3172 Parkview Dr Unit 3172 Grove City, OH 43123

Estimated Value: $216,000 - $234,000

2

Beds

2

Baths

1,120

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 3172 Parkview Dr Unit 3172, Grove City, OH 43123 and is currently estimated at $224,934, approximately $200 per square foot. 3172 Parkview Dr Unit 3172 is a home located in Franklin County with nearby schools including Monterey Elementary School, Park Street Intermediate School, and Grove City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 30, 2017

Sold by

Ewing Alice P and Ewing Tom

Bought by

Steriti Gloria D

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,500

Interest Rate

3.83%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 22, 2014

Sold by

Burke Paul D and Burke Linda S

Bought by

Ewing Alice P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$60,800

Interest Rate

4.28%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jul 14, 2005

Sold by

Middleton Debra

Bought by

Burke Paul D and Burke Linda S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,600

Interest Rate

5.12%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Oct 28, 1988

Bought by

Middleton Debra P

Purchase Details

Closed on

Jun 1, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Steriti Gloria D | $129,500 | Pm Title Box | |

| Ewing Alice P | $76,000 | Stewart Title | |

| Burke Paul D | $92,000 | Chicago Tit | |

| Middleton Debra P | $66,900 | -- | |

| -- | $58,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Steriti Gloria D | $99,500 | |

| Previous Owner | Ewing Alice P | $60,800 | |

| Previous Owner | Burke Paul D | $73,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,464 | $63,980 | $12,250 | $51,730 |

| 2023 | $2,457 | $63,980 | $12,250 | $51,730 |

| 2022 | $1,857 | $39,200 | $4,830 | $34,370 |

| 2021 | $1,893 | $39,200 | $4,830 | $34,370 |

| 2020 | $1,887 | $39,200 | $4,830 | $34,370 |

| 2019 | $1,692 | $34,090 | $4,200 | $29,890 |

| 2018 | $1,894 | $34,090 | $4,200 | $29,890 |

| 2017 | $2,260 | $34,090 | $4,200 | $29,890 |

| 2016 | $2,101 | $28,990 | $4,170 | $24,820 |

| 2015 | $2,102 | $28,990 | $4,170 | $24,820 |

| 2014 | $2,103 | $28,990 | $4,170 | $24,820 |

| 2013 | $1,164 | $32,200 | $4,620 | $27,580 |

Source: Public Records

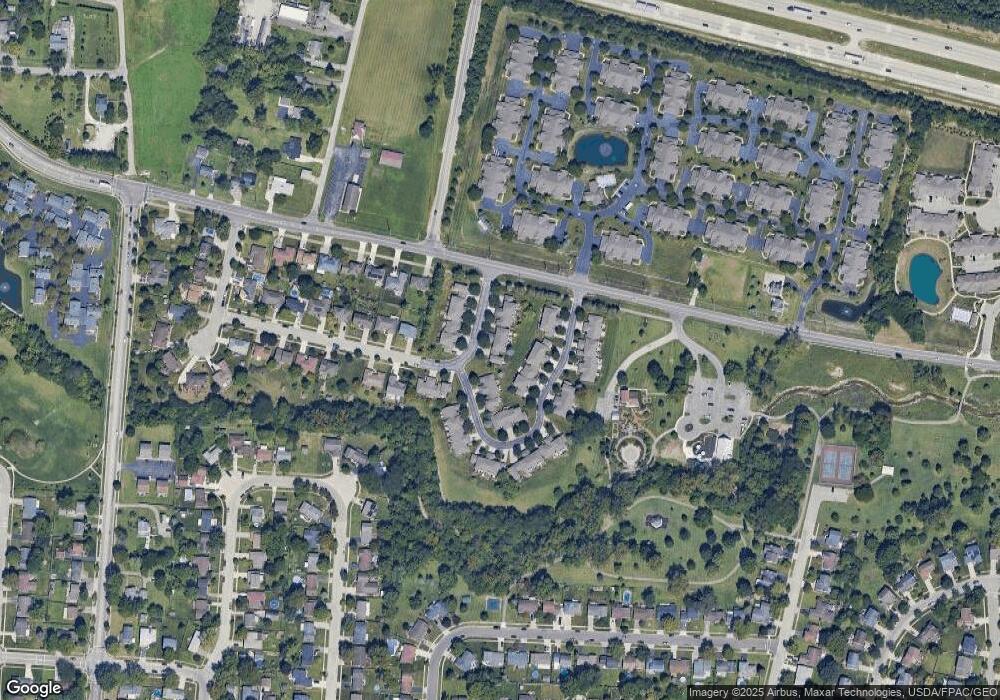

Map

Nearby Homes

- 3187 Parkview Cir Unit 3187

- 3140 Catan Loop Unit 3140

- 3153 Scenic Way

- 3156 Hoover Rd

- 3378 Josephine Cir

- 3333 Tareyton Dr

- 2539 Swan Dr Unit 2539

- 3343 Marshrun Dr

- 2541 Swan Dr

- 3172 Pine Manor Blvd Unit 3172

- 3400 Marshrun Dr

- 2300 Ziner Cir N

- 2407 Sunladen Dr

- 1892 Farmbrook Cir S

- 3267 Castleton St

- 3120-3122 Walden Place

- 1948 Farmbrook Cir S Unit 7

- 1962 Farmbrook Cir N Unit 6

- 2408 Warfield Dr

- 2711-2713 Charles Dr

- 3172 Parkview Dr

- 3168 Parkview Dr

- 3168 Parkview Dr

- 3176 Parkview Dr

- 3176 Parkview Dr Unit 3176

- 3164 Parkview Dr Unit 3164

- 3164 Parkview Dr Unit 3164

- 3164 Parkview Dr

- 3160 Parkview Dr Unit 3160

- 3156 Parkview Dr Unit 3156

- 3156 Parkview Dr

- 3152 Parkview Dr Unit 3152

- 3152 Parkview Dr

- 3215 Parkview Cir

- 3175 Parkview Cir

- 3171 Parkview Cir

- 3179 Parkview Cir Unit 3179

- 3183 Parkview Cir

- 3191 Parkview Cir

- 3167 Parkview Cir Unit 3167