327 Lemery Dr Unit 215 Columbus, OH 43213

East Broad NeighborhoodEstimated Value: $297,000 - $394,000

3

Beds

3

Baths

2,300

Sq Ft

$155/Sq Ft

Est. Value

About This Home

This home is located at 327 Lemery Dr Unit 215, Columbus, OH 43213 and is currently estimated at $357,342, approximately $155 per square foot. 327 Lemery Dr Unit 215 is a home located in Franklin County with nearby schools including Lincoln Elementary School, Gahanna South Middle School, and Lincoln High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 12, 2015

Sold by

Gaiffe Mark William and Mikkelson Rhiannon Marie

Bought by

Onyango Martha

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$162,011

Outstanding Balance

$120,405

Interest Rate

3.37%

Mortgage Type

FHA

Estimated Equity

$236,937

Purchase Details

Closed on

Jun 28, 2013

Sold by

Sams Abby L

Bought by

Gaiffe Mark William and Mikkelson Rhiannon Marie

Purchase Details

Closed on

Sep 18, 2009

Sold by

M/I Homes Of Central Ohio Llc

Bought by

Sams Abby L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$154,351

Interest Rate

5.19%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Onyango Martha | $165,000 | Northwest Title Family Of Co | |

| Gaiffe Mark William | $158,100 | None Available | |

| Sams Abby L | $157,300 | Transohio |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Onyango Martha | $162,011 | |

| Previous Owner | Sams Abby L | $154,351 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,701 | $112,850 | $29,760 | $83,090 |

| 2024 | $5,701 | $112,850 | $29,760 | $83,090 |

| 2023 | $5,620 | $112,840 | $29,750 | $83,090 |

| 2022 | $5,645 | $89,750 | $13,130 | $76,620 |

| 2021 | $5,653 | $89,750 | $13,130 | $76,620 |

| 2020 | $5,598 | $89,750 | $13,130 | $76,620 |

| 2019 | $4,405 | $71,800 | $10,510 | $61,290 |

| 2018 | $3,752 | $71,800 | $10,510 | $61,290 |

| 2017 | $3,982 | $71,800 | $10,510 | $61,290 |

| 2016 | $3,136 | $51,710 | $11,980 | $39,730 |

| 2015 | $3,138 | $51,710 | $11,980 | $39,730 |

| 2014 | $3,109 | $51,710 | $11,980 | $39,730 |

| 2013 | $68 | $2,275 | $2,275 | $0 |

Source: Public Records

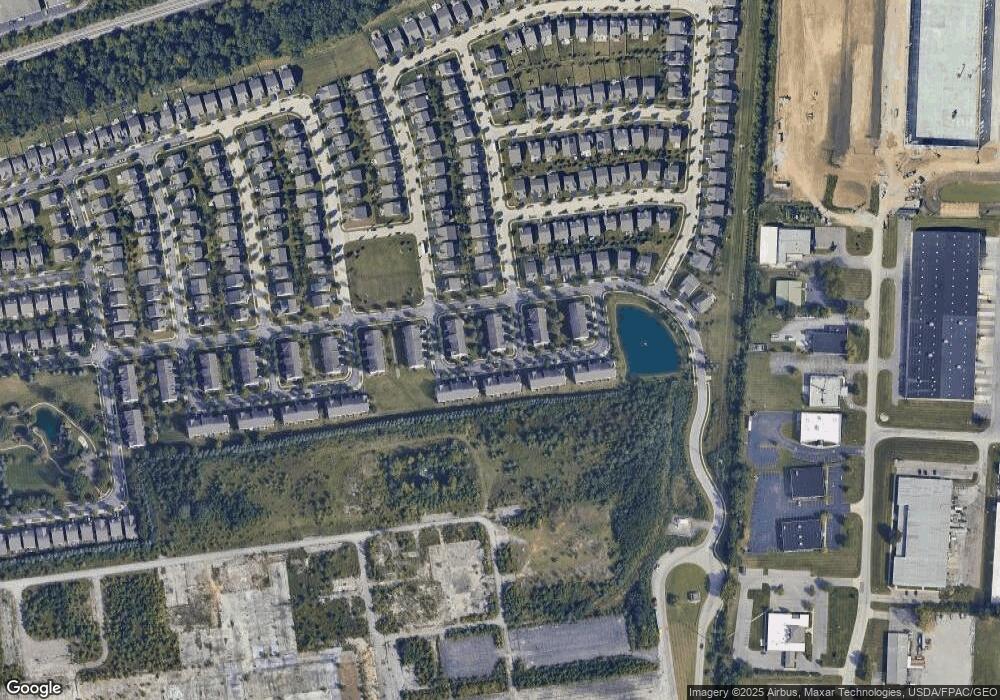

Map

Nearby Homes

- 324 Benedetti Ave

- 6162 Stockton Trail Way

- 362 Hoskins Way

- 875 Taylor Station Rd

- 85 Stornoway Dr W Unit 85

- 117 Stornoway Dr E

- 6415 Old Church Way

- 142 Villamere Dr Unit 6

- 71 Villa Side Ln

- 970 Claycraft Rd

- 6204 Marias Point Ln

- 445 Hawthorne Place

- 6560 Schenk Ave

- 458 Brice Rd

- 6571 Schenk Ave

- 491 Durbin Rd Unit A

- 524 Woodingham Place Unit 3-B

- 5825 Bastille Place Unit 69

- 217 MacAndrews Way Unit 61C

- 6033 McNaughten Grove Ln

- 327 Lemery Dr

- 331 Lemery Dr

- 333 Lemery Dr

- 333 Lemery Dr Unit 217

- 335 Lemery Dr

- 339 Lemery Dr

- 324 Josaphat Way Unit 214

- 6301 Chetti Dr

- 6297 Chetti Dr Unit 243

- 6293 Chetti Dr

- 328 Josaphat Way

- 328 Josaphat Way Unit 213

- 6289 Chetti Dr

- 332 Josaphat Way Unit 211

- 328 Lemery Dr

- 328 Lemery Dr Unit 224

- 330 Josaphat Way Unit 212

- 330 Josaphat Way

- 330 Lemery Dr Unit 223

- 330 Lemery Dr

Your Personal Tour Guide

Ask me questions while you tour the home.