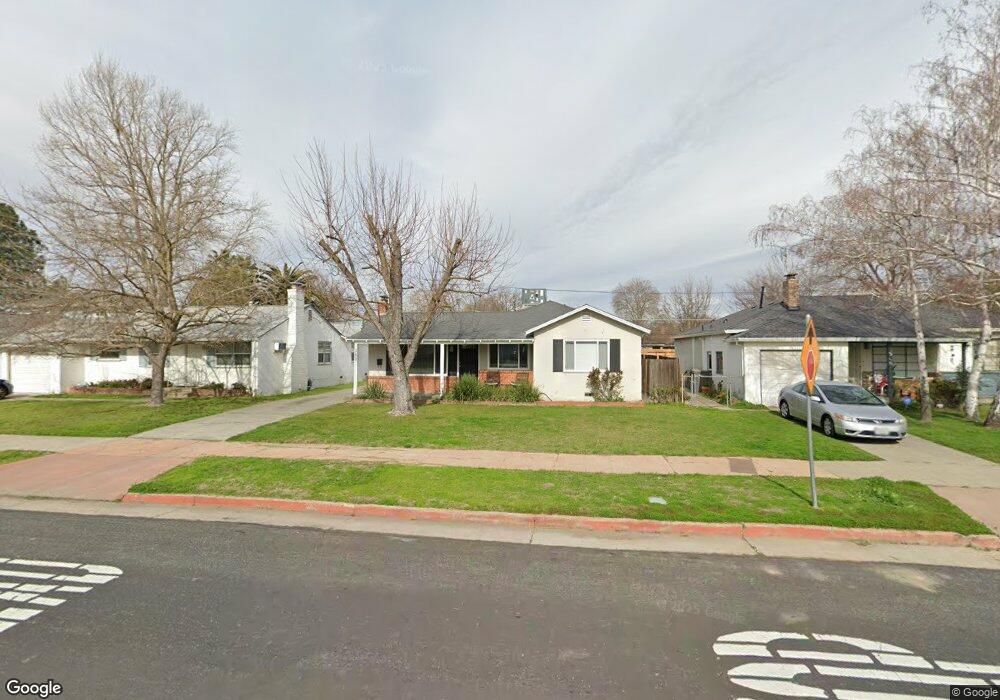

310 15th St West Sacramento, CA 95691

Old West Sacramento NeighborhoodEstimated Value: $299,000 - $517,000

2

Beds

1

Bath

1,471

Sq Ft

$281/Sq Ft

Est. Value

About This Home

This home is located at 310 15th St, West Sacramento, CA 95691 and is currently estimated at $412,973, approximately $280 per square foot. 310 15th St is a home located in Yolo County with nearby schools including Westmore Oaks Elementary School, River City High, and Sacramento Valley Charter School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 4, 1998

Sold by

Dishman Ron and Clements Gary

Bought by

Madrigal Martin C and Cabrera Rebecca

Current Estimated Value

Purchase Details

Closed on

Nov 8, 1996

Sold by

Dishman Donna and Clements Diane

Bought by

Dishman Ron and Clements Gary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

8.14%

Purchase Details

Closed on

Nov 4, 1996

Sold by

Gibson William A Tr

Bought by

Dishman Ron and Clements Gary

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Interest Rate

8.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Madrigal Martin C | $75,000 | -- | |

| Dishman Ron | -- | Placer Title Company | |

| Dishman Ron | $65,000 | Placer Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Dishman Ron | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,516 | $117,554 | $39,180 | $78,374 |

| 2023 | $1,516 | $112,991 | $37,659 | $75,332 |

| 2022 | $1,417 | $110,776 | $36,921 | $73,855 |

| 2021 | $1,405 | $108,605 | $36,198 | $72,407 |

| 2020 | $1,341 | $107,492 | $35,827 | $71,665 |

| 2019 | $1,325 | $105,385 | $35,125 | $70,260 |

| 2018 | $1,300 | $103,320 | $34,437 | $68,883 |

| 2017 | $1,287 | $101,295 | $33,762 | $67,533 |

| 2016 | $1,269 | $99,309 | $33,100 | $66,209 |

| 2015 | $1,149 | $97,818 | $32,603 | $65,215 |

| 2014 | $1,149 | $95,903 | $31,965 | $63,938 |

Source: Public Records

Map

Nearby Homes

- 1549 Virginia Ave

- 1712 Ferndale Cir

- 1911 Vermont Ave

- 1826 Maryland Ave

- 1021 Sycamore Ave

- 1908 Proctor Ave

- 1916 Park Blvd

- 1925 Willow Ave

- 1003 Central St

- 989 Central St

- 785 Dolomite Ct

- 788 Pearlite Ct

- 839 Graphite Ln

- 853 Bainite Ct

- 845 Zinc Ct

- 792 Alloy Ct

- 2000 W Capitol Ave Unit 125

- 1832 Rockrose Rd

- 1050 W Capitol Ave Unit 10

- 1050 W Capitol Ave Unit 33