3300 Emerald Lakes Dr Unit 3 Cincinnati, OH 45211

South Monfort Heights NeighborhoodEstimated Value: $169,000 - $182,000

2

Beds

2

Baths

1,144

Sq Ft

$153/Sq Ft

Est. Value

About This Home

This home is located at 3300 Emerald Lakes Dr Unit 3, Cincinnati, OH 45211 and is currently estimated at $175,073, approximately $153 per square foot. 3300 Emerald Lakes Dr Unit 3 is a home located in Hamilton County with nearby schools including Monfort Heights Elementary School, White Oak Middle School, and Colerain High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2024

Sold by

Andriacco Anthony A

Bought by

Cuda Ryan Robert and Rackley-Cuda Colleen K

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,600

Outstanding Balance

$131,694

Interest Rate

6.79%

Mortgage Type

New Conventional

Estimated Equity

$43,379

Purchase Details

Closed on

Nov 2, 2005

Sold by

Eisenmann Stephanie K

Bought by

Andriacco Anthony A and King Andriacco Martha L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$59,400

Interest Rate

5.98%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Mar 29, 2001

Sold by

Emerald Lakes Condominium

Bought by

Eisenmann Stephanie K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,400

Interest Rate

7.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cuda Ryan Robert | $168,500 | Mattingly Ford Title | |

| Cuda Ryan Robert | $168,500 | Mattingly Ford Title | |

| Andriacco Anthony A | $114,400 | None Available | |

| Eisenmann Stephanie K | $113,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cuda Ryan Robert | $133,600 | |

| Closed | Cuda Ryan Robert | $133,600 | |

| Previous Owner | Andriacco Anthony A | $59,400 | |

| Previous Owner | Eisenmann Stephanie K | $96,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,612 | $40,268 | $6,300 | $33,968 |

| 2023 | $1,659 | $40,268 | $6,300 | $33,968 |

| 2022 | $1,171 | $26,635 | $6,300 | $20,335 |

| 2021 | $1,068 | $26,635 | $6,300 | $20,335 |

| 2020 | $1,086 | $26,635 | $6,300 | $20,335 |

| 2019 | $1,196 | $26,635 | $6,300 | $20,335 |

| 2018 | $1,066 | $26,635 | $6,300 | $20,335 |

| 2017 | $1,004 | $26,635 | $6,300 | $20,335 |

| 2016 | $1,057 | $27,405 | $5,481 | $21,924 |

| 2015 | $1,072 | $27,405 | $5,481 | $21,924 |

| 2014 | $1,074 | $27,405 | $5,481 | $21,924 |

| 2013 | $1,225 | $31,500 | $6,300 | $25,200 |

Source: Public Records

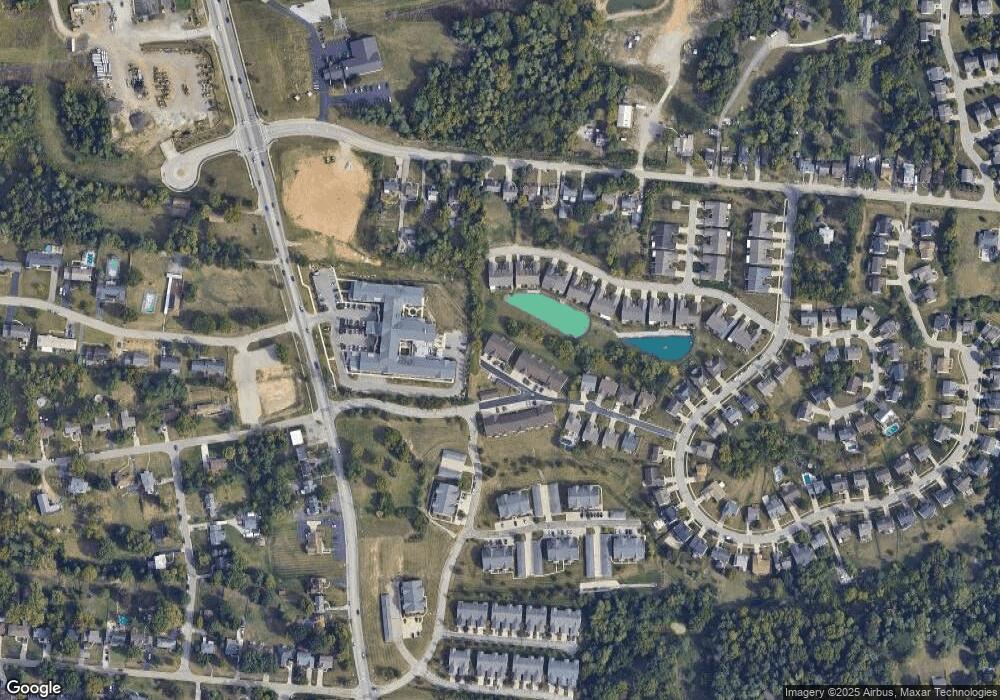

Map

Nearby Homes

- 4790 N Bend Rd

- 3352 Emerald Lakes Dr

- 3352 Emerald Lakes Dr Unit 1-A

- 4820 N Bend Rd

- 4830 N Bend Rd

- 4808 N Bend Rd

- 4798 N Bend Rd

- 4911 N Bend Rd

- 3308 Kleeman Lake Ct

- 4768 Kleeman Green Dr

- 3318 Kleeman Rd

- 3579 Rackacres Dr

- 3363 Diehl Rd

- 3354 Forestview Gardens Dr

- 3073 Timberview Dr

- 3743 Centurion Dr

- 4375 Airycrest Ln

- 2903 Goda Ave

- 3775 Boomer Rd

- 3774 Ridgewood Ave

- 3300 Emerald Lakes Dr Unit 4

- 3300 Emerald Lakes Dr Unit 1

- 3300 Emerald Lakes Dr Unit 2

- 3300 Emerald Lakes Dr

- 3302 Emerald Lakes Dr

- 3302 Emerald Lakes Dr Unit 6

- 3302 Emerald Lakes Dr Unit 10

- 3302 Emerald Lakes Dr Unit 7

- 3302 Emerald Lakes Dr Unit 8

- 3302 Emerald Lakes Dr Unit 9

- 3304 Emerald Lakes Dr Unit 14

- 3304 Emerald Lakes Dr Unit 11

- 3304 Emerald Lakes Dr Unit 12

- 3304 Emerald Lakes Dr Unit 13

- 3304 Emerald Lakes Dr Unit 15

- 3312 Emerald Lakes Dr Unit 23

- 3312 Emerald Lakes Dr Unit 22

- 3312 Emerald Lakes Dr Unit 21

- 3312 Emerald Lakes Dr Unit 24

- 3312 Emerald Lakes Dr