31709 Haun Rd Menifee, CA 92584

Paloma Valley NeighborhoodEstimated Value: $590,000 - $965,913

2

Beds

2

Baths

700

Sq Ft

$1,068/Sq Ft

Est. Value

About This Home

This home is located at 31709 Haun Rd, Menifee, CA 92584 and is currently estimated at $747,728, approximately $1,068 per square foot. 31709 Haun Rd is a home located in Riverside County with nearby schools including Chester W. Morrison Elementary School, Menifee Valley Middle School, and Pinacate Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 5, 2008

Sold by

Brady Kimberly A

Bought by

Brady Peter

Current Estimated Value

Purchase Details

Closed on

Jun 24, 2004

Sold by

Vieyra Michael and Vieyra Linda P

Bought by

Brady Peter and Walker Robert

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Outstanding Balance

$124,579

Interest Rate

6.29%

Mortgage Type

Seller Take Back

Estimated Equity

$623,149

Purchase Details

Closed on

Nov 9, 2001

Sold by

Eastman Jack and Eastman Judith C

Bought by

Vieyra Michael and Vieyra Linda P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

6.57%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Brady Peter | -- | Chicago Title Company | |

| Walker Robert | -- | Chicago Title Company | |

| Brady Peter | $500,000 | New Century Title Company | |

| Vieyra Michael | $310,000 | Commonwealth Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Brady Peter | $250,000 | |

| Previous Owner | Vieyra Michael | $210,000 | |

| Closed | Vieyra Michael | $73,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,778 | $696,929 | $557,554 | $139,375 |

| 2023 | $7,778 | $669,868 | $535,904 | $133,964 |

| 2022 | $7,731 | $656,735 | $525,397 | $131,338 |

| 2021 | $7,588 | $643,859 | $515,096 | $128,763 |

| 2020 | $7,502 | $637,258 | $509,815 | $127,443 |

| 2019 | $7,347 | $624,764 | $499,819 | $124,945 |

| 2018 | $7,022 | $612,515 | $490,018 | $122,497 |

| 2017 | $6,899 | $600,506 | $480,410 | $120,096 |

| 2016 | $6,625 | $588,733 | $470,991 | $117,742 |

| 2015 | $6,524 | $579,891 | $463,917 | $115,974 |

| 2014 | $6,338 | $568,534 | $454,831 | $113,703 |

Source: Public Records

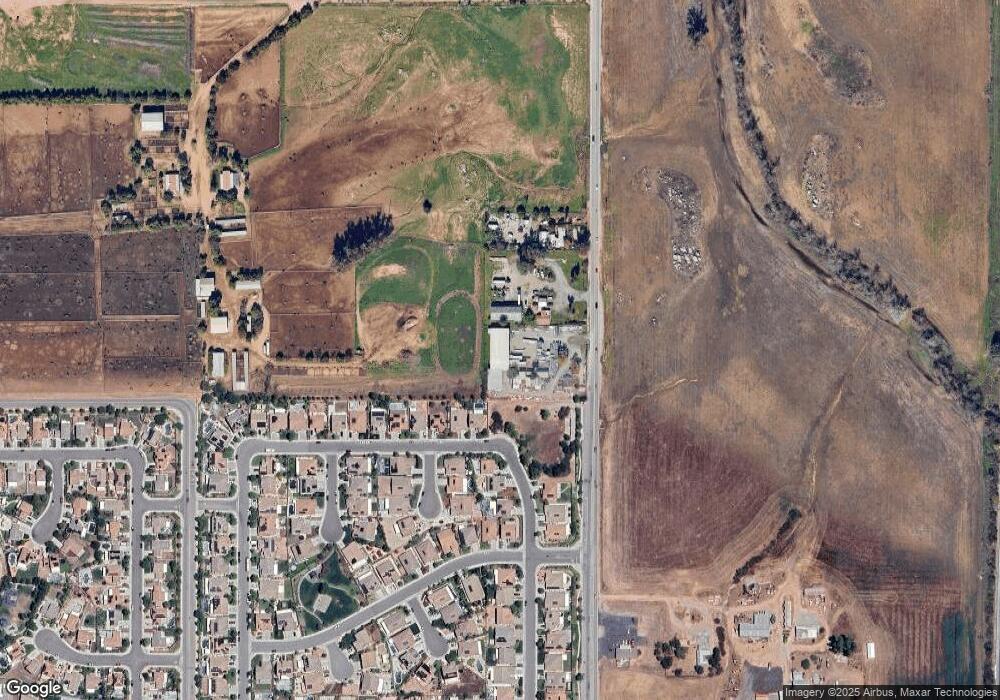

Map

Nearby Homes

- 0 Holland Canyon Hills Rd Unit SW22068780

- 31818 Ruxton St

- 0 Olive Unit IG25143719

- 0 Scott Rd Unit SW24149762

- 27860 Garbani Rd

- 0 Haun Rd Unit SW22239539

- 31961 Harden St

- 472 Scott

- 29532 Monarch Rd

- 29524 Monarch Rd

- 0 Coyote Lane Yucca St Unit SW25096357

- 29552 Monarch Rd

- 17 Orange

- 16 Orange

- 15 Orange

- 0 Antelope Rd

- 27481 Freedom Ln

- 28315 Feldspar Dr

- 31221 Saddleback Ln

- 27517 Blooming Vista Way

- 31699 Haun Rd

- 31599 Northfield Dr

- 27698 Claymen St

- 27684 Claymen St

- 27670 Claymen St

- 27656 Claymen St

- 0 Holland Canyon Hills Rd Unit CRSW22068780

- 0 Margaret Unit SW23168303

- 0 Margaret Unit SW23067277

- 0 Margaret Unit SW22248620

- 63 Bluejay Ct

- 0 Sugar Ct Unit SW22074300

- 0 Sugar Ct Unit IV22070356

- 27232 Garbani Rd

- 0 Wickard Rd Unit SW22065293

- 0 Sweetwater Cyn Rd Unit IG22031331

- 0 Scott Rd Murrieta Rd Unit SW22003539

- 0 John Unit SW21255061

- 0 No Address Unit IV21250753

- 0 Margaret Unit SW21239586