31107 Manzanita Crest Rd Unit B Valley Center, CA 92082

Estimated Value: $1,018,000 - $1,162,259

4

Beds

4

Baths

2,665

Sq Ft

$417/Sq Ft

Est. Value

About This Home

This home is located at 31107 Manzanita Crest Rd Unit B, Valley Center, CA 92082 and is currently estimated at $1,111,065, approximately $416 per square foot. 31107 Manzanita Crest Rd Unit B is a home located in San Diego County with nearby schools including Lilac, Valley Center Middle School, and Valley Center High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 7, 2019

Sold by

Rosales Miguel and Rosales Raquel N

Bought by

Rosales Miguel and Rosales Raquel N

Current Estimated Value

Purchase Details

Closed on

May 5, 2016

Sold by

Wizner Nikos and Wizner Veronica

Bought by

Rosales Miguel and Rosales Raquel N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,500

Interest Rate

3.45%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 22, 2002

Sold by

Panek Ann Marie

Bought by

Panek Robert L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$573,750

Interest Rate

7%

Mortgage Type

Construction

Purchase Details

Closed on

Jun 25, 2002

Sold by

Panek Robert L

Bought by

Wizner Nikos and Wizner Veronica

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$573,750

Interest Rate

7%

Mortgage Type

Construction

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rosales Miguel | -- | None Available | |

| Rosales Miguel | $550,000 | Lawyers Title Company | |

| Panek Robert L | -- | Equity Title Company | |

| Wizner Nikos | $320,000 | Equity Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rosales Miguel | $412,500 | |

| Previous Owner | Wizner Nikos | $573,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,533 | $638,316 | $217,027 | $421,289 |

| 2024 | $7,533 | $625,801 | $212,772 | $413,029 |

| 2023 | $7,371 | $613,531 | $208,600 | $404,931 |

| 2022 | $7,249 | $601,502 | $204,510 | $396,992 |

| 2021 | $7,116 | $589,708 | $200,500 | $389,208 |

| 2020 | $7,044 | $583,663 | $198,445 | $385,218 |

| 2019 | $7,069 | $572,219 | $194,554 | $377,665 |

| 2018 | $6,890 | $561,000 | $190,740 | $370,260 |

| 2017 | $6,754 | $550,000 | $187,000 | $363,000 |

| 2016 | $6,807 | $550,000 | $187,000 | $363,000 |

| 2015 | $7,399 | $600,000 | $204,000 | $396,000 |

| 2014 | $6,810 | $550,000 | $187,000 | $363,000 |

Source: Public Records

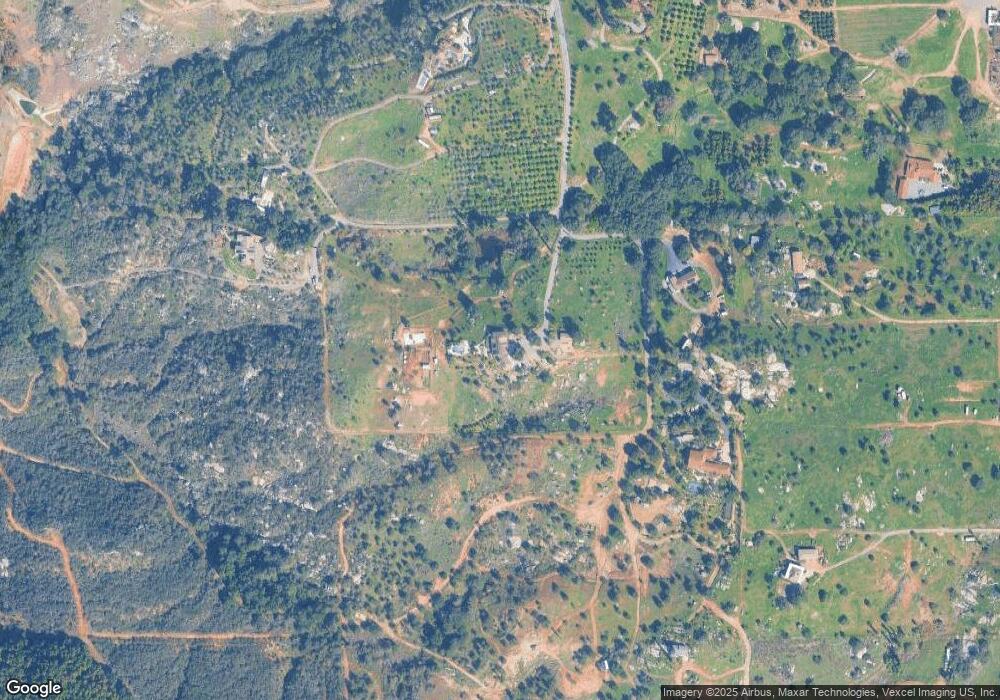

Map

Nearby Homes

- 30408 Lennie Dr

- 12516 Montanya Dr

- 11591 Frog Hollow

- 9504 Old Castle Rd

- 11550 Old Castle Rd

- 11927 Keys Creek Rd

- 30727 Rolling Hills Dr

- 29738 Roble Verde

- 13511 Hilldale Rd

- 30136 Rolling Hills Dr

- 12028 Keys Creek Rd

- 12110 Keys Creek Rd

- 11776 Park Lilac Ln

- 29550 Anthony Rd

- 77.78 ac Jeffrey Heights Rd

- 29345 Wilkes Rd

- 29197 Lilac Rd

- 29679 Valley Stream Rd

- 13815 Hilldale Rd

- 12341 Sierra Rojo Rd

- 31107 Manzanita Crest Rd

- 0000 Manzanita Crest Rd

- 0000 Manzanita Crest Rd Unit A

- 0000 Manzanita Crest Dr

- 12327 Mesa Verde Dr

- 31109 Manzanita Crest Rd

- 31120 Manzanita Crest Rd

- 31120 Manzanita Crest Rd Unit 81 & 83

- 31222 Manzanita Crest Rd

- 31216 Manzanita Crest Rd

- 0 Manzanita Unit 80039632

- 1 Manzanita Crest Rd

- 12331 Mesa Verde Dr

- 30532 Mesa Crest Rd

- 0 Manzanita Crest Rd

- 31210 Manzanita Crest Rd

- 30718 Mesa Crest Rd

- 31290 Manzanita Crest Rd

- 30636 Mesa Crest Rd

- 13301 Manzanita Crest Rd