3313 Duckett Mill Rd Gainesville, GA 30506

Estimated Value: $723,000 - $1,271,000

4

Beds

4

Baths

2,772

Sq Ft

$343/Sq Ft

Est. Value

About This Home

This home is located at 3313 Duckett Mill Rd, Gainesville, GA 30506 and is currently estimated at $951,748, approximately $343 per square foot. 3313 Duckett Mill Rd is a home located in Hall County with nearby schools including Sardis Elementary School, Cartersville Primary School, and Chestatee Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 25, 2006

Sold by

Fortney Kim and Fortney Peggy M

Bought by

Goodman Kenneth M and Goodman Faith A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,200

Interest Rate

6.67%

Mortgage Type

Trade

Purchase Details

Closed on

Feb 5, 2003

Sold by

Fortney Kim

Bought by

Fortney Kim and Fortney Peggy M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$490,000

Interest Rate

5.93%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 2, 1998

Sold by

Fortney Joyce E

Bought by

Fortney Kim

Purchase Details

Closed on

Nov 1, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Goodman Kenneth M | $435,000 | -- | |

| Fortney Kim | -- | -- | |

| Fortney Kim | -- | -- | |

| -- | $27,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Goodman Kenneth M | $400,200 | |

| Previous Owner | Fortney Kim | $490,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,768 | $339,352 | $116,600 | $222,752 |

| 2023 | $2,471 | $315,992 | $116,600 | $199,392 |

| 2022 | $6,205 | $305,308 | $116,600 | $188,708 |

| 2021 | $6,387 | $261,680 | $75,800 | $185,880 |

| 2020 | $6,387 | $254,760 | $75,800 | $178,960 |

| 2019 | $8,112 | $315,800 | $160,178 | $155,622 |

| 2018 | $8,379 | $315,800 | $160,178 | $155,622 |

| 2017 | $5,985 | $418,360 | $247,400 | $170,960 |

| 2016 | $6,345 | $232,800 | $61,840 | $170,960 |

| 2015 | $6,396 | $232,800 | $61,840 | $170,960 |

| 2014 | $6,396 | $232,800 | $61,840 | $170,960 |

Source: Public Records

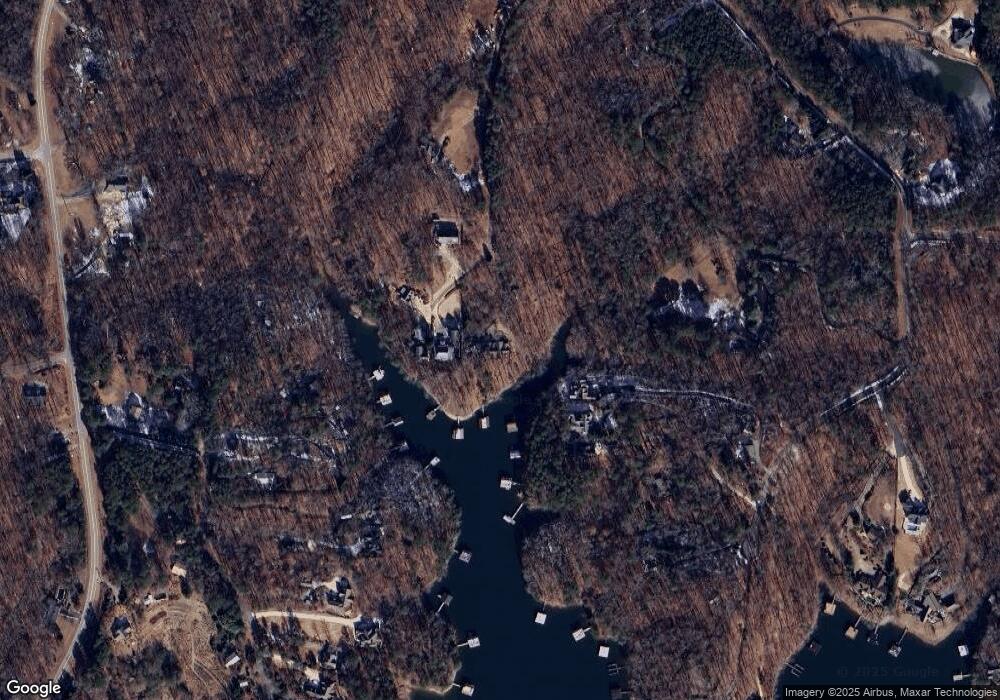

Map

Nearby Homes

- 3551 Monroe Cir

- 3593 Duckett Mill Rd

- 3498 Hickory Lake Dr

- 3393 Banks Mountain Dr

- 3568 Old Duckett Mill Rd

- 3641 Bert Dr

- 3645 Bert Dr

- 0 Dawsonville Hwy Unit 7642688

- 3550 Dockside Shores Dr

- 3551 Dockside Shores Dr

- 3524 Lake Ridge Dr

- 3543 Dockside Shores Dr

- 3311 Marina View Way

- 3533 Lake Ridge Dr

- 2903 Lynncliff Dr

- 3552 Lake Ridge Dr

- 3317 Duckett Mill Rd

- 3315 Duckett Mill Rd

- 3444 Green Apple Rd

- 3450 Green Apple Rd Unit TRACT 3

- 3450 Green Apple Rd

- 3329 Duckett Mill Rd Unit 25

- 3329 Duckett Mill Rd

- 3445 Monroe Cir

- 3441 Monroe Cir

- 3501 Monroe Cir

- 3442 Green Apple Rd Unit TRACT 1

- 3442 Green Apple Rd

- 3513 Monroe Cir

- 3309 Duckett Mill Rd

- 3519 Monroe Cir

- 3435 Monroe Cir

- 3429 Monroe Cir

- 3454 Green Apple Rd

- 3507 Monroe Cir

- 3336 Green Apple Rd