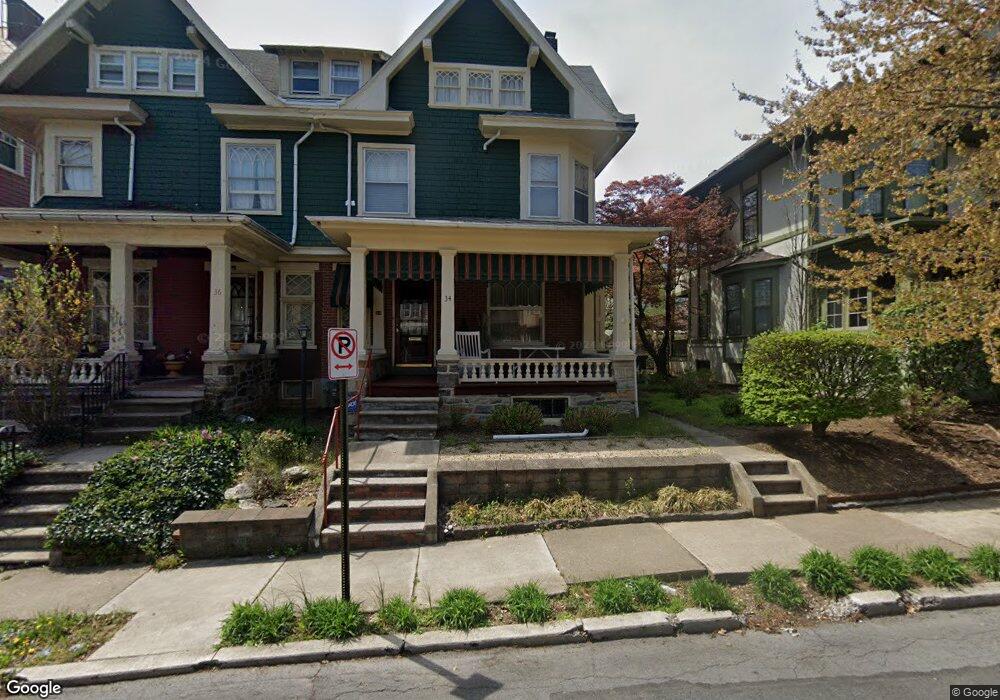

32 S West St Unit 34 Allentown, PA 18102

West End Allentown NeighborhoodEstimated Value: $290,000 - $326,000

5

Beds

1

Bath

2,801

Sq Ft

$108/Sq Ft

Est. Value

About This Home

This home is located at 32 S West St Unit 34, Allentown, PA 18102 and is currently estimated at $301,279, approximately $107 per square foot. 32 S West St Unit 34 is a home located in Lehigh County with nearby schools including Union Terrace Elementary School, Francis D Raub Middle School, and William Allen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 13, 2025

Sold by

Wukitch John W and Wukitch Gailann

Bought by

Tesche Brooke C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,400

Outstanding Balance

$229,803

Interest Rate

6.76%

Mortgage Type

New Conventional

Estimated Equity

$71,476

Purchase Details

Closed on

Sep 16, 2003

Sold by

Heckman Lee G and Heckman Ronald

Bought by

Wukitch John W and Wukitch Gail Ann

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,500

Interest Rate

6.01%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 10, 2003

Sold by

Lambinus Eric A and Snow Cindy L

Bought by

Bubnis Wayne J and Bubnis Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,000

Interest Rate

5.71%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 13, 1994

Sold by

Heckman Lee G and Heckman Marie F

Bought by

Heckman Marie F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tesche Brooke C | $288,000 | None Listed On Document | |

| Wukitch John W | $110,000 | -- | |

| Bubnis Wayne J | $148,500 | Land America Lawyers Title | |

| Heckman Marie F | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tesche Brooke C | $230,400 | |

| Previous Owner | Wukitch John W | $104,500 | |

| Previous Owner | Bubnis Wayne J | $110,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,317 | $162,700 | $15,400 | $147,300 |

| 2024 | $5,317 | $162,700 | $15,400 | $147,300 |

| 2023 | $5,317 | $162,700 | $15,400 | $147,300 |

| 2022 | $5,132 | $162,700 | $147,300 | $15,400 |

| 2021 | $5,030 | $162,700 | $15,400 | $147,300 |

| 2020 | $4,899 | $162,700 | $15,400 | $147,300 |

| 2019 | $4,821 | $162,700 | $15,400 | $147,300 |

| 2018 | $4,495 | $162,700 | $15,400 | $147,300 |

| 2017 | $4,382 | $162,700 | $15,400 | $147,300 |

| 2016 | -- | $162,700 | $15,400 | $147,300 |

| 2015 | -- | $162,700 | $15,400 | $147,300 |

| 2014 | -- | $162,700 | $15,400 | $147,300 |

Source: Public Records

Map

Nearby Homes

- 39 S 17th St

- 128 S West St

- 129 S Saint Cloud St

- 134 S Franklin St

- 1605 W Turner St

- 1420 W Linden St

- 406 S 17th St

- 225 S Franklin St

- 19 S 14th St

- 1331 W Maple St

- 1840 W Turner St

- 447 S 17th St

- 120 S 13th St

- 24 N 13th St

- 1501 W Chew St

- 42 N 13th St

- 1416 W Chew St

- 114 S Saint Elmo St

- 1225 SW Walnut

- 1244 W Union St