3023 Via de Paz Unit 2 Carlsbad, CA 92010

Tamarack Point NeighborhoodEstimated Value: $698,427 - $850,000

3

Beds

2

Baths

1,104

Sq Ft

$722/Sq Ft

Est. Value

About This Home

This home is located at 3023 Via de Paz Unit 2, Carlsbad, CA 92010 and is currently estimated at $796,607, approximately $721 per square foot. 3023 Via de Paz Unit 2 is a home located in San Diego County with nearby schools including Buena Vista Elementary, Carlsbad High School, and Sage Creek High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2019

Sold by

Yasuda James R

Bought by

Yasuda James R and James R Yasuda Trust

Current Estimated Value

Purchase Details

Closed on

Oct 26, 2001

Sold by

Perez Hector R and Rivera Maria Delourdes

Bought by

Yasuda James R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$212,991

Outstanding Balance

$82,695

Interest Rate

6.63%

Mortgage Type

FHA

Estimated Equity

$713,912

Purchase Details

Closed on

Jul 20, 1990

Purchase Details

Closed on

Aug 29, 1988

Purchase Details

Closed on

Sep 25, 1984

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Yasuda James R | -- | None Available | |

| Yasuda James R | $216,000 | California Title Company | |

| -- | $145,000 | -- | |

| -- | $109,000 | -- | |

| -- | $82,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Yasuda James R | $212,991 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,299 | $319,074 | $206,813 | $112,261 |

| 2024 | $3,299 | $312,818 | $202,758 | $110,060 |

| 2023 | $3,280 | $306,685 | $198,783 | $107,902 |

| 2022 | $3,228 | $300,673 | $194,886 | $105,787 |

| 2021 | $3,202 | $294,778 | $191,065 | $103,713 |

| 2020 | $3,180 | $291,756 | $189,106 | $102,650 |

| 2019 | $3,122 | $286,037 | $185,399 | $100,638 |

| 2018 | $2,989 | $280,429 | $181,764 | $98,665 |

| 2017 | $2,938 | $274,931 | $178,200 | $96,731 |

| 2016 | $2,818 | $269,541 | $174,706 | $94,835 |

| 2015 | $2,806 | $265,493 | $172,082 | $93,411 |

| 2014 | $2,758 | $260,294 | $168,712 | $91,582 |

Source: Public Records

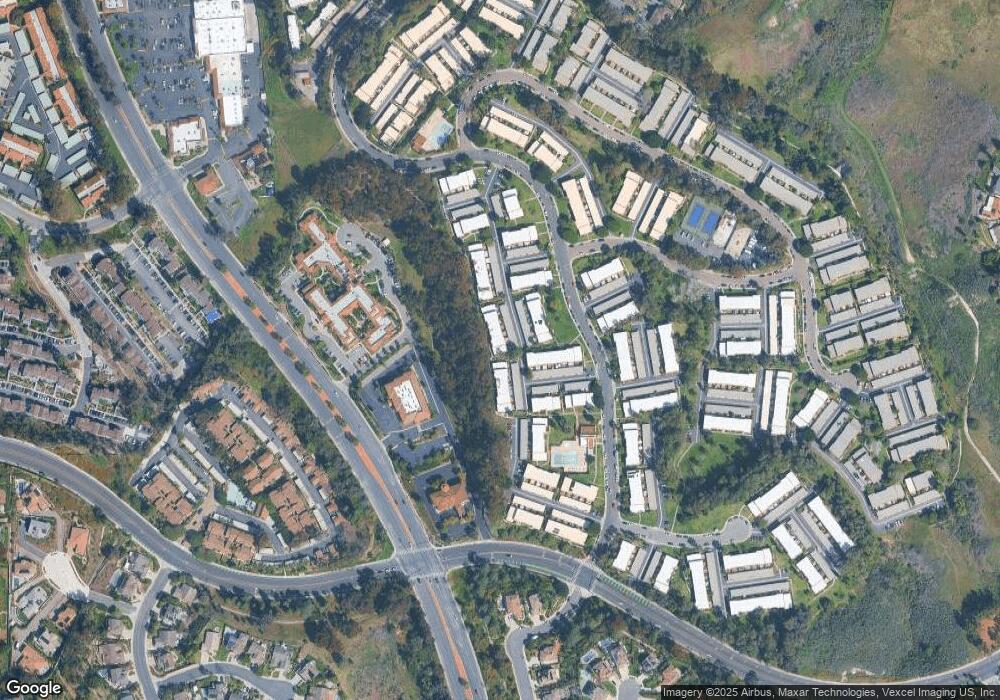

Map

Nearby Homes

- 2517 Via Astuto Unit 1

- 2334 Kimberly Ct

- 2360 Hosp Way Unit 331

- 2336 Hosp Way Unit 314

- 3190 Falcon Dr

- 3442 Celinda Dr

- 3354 Seacrest Dr

- 2195 Basswood Ave

- 3365 Seacrest Dr

- 3306 Donna Dr

- 2225 David Place

- 2732 Forest Park Ln

- 2360 Paseo de Laura Unit 2

- 2035 Basswood Ave

- 2062 Avenue of The Trees

- 3072 Marron Rd

- 3736 Donna Ct

- 3721 Donna Ct

- 3304 Telaga Rd

- 3573 Paseo de Los Californianos Unit 273

- 3021 Via de Paz

- 3019 Via de Paz

- 3027 Via Amador

- 3017 Via de Paz

- 3029 Via Amador

- 3015 Via de Paz

- 2510 Via Esparto Unit 2

- 3031 Via Amador

- 3013 Via de Paz

- 3024 Via de Paz

- 2512 Via Esparto

- 3022 Via de Paz Unit 2

- 3033 Via Amador

- 3020 Via de Paz

- 3018 Via de Paz

- 2514 Via Esparto

- 3011 Via de Paz

- 3035 Via Amador Unit 2

- 3016 Via de Paz

- 2516 Via Esparto