31602 Oak Glen Rd Valley Center, CA 92082

Estimated Value: $652,000 - $741,486

3

Beds

1

Bath

1,200

Sq Ft

$584/Sq Ft

Est. Value

About This Home

This home is located at 31602 Oak Glen Rd, Valley Center, CA 92082 and is currently estimated at $701,372, approximately $584 per square foot. 31602 Oak Glen Rd is a home located in San Diego County with nearby schools including Valley Center Middle School, Oak Glen High School, and Valley Center High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2024

Sold by

Lovelady Revocable Living Trust and David Franklin J

Bought by

Luna Jose Gerardo and Luna Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$455,000

Outstanding Balance

$449,115

Interest Rate

6.95%

Mortgage Type

New Conventional

Estimated Equity

$252,257

Purchase Details

Closed on

Sep 15, 2005

Sold by

Lovelady Dorothy V

Bought by

Aguilera William R and Aguilera Nancy A

Purchase Details

Closed on

Aug 20, 2002

Sold by

Lovelady Dorothy V

Bought by

Lovelady Dorothy

Purchase Details

Closed on

Sep 10, 2001

Sold by

Vanwormer Frank L and Vanwormer Anna L

Bought by

Lovelady Dorothy

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Luna Jose Gerardo | $650,000 | Fidelity National Title | |

| Aguilera William R | $3,500 | -- | |

| Lovelady Dorothy | -- | -- | |

| Lovelady Dorothy | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Luna Jose Gerardo | $455,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,698 | $650,000 | $418,760 | $231,240 |

| 2024 | $1,698 | $111,327 | $71,722 | $39,605 |

| 2023 | $1,581 | $109,145 | $70,316 | $38,829 |

| 2022 | $1,542 | $107,006 | $68,938 | $38,068 |

| 2021 | $1,507 | $104,909 | $67,587 | $37,322 |

| 2020 | $1,490 | $103,834 | $66,894 | $36,940 |

| 2019 | $1,487 | $101,799 | $65,583 | $36,216 |

| 2018 | $1,451 | $99,804 | $64,298 | $35,506 |

| 2017 | $1,422 | $97,848 | $63,038 | $34,810 |

| 2016 | $1,416 | $95,930 | $61,802 | $34,128 |

| 2015 | $1,401 | $94,490 | $60,874 | $33,616 |

| 2014 | $1,371 | $92,640 | $59,682 | $32,958 |

Source: Public Records

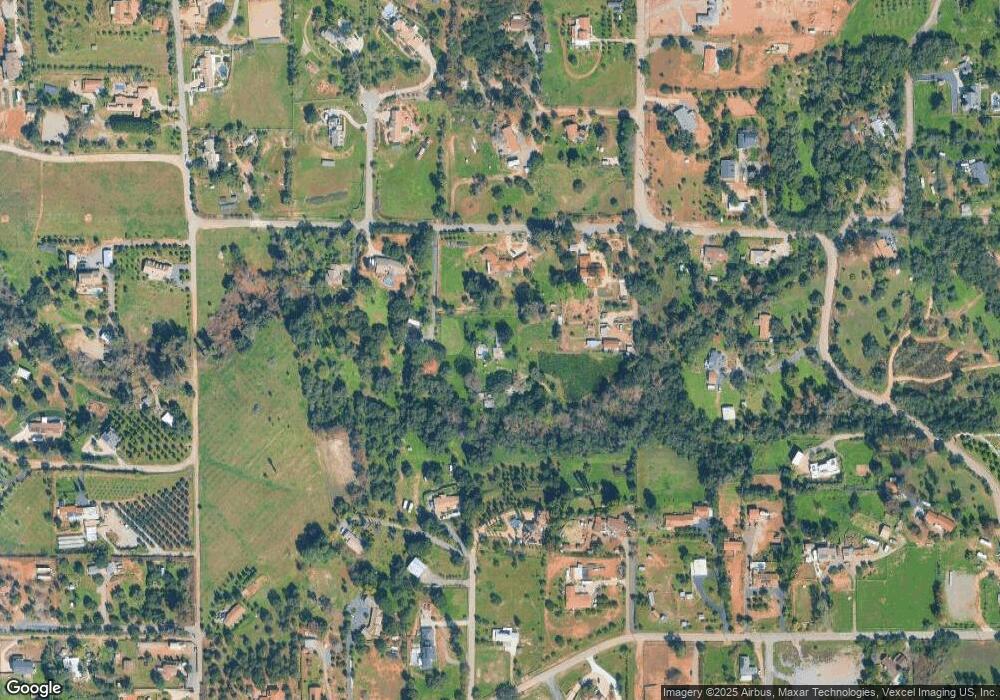

Map

Nearby Homes

- 31600 Oak Glen Rd

- 40 Oak Glen Rd

- 77.78 ac Jeffrey Heights Rd

- 14053 Mcnally Rd

- 13764 Mcnally Rd

- 13584 Mcnally Rd

- 0 Pauma Heights Rd Unit 9

- 13815 Hilldale Rd

- 13723 Pauma Vista Dr Unit 130-141-0600, 130-14

- 13701 Pauma Vista Dr Unit 130-141-0700

- 13511 Hilldale Rd

- 0 Mcnally Rd Unit NDP2506437

- 14786 Cool Valley Ranch Rd

- 14748 Cool Valley Ranch Rd

- 14443 Cool Valley Rd

- 30237 Cole Grade Rd

- 36353 Carney Rd

- 30785 Pauma Heights Rd

- 36485 Carney Rd

- 36591 Carney Rd

- 13695 Ricks Ranch Rd

- 13729 Ricks Ranch Rd

- 13677 Ricks Ranch Rd

- 31394 Regina Glen Unit 1

- 31394 Regina Glen

- 31394 Regina Glen

- 13661 Ricks Ranch Rd

- 31391 Regina Glen

- 31630 Oak Glen Rd

- 13770 W Oak Glen Rd

- 31524 Oak Glen Rd

- 31588 Oak Glen Rd

- 31620 Oak Glen Rd

- 31390 Regina Glen

- 31687 Ricks Ranch Ct

- 13822 W Oak Glen Rd

- 31686 Ricks Ranch Ct

- 31530 Oak Glen Rd

- 13768 W Oak Glen Rd

- 13734 W Oak Glen Rd