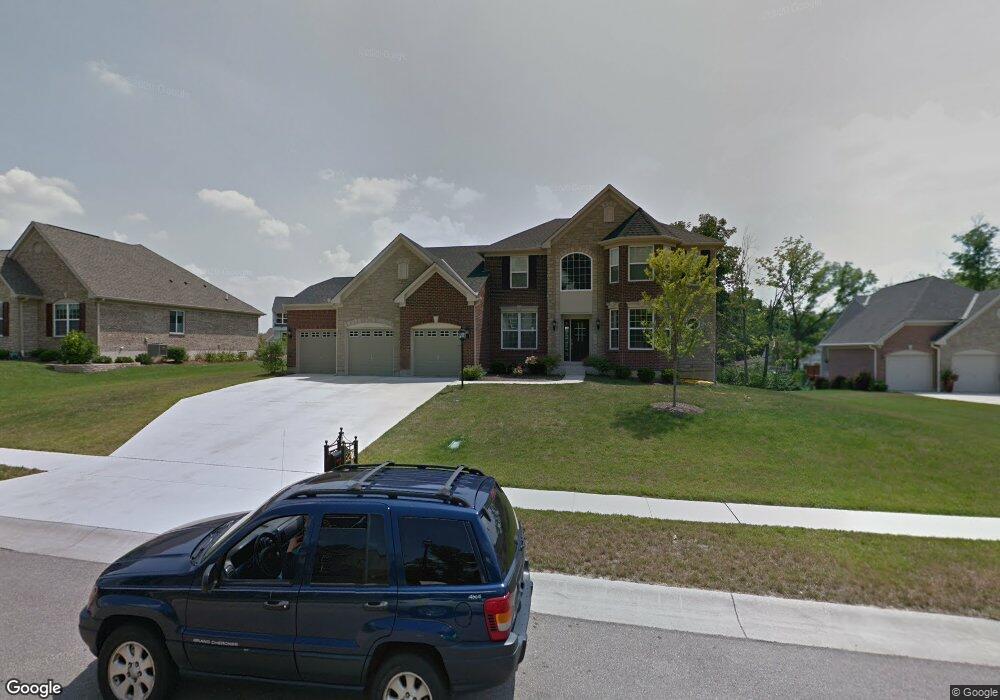

3270 Cornwallis Ct Dayton, OH 45414

Estimated Value: $402,368 - $521,000

4

Beds

4

Baths

3,063

Sq Ft

$150/Sq Ft

Est. Value

About This Home

This home is located at 3270 Cornwallis Ct, Dayton, OH 45414 and is currently estimated at $460,342, approximately $150 per square foot. 3270 Cornwallis Ct is a home located in Montgomery County with nearby schools including Smith Middle School, Demmitt Elementary School, and Butler High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 15, 2025

Sold by

Green Dena L and Green Robert M

Bought by

Green Ethan Scott and Green Cassie H

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$299,197

Outstanding Balance

$297,654

Interest Rate

6.56%

Mortgage Type

New Conventional

Estimated Equity

$162,688

Purchase Details

Closed on

Jun 15, 2016

Sold by

Green Dena I

Bought by

Green Dena I and Green Robert M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$294,611

Interest Rate

3.48%

Mortgage Type

VA

Purchase Details

Closed on

Jun 11, 2014

Sold by

Lozan Jamie M

Bought by

Green Dena I

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

4.13%

Mortgage Type

VA

Purchase Details

Closed on

Jun 9, 2014

Sold by

Lozan Tara D

Bought by

Lozan Jamie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,000

Interest Rate

4.13%

Mortgage Type

VA

Purchase Details

Closed on

Jun 23, 2010

Sold by

The Drees Company

Bought by

Lozan Jamie M and Lozan Tara D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$277,353

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 11, 2007

Sold by

Yorkshire Reserve Llc

Bought by

The Drees Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Green Ethan Scott | -- | Mortgage Connect | |

| Green Dena I | -- | None Available | |

| Green Dena I | $292,000 | First Ohio Title Agency | |

| Lozan Jamie M | -- | First Ohio Title Agency | |

| Lozan Jamie M | $315,300 | None Available | |

| The Drees Co | $228,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Green Ethan Scott | $299,197 | |

| Previous Owner | Green Dena I | $294,611 | |

| Previous Owner | Green Dena I | $292,000 | |

| Previous Owner | Lozan Jamie M | $277,353 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,933 | $19,250 | $14,000 | $5,250 |

| 2024 | $6,133 | $19,250 | $14,000 | $5,250 |

| 2023 | $6,133 | $19,250 | $14,000 | $5,250 |

| 2022 | $7,663 | $78,309 | $0 | $78,309 |

| 2021 | $7,648 | $78,309 | $0 | $78,309 |

| 2020 | $7,492 | $78,309 | $0 | $78,309 |

| 2019 | $8,201 | $78,309 | $0 | $78,309 |

| 2018 | $8,210 | $78,309 | $0 | $78,309 |

| 2017 | $8,130 | $78,309 | $0 | $78,309 |

| 2016 | $7,785 | $70,714 | $0 | $70,714 |

| 2015 | $7,388 | $70,714 | $0 | $70,714 |

| 2014 | $7,388 | $19,250 | $14,000 | $5,250 |

| 2012 | -- | $19,250 | $19,250 | $0 |

Source: Public Records

Map

Nearby Homes

- 3338 Turtle Shell Dr

- 3179 Northerton Ct

- 3181 Northerton Ct

- 3185 Northerton Ct

- 3178 Northerton Ct

- 3162 Scarborough Ct

- 3158 Scarborough Ct

- 3332 Sea Turtle Dr

- 7531 Turtleback Dr

- 7543 Abraham Ct

- 7580 Turtle Creek Dr

- 7060 Peters Pike

- 2501 Harrow Ct

- 8375 Peters Pike

- 6810 Trailview Dr

- 2750 Brantwood Ct

- 2064 Echoing Oaks Cir

- 3600 Little York Rd

- 1371 Cornish Dr

- 1727 Ashworth Dr

- 3280 Cornwallis Ct

- 3264 Cornwallis Ct

- 0 Cornwallis Court - Lot #43 Unit 553204

- 0 Cornwallis Court - Lot #42 Unit 553195

- 3301 Turtle Shell Dr

- 3289 Cornwallis Ct

- 3311 Turtle Shell Dr

- 3273 Cornwallis Ct

- 3265 Cornwallis Ct

- 3281 Cornwallis Ct

- 3250 Cornwallis Ct

- 3294 Cornwallis Ct

- 3257 Cornwallis Ct

- 7640 Peters Pike

- 3299 Cornwallis Ct

- 3249 Cornwallis Ct

- 3010 Desert Turtle Ct

- 3310 Turtle Shell Dr

- 7770 Peters Pike

- 3326 Turtle Shell Dr

Your Personal Tour Guide

Ask me questions while you tour the home.