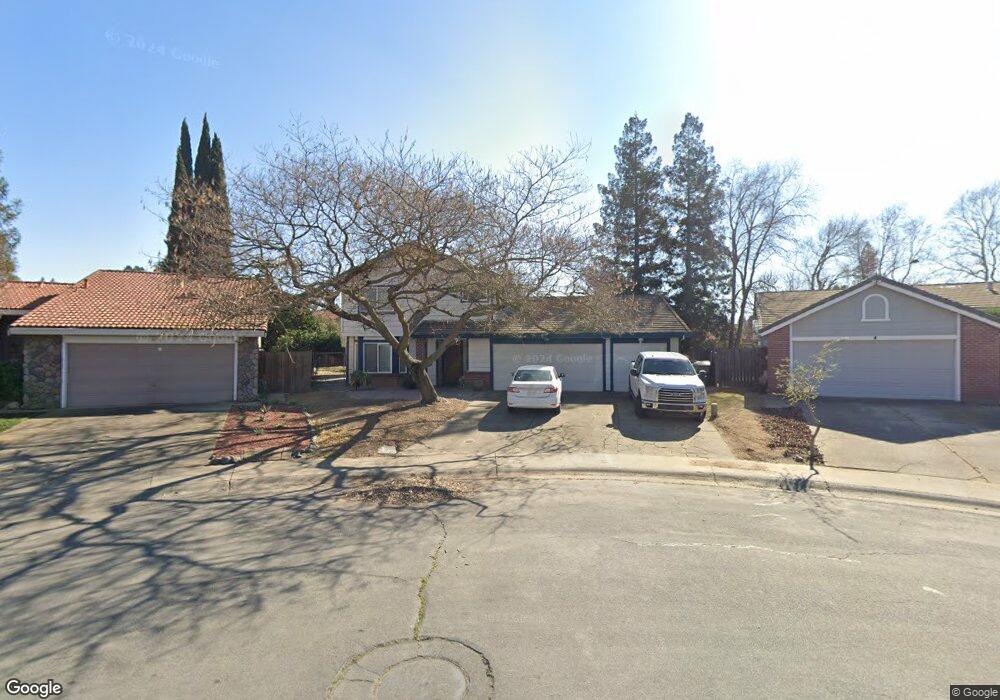

3206 Doroteo Way Sacramento, CA 95833

Frates Ranch NeighborhoodEstimated Value: $389,000 - $548,000

4

Beds

3

Baths

2,146

Sq Ft

$229/Sq Ft

Est. Value

About This Home

This home is located at 3206 Doroteo Way, Sacramento, CA 95833 and is currently estimated at $491,916, approximately $229 per square foot. 3206 Doroteo Way is a home located in Sacramento County with nearby schools including Jefferson Elementary School, Natomas High School, and READ Academy of Sacramento.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 1, 2022

Sold by

Miller Christian James

Bought by

Miller Christian James and Moizeau Cathering

Current Estimated Value

Purchase Details

Closed on

Apr 14, 2003

Sold by

Rutkowski M Hollie

Bought by

Miller Christian James

Purchase Details

Closed on

Apr 6, 1999

Sold by

Ruthkowski Hollie

Bought by

Miller Christian James and Hollie Rutkowski M

Purchase Details

Closed on

Feb 4, 1998

Sold by

Ruthkowski Hollie and Christian James

Bought by

Swathell Hollie R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

6.98%

Purchase Details

Closed on

Jun 4, 1996

Sold by

Rutkowski Hollie and Swathell Hollie R

Bought by

Miller Christian James and Rutkowski Hollie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Miller Christian James | -- | None Listed On Document | |

| Miller Christian James | -- | -- | |

| Miller Christian James | -- | -- | |

| Swathell Hollie R | -- | American Title Co | |

| Miller Christian James | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Swathell Hollie R | $120,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,499 | $249,550 | $52,524 | $197,026 |

| 2024 | $3,499 | $244,658 | $51,495 | $193,163 |

| 2023 | $3,318 | $239,862 | $50,486 | $189,376 |

| 2022 | $3,166 | $235,160 | $49,497 | $185,663 |

| 2021 | $3,181 | $230,550 | $48,527 | $182,023 |

| 2020 | $3,179 | $228,187 | $48,030 | $180,157 |

| 2019 | $3,130 | $223,714 | $47,089 | $176,625 |

| 2018 | $3,018 | $219,328 | $46,166 | $173,162 |

| 2017 | $2,948 | $215,028 | $45,261 | $169,767 |

| 2016 | $2,885 | $210,813 | $44,374 | $166,439 |

| 2015 | $2,807 | $207,647 | $43,708 | $163,939 |

| 2014 | $2,660 | $203,580 | $42,852 | $160,728 |

Source: Public Records

Map

Nearby Homes

- 30 Cedro Cir

- 2897 Candido Dr

- 2872 Baronet Way

- 2511 Aimonetti Ave

- 1763 Bridgecreek Dr

- 1745 Teralba Way

- 100 Del Verde Cir Unit 4

- 600 Del Verde Cir Unit 2

- 350 Del Verde Cir Unit 6

- 100 La Contera Ct Unit 146

- 3150 Spoonwood Way

- 750 Del Verde Cir Unit 6

- 3801 Airport Rd

- 800 Del Verde Cir Unit 6

- 3241 Tice Creek Way

- 3044 Spoonwood Way

- 3028 Spoonwood Way

- 2360 Nucla Way

- 3696 Naturita Way

- 109 Luna Grande Cir Unit 60

- 3210 Doroteo Way

- 3202 Doroteo Way

- 2151 Lejano Way

- 2155 Lejano Way

- 3181 Azevedo Dr

- 3191 Azevedo Dr

- 3214 Doroteo Way

- 3198 Doroteo Way

- 2159 Lejano Way

- 3171 Azevedo Dr

- 3201 Azevedo Dr

- 3215 Doroteo Way

- 3218 Doroteo Way

- 3194 Doroteo Way

- 3211 Azevedo Dr

- 2163 Lejano Way

- 3211 Doroteo Way

- 3190 Doroteo Way

- 3222 Doroteo Way

- 2154 Lejano Way