320 W Walnut St Unit 5 Ontario, CA 91762

Downtown Ontario NeighborhoodEstimated Value: $293,362 - $297,000

1

Bed

1

Bath

624

Sq Ft

$473/Sq Ft

Est. Value

About This Home

This home is located at 320 W Walnut St Unit 5, Ontario, CA 91762 and is currently estimated at $295,091, approximately $472 per square foot. 320 W Walnut St Unit 5 is a home located in San Bernardino County with nearby schools including Richard Haynes Elementary, Oaks Middle, and Ontario High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2024

Sold by

Lowy David L

Bought by

David L Lowy Family Trust and Rotman

Current Estimated Value

Purchase Details

Closed on

Jul 1, 2010

Sold by

Federal National Mortgage Association

Bought by

Lowy David L

Purchase Details

Closed on

Mar 19, 2010

Sold by

Wilson Shermaine

Bought by

Federal National Mortgage Association

Purchase Details

Closed on

Dec 6, 2005

Sold by

Laurent Marcus Anthony and Laurent Judith P

Bought by

Wilson Shermaine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$38,000

Interest Rate

6.25%

Mortgage Type

Stand Alone Second

Purchase Details

Closed on

Dec 27, 2001

Sold by

Laurent Judith P

Bought by

Laurent Marcus Anthony and Laurent Judith P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$54,283

Interest Rate

6.51%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| David L Lowy Family Trust | -- | None Listed On Document | |

| Lowy David L | $65,000 | Lsi Title Company Inc | |

| Federal National Mortgage Association | $243,723 | Accommodation | |

| Wilson Shermaine | $190,000 | Fidelity National Title Co | |

| Laurent Marcus Anthony | -- | Landsafe Title | |

| Laurent Judith P | -- | Landsafe Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wilson Shermaine | $38,000 | |

| Previous Owner | Wilson Shermaine | $152,000 | |

| Previous Owner | Laurent Judith P | $54,283 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $921 | $83,275 | $29,466 | $53,809 |

| 2024 | $921 | $81,642 | $28,888 | $52,754 |

| 2023 | $896 | $80,042 | $28,322 | $51,720 |

| 2022 | $884 | $78,473 | $27,767 | $50,706 |

| 2021 | $878 | $76,935 | $27,223 | $49,712 |

| 2020 | $863 | $76,146 | $26,944 | $49,202 |

| 2019 | $856 | $74,653 | $26,416 | $48,237 |

| 2018 | $845 | $73,189 | $25,898 | $47,291 |

| 2017 | $815 | $71,754 | $25,390 | $46,364 |

| 2016 | $784 | $70,347 | $24,892 | $45,455 |

| 2015 | $779 | $69,290 | $24,518 | $44,772 |

| 2014 | $755 | $67,933 | $24,038 | $43,895 |

Source: Public Records

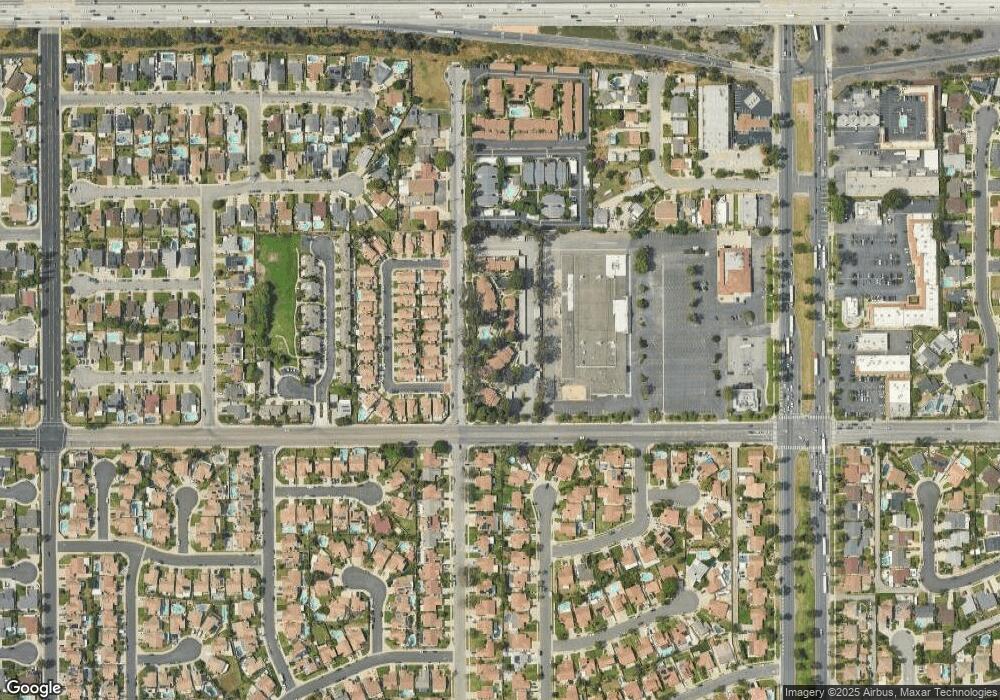

Map

Nearby Homes

- 320 W Walnut St Unit 6

- 12482 Silkleaf Ave

- 12476 Park Ave

- 6763 Poinsettia Ct

- 6703 Poinsettia Ct

- 6703 Aster Ct

- 2350 S Via Esplanade Unit 31

- 2333 S Via Esplanade Unit 25

- 209 W Via Rua Flores

- 2343 S Via Veranda Unit 10

- 2890 S Via Belamaria

- 6766 Foxcroft Ct

- 12834 Zinnea Ave

- 6542 Hamilton St

- 12891 Somerset Place

- 310 E Philadelphia St

- 310 E Philadelphia St Unit 35

- 310 E Philadelphia St Unit SPC 102

- 558 W Philadelphia St

- 12689 Cypress Ave

- 320 W Walnut St Unit 15

- 320 W Walnut St Unit 18

- 320 W Walnut St

- 320 W Walnut St Unit 1

- 320 W Walnut St Unit 3

- 320 W Walnut St Unit 7

- 320 W Walnut St Unit 2

- 320 W Walnut St Unit 9

- 320 W Walnut St Unit 21

- 320 W Walnut St Unit 19

- 320 W Walnut St Unit 10

- 320 W Walnut St Unit 24

- 320 W Walnut St Unit 22

- 320 W Walnut St Unit 20

- 320 W Walnut St Unit 11

- 320 W Walnut St Unit 13

- 320 W Walnut St Unit 40

- 320 W Walnut St Unit 38

- 320 W Walnut St Unit 36

- 320 W Walnut St Unit 34