- 6601 W 32nd St

- 3209 Glade Rd

- 2866 Glade Rd

- 6513 W 32nd St

- 3012 Rocky View Rd

- 6506 W 32nd St

- 3229 Glade Rd

- 6755 W County Road 24