303 Willow Bend Dr Columbus Grove, OH 45830

Estimated Value: $198,000 - $230,000

2

Beds

2

Baths

1,440

Sq Ft

$149/Sq Ft

Est. Value

About This Home

This home is located at 303 Willow Bend Dr, Columbus Grove, OH 45830 and is currently estimated at $214,370, approximately $148 per square foot. 303 Willow Bend Dr is a home located in Putnam County with nearby schools including Columbus Grove Elementary School, Columbus Grove Middle School, and Columbus Grove High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 4, 2023

Sold by

Schroeder Alice

Bought by

Stechschulte Sarah A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,800

Outstanding Balance

$149,547

Interest Rate

6.42%

Mortgage Type

New Conventional

Estimated Equity

$64,823

Purchase Details

Closed on

May 2, 2023

Sold by

Schroeder Roger

Bought by

Schroeder Alice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,800

Outstanding Balance

$149,547

Interest Rate

6.42%

Mortgage Type

New Conventional

Estimated Equity

$64,823

Purchase Details

Closed on

Apr 5, 2005

Sold by

Schroeder Walter and Schroeder Alice

Bought by

Schroeder Roger and Beattie Kathleen

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stechschulte Sarah A | -- | None Listed On Document | |

| Schroeder Alice | -- | None Listed On Document | |

| Schroeder Roger | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stechschulte Sarah A | $153,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,904 | $57,970 | $1,400 | $56,570 |

| 2023 | $1,697 | $49,420 | $1,400 | $48,020 |

| 2022 | $1,626 | $49,420 | $1,400 | $48,020 |

| 2021 | $1,542 | $49,420 | $1,400 | $48,020 |

| 2020 | $1,544 | $46,200 | $1,400 | $44,800 |

| 2019 | $1,516 | $49,420 | $1,400 | $48,020 |

| 2018 | $1,514 | $49,420 | $1,400 | $48,020 |

| 2017 | $1,378 | $49,420 | $1,400 | $48,020 |

| 2016 | $1,378 | $46,200 | $1,400 | $44,800 |

| 2015 | $1,384 | $46,200 | $1,400 | $44,800 |

| 2014 | $1,396 | $46,200 | $1,400 | $44,800 |

| 2013 | $1,393 | $46,200 | $1,400 | $44,800 |

Source: Public Records

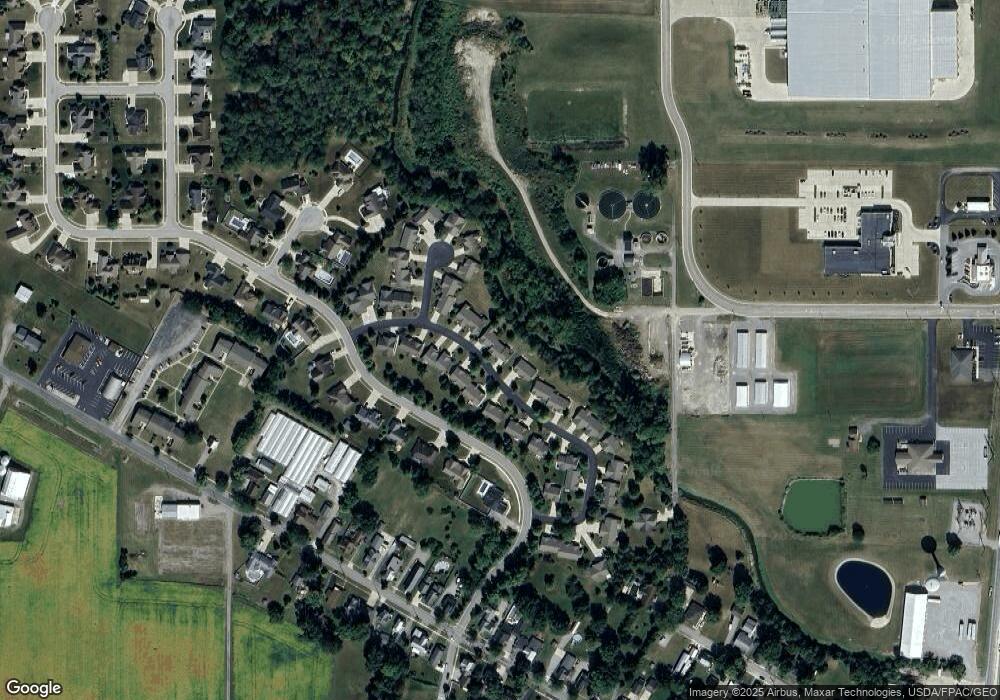

Map

Nearby Homes

- 209 Willow Bend Dr

- 205 S Broadway St

- 204 S Broadway St

- 308 Delphos Rd

- 11059 Ottawa Rd

- 147 Elm St

- 148 S Water St

- 15105 Road 15m

- 704 Sherman St

- 208 E Monroe St

- 17429 Road 5

- 101 Maplewood Dr

- 00000 Ohio 696

- 000 Ohio 696

- 0000 Ohio 696

- 8160 Columbus Grove-Bluffton Rd

- 370 S Thomas St

- 6585 Ottawa Rd

- 717 E 2nd St

- 201 Wall St

- 305 Willow Bend Dr

- 301 Willow Bend Dr

- 304 Willow Bend Dr Unit 2A

- 309 Willow Bend Dr

- 306 Willow Bend Dr

- 229 Willow Bend Dr

- 300 Willow Bend Dr

- 308 Willow Bend Dr

- 201 Timber Creek Ct

- 227 Willow Bend Dr

- 228 Willow Bend Dr

- 207 Timber Creek Ct

- 400 Willow Bend Dr

- 216 Willow Bend Dr

- 221 Willow Bend Dr

- 401 Willow Bend Dr

- 404 Willow Bend Dr