31 E Fox Run Ln Grapeview, WA 98546

Estimated Value: $350,860 - $493,000

3

Beds

2

Baths

1,048

Sq Ft

$397/Sq Ft

Est. Value

About This Home

This home is located at 31 E Fox Run Ln, Grapeview, WA 98546 and is currently estimated at $416,465, approximately $397 per square foot. 31 E Fox Run Ln is a home located in Mason County with nearby schools including Grapeview Elementary/Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 1, 2025

Sold by

Garrett James W

Bought by

Garrett James W and Garrett Deena Kaye

Current Estimated Value

Purchase Details

Closed on

Jul 12, 2011

Sold by

The Secretary Of Hud

Bought by

Garrett James W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$132,552

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Apr 29, 2011

Sold by

Wells Fargo Bank Na

Bought by

Secretary Of Hud

Purchase Details

Closed on

Apr 28, 2011

Sold by

Wells Fargo Bank Na

Bought by

Secretary Of Hud

Purchase Details

Closed on

Apr 18, 2011

Sold by

Northwest Trustee Services Inc

Bought by

Wells Fargo Bank Na

Purchase Details

Closed on

May 23, 2008

Sold by

Clement Tricia A

Bought by

Collinsworth Lisa D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,693

Interest Rate

5.87%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Garrett James W | -- | Land Title | |

| Garrett James W | -- | Land Title Co | |

| Secretary Of Hud | -- | None Available | |

| Secretary Of Hud | -- | None Available | |

| Wells Fargo Bank Na | $233,461 | None Available | |

| Collinsworth Lisa D | $214,000 | Mason County Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Garrett James W | $132,552 | |

| Previous Owner | Collinsworth Lisa D | $210,693 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,679 | $227,165 | $46,495 | $180,670 |

| 2023 | $1,679 | $241,715 | $43,325 | $198,390 |

| 2022 | $1,600 | $179,535 | $34,940 | $144,595 |

| 2021 | $1,853 | $179,535 | $34,940 | $144,595 |

| 2020 | $1,724 | $208,200 | $34,255 | $173,945 |

| 2018 | $1,631 | $148,815 | $30,790 | $118,025 |

| 2017 | $1,664 | $148,815 | $30,790 | $118,025 |

| 2016 | $1,632 | $161,510 | $30,240 | $131,270 |

| 2015 | $1,735 | $158,035 | $29,295 | $128,740 |

| 2014 | -- | $161,550 | $29,925 | $131,625 |

| 2013 | -- | $158,935 | $28,350 | $130,585 |

Source: Public Records

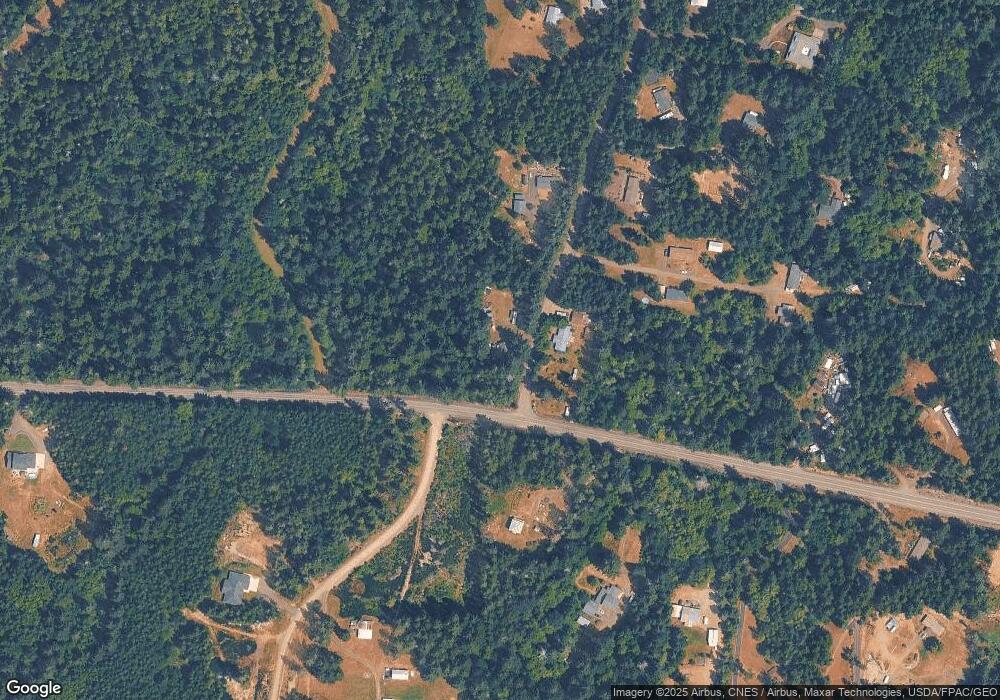

Map

Nearby Homes

- 900 E Wilson Way

- 900 930 E Wilson Way

- 930 E Wilson Way

- 670 E Wilson Way

- 430 Twilight Way

- 311 E Murray Rd N

- 310 E Rauschert Rd

- 758 E Promontory Rd

- 0 E Murray Rd N Unit NWM2467437

- 681 E Pointes Dr W

- 625 E Pointes Dr W

- 664 E Portage Rd

- 301 E Pointes Dr E

- 1236 E Island View Rd

- 432 E Pointes Dr E

- 512 E Madrona Pkwy

- 101 E Harstine Heights Ln

- 0 E Passage View Rd Unit NWM2457101

- 81 E Panorama Way

- 50 E Lookout Ct

- 0 E Fox Run Ln

- 0 E Fox Run Ln Unit NWM30902330

- 0 E Fox Run Ln Unit NWM30902331

- 0 E Fox Run Ln Unit NWM2034739

- 0 E Fox Run Ln Unit NWM1998192

- 0 E Fox Run Ln Unit NWM1997921

- 0 XXX Grapeview Loop Rd

- 1322 E Grapeview Loop Rd

- 0 Fox Run Lot 2

- 0 Fox Run Lot 1

- 70 E Fox Run Ln

- 0 XX Grapeview Loop Rd

- 72 E Fox Run Ln

- 148 E Fox Run Ln

- 1320 E Grapeview Loop Rd

- 74 E Fox Run Ln

- 150 E Fox Run Ln

- 321 E Fox Run Ln

- 0 xx E Fox Run Ln

- 0 T 1&2 E Fox Run Ln