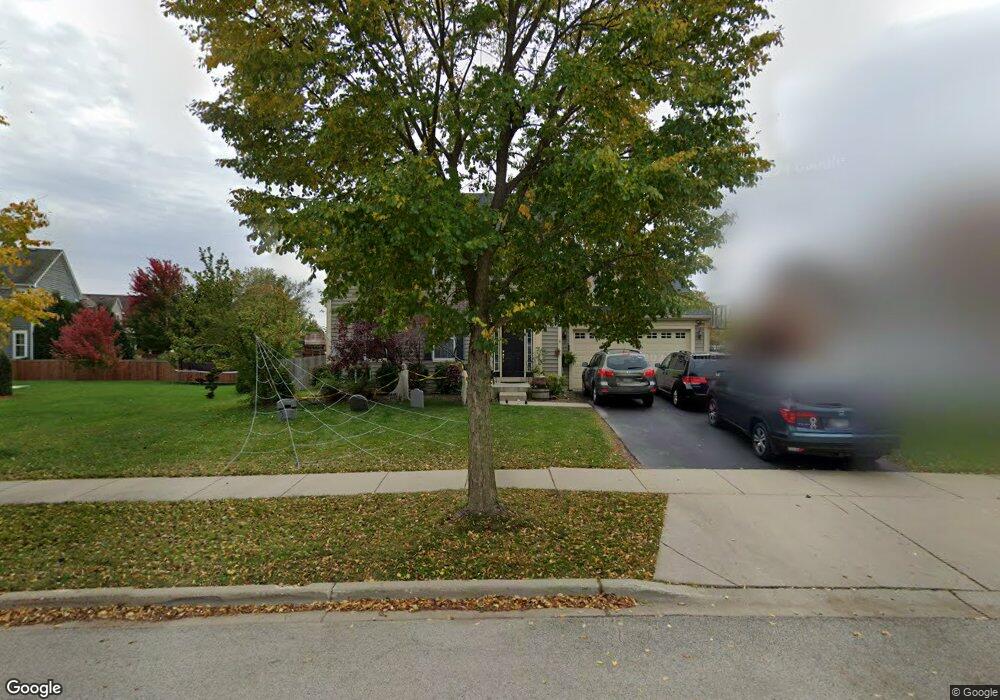

3130 Chalkstone Ave Unit 2A Elgin, IL 60124

Providence NeighborhoodEstimated Value: $519,000 - $536,132

5

Beds

4

Baths

3,070

Sq Ft

$172/Sq Ft

Est. Value

About This Home

This home is located at 3130 Chalkstone Ave Unit 2A, Elgin, IL 60124 and is currently estimated at $529,533, approximately $172 per square foot. 3130 Chalkstone Ave Unit 2A is a home located in Kane County with nearby schools including Prairie View Grade School, Prairie Knolls Middle School, and Central Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 3, 2022

Sold by

Jozwiak Elizabeth E and Jozwiak Kevin Michael

Bought by

Jozwiak Elizabeth E and Jozwiak Kevin Michael

Current Estimated Value

Purchase Details

Closed on

Feb 11, 2011

Sold by

Fannie Mae

Bought by

Jozwiak Kevin M and Jozwiak Elizabeth E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$237,500

Interest Rate

4.85%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 20, 2010

Sold by

Avanzado Maria G

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

May 2, 2006

Sold by

Pinnacle Corp

Bought by

Avanzado Maria Gerlinda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$269,292

Interest Rate

6.87%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jozwiak Elizabeth E | -- | None Listed On Document | |

| Jozwiak Kevin M | $250,000 | Attorneys Title Guaranty Fun | |

| Federal National Mortgage Association | -- | None Available | |

| Avanzado Maria Gerlinda | $337,000 | Chicago Title Insurance Comp |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Jozwiak Kevin M | $237,500 | |

| Previous Owner | Avanzado Maria Gerlinda | $269,292 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $12,091 | $145,692 | $39,827 | $105,865 |

| 2023 | $11,596 | $131,622 | $35,981 | $95,641 |

| 2022 | $10,923 | $120,016 | $32,808 | $87,208 |

| 2021 | $10,564 | $112,206 | $30,673 | $81,533 |

| 2020 | $10,258 | $107,118 | $29,282 | $77,836 |

| 2019 | $9,949 | $102,037 | $27,893 | $74,144 |

| 2018 | $10,866 | $109,745 | $26,277 | $83,468 |

| 2017 | $10,464 | $103,748 | $24,841 | $78,907 |

| 2016 | $10,434 | $96,250 | $23,046 | $73,204 |

| 2015 | -- | $88,222 | $21,124 | $67,098 |

| 2014 | -- | $74,253 | $20,863 | $53,390 |

| 2013 | -- | $76,211 | $21,413 | $54,798 |

Source: Public Records

Map

Nearby Homes

- 379 Fountain Ave

- 3311 Lafayette St

- 003 South St

- 366 Copper Springs Ln

- COVENTRY Plan at West Point Gardens

- EMERSON Plan at West Point Gardens

- HENLEY Plan at West Point Gardens

- FAIRFIELD Plan at West Point Gardens

- 279 Garden Dr

- 3134 Kyra Ln

- 311 Snowdrop Ln

- 264 Snowdrop Ln

- 313 Snowdrop Ln

- 315 Snowdrop Ln

- 268 Snowdrop Ln

- 294 Comstock Dr Unit 2013

- Lot 267 Marigold Dr

- Lot 264 Marigold Dr

- Lot 266 Marigold Dr

- Lot 255 Marigold Dr

- 3128 Chalkstone Ave

- 346 Fountain Ave

- 348 Fountain Ave

- 313 Red Rock Ln

- 350 Fountain Ave

- 3126 Chalkstone Ave Unit 2A

- 311 Red Rock Ln

- 315 Red Rock Ln

- 344 Fountain Ave

- 352 Fountain Ave

- 309 Red Rock Ln

- 3124 Chalkstone Ave

- 317 Red Rock Ln

- 3123 Chalkstone Ave Unit 2A

- 354 Fountain Ave

- 342 Fountain Ave

- 307 Red Rock Ln

- 3122 Chalkstone Ave

- 310 Red Rock Ln

- 312 Red Rock Ln