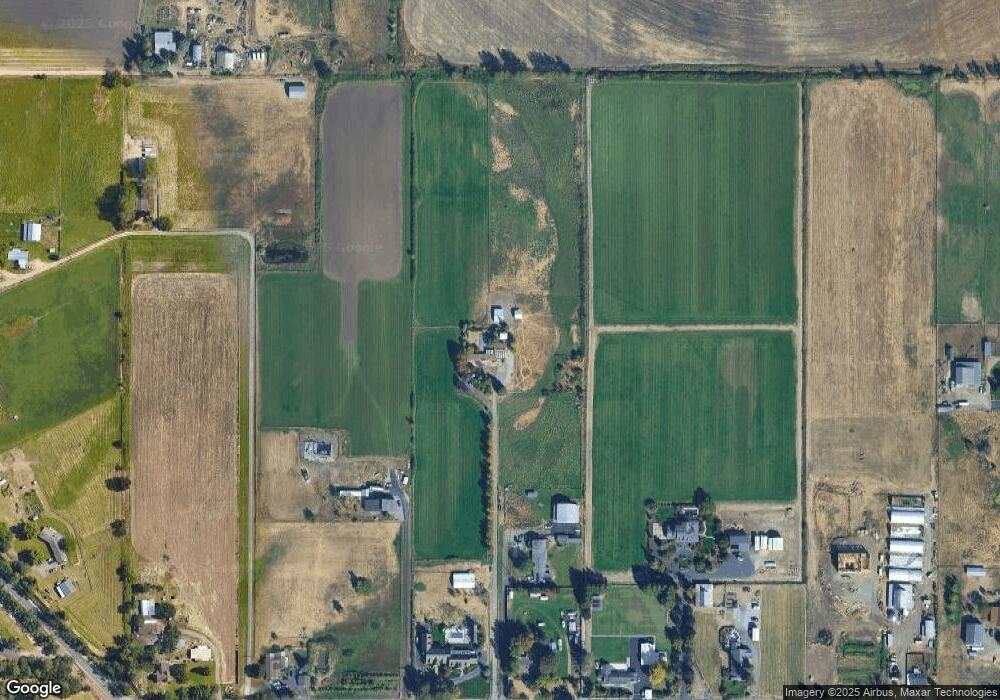

3230 Taylor Rd Central Point, OR 97502

Estimated Value: $706,000 - $1,008,000

4

Beds

3

Baths

2,372

Sq Ft

$365/Sq Ft

Est. Value

About This Home

This home is located at 3230 Taylor Rd, Central Point, OR 97502 and is currently estimated at $864,853, approximately $364 per square foot. 3230 Taylor Rd is a home located in Jackson County with nearby schools including Richardson Elementary School, Scenic Middle School, and Crater High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2011

Sold by

Young Kathleen A and Young Frank A

Bought by

Young Kathleen A and Young Frank A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,500

Outstanding Balance

$168,831

Interest Rate

4.16%

Mortgage Type

New Conventional

Estimated Equity

$696,022

Purchase Details

Closed on

Oct 17, 2001

Sold by

Darst Leonard J and Darst Marilyn R

Bought by

Young Kathleen A and Young Frank A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$275,000

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Young Kathleen A | -- | None Available | |

| Young Kathleen A | $379,000 | Amerititle |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Young Kathleen A | $250,500 | |

| Closed | Young Kathleen A | $275,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2026 | $3,896 | $318,979 | -- | -- |

| 2025 | $3,808 | $309,806 | $17,176 | $292,630 |

| 2024 | $3,808 | $300,901 | $16,791 | $284,110 |

| 2023 | $3,683 | $292,263 | $16,423 | $275,840 |

| 2022 | $3,606 | $292,263 | $16,423 | $275,840 |

| 2021 | $3,369 | $290,442 | $16,062 | $274,380 |

| 2020 | $3,272 | $264,998 | $15,708 | $249,290 |

| 2019 | $3,198 | $250,020 | $15,040 | $234,980 |

| 2018 | $3,100 | $242,856 | $14,716 | $228,140 |

| 2017 | $3,028 | $242,856 | $14,716 | $228,140 |

| 2016 | $2,941 | $229,157 | $14,107 | $215,050 |

| 2015 | $2,806 | $229,157 | $14,107 | $215,050 |

| 2014 | $2,740 | $216,241 | $13,521 | $202,720 |

Source: Public Records

Map

Nearby Homes

- 1134 Steamboat Dr

- 1135 Shake Dr

- 1317 River Run St

- 545 Bridge Creek Dr

- 420 Mayberry Ln

- 3307 Freeland Rd

- 407 Silver Creek Dr

- 4459 Old Stage Rd

- 570 Bachand Cir

- 606 Blue Moon Dr

- 3220 Freeland Rd

- 1167 Boulder Ridge St

- 426 Bridge Creek Dr

- 0 Boulder Ridge St

- 626 Griffin Oaks Dr

- 4533 Old Stage Rd

- 348 Cascade Dr

- 327 Brookhaven Dr

- 369 Cascade Dr

- 2021 Taylor Rd

- 3320 Taylor Rd

- 3210 Taylor Rd

- 3124 Taylor Rd

- 3250 Taylor Rd

- 3198 Taylor Rd

- 3148 Taylor Rd

- 3330 Taylor Rd

- 3358 Taylor Rd

- 3080 Taylor Rd

- 3235 Taylor Rd

- 4202 Old Stage Rd

- 3396 Taylor Rd

- 4048 Old Stage Rd

- 3930 Old Stage Rd

- 2982 Taylor Rd

- 2940 Taylor Rd

- 3223 Taylor Rd

- 3360 Taylor Rd

- 3317 Taylor Rd

- 4021 Old Stage Rd