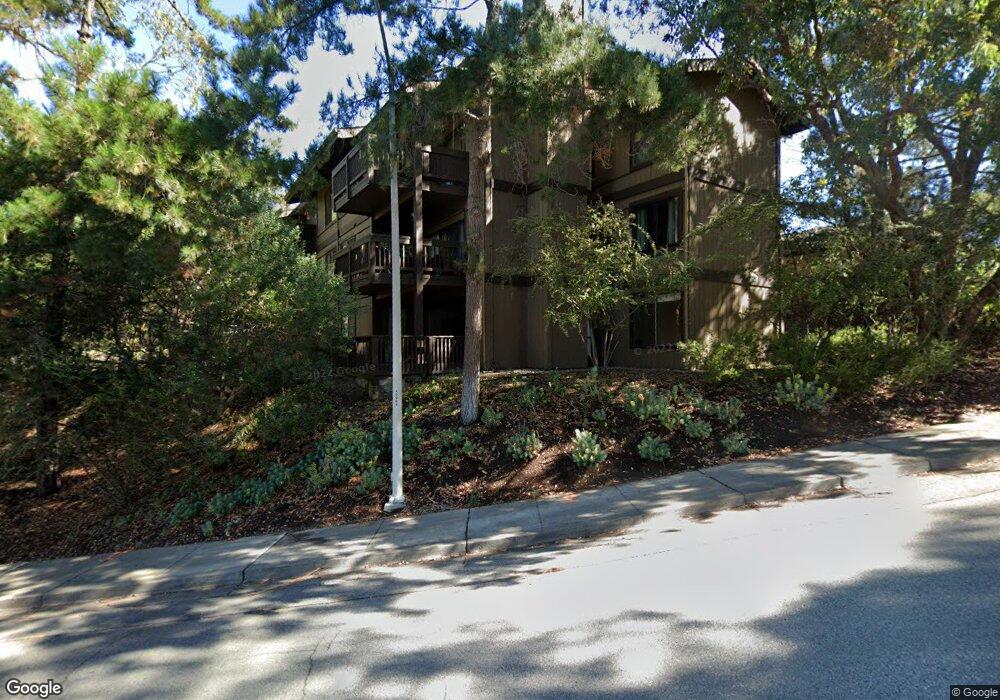

3328 Brittan Ave Unit 11 San Carlos, CA 94070

Beverly Terrace NeighborhoodEstimated Value: $773,686 - $897,000

2

Beds

2

Baths

1,040

Sq Ft

$788/Sq Ft

Est. Value

About This Home

This home is located at 3328 Brittan Ave Unit 11, San Carlos, CA 94070 and is currently estimated at $819,172, approximately $787 per square foot. 3328 Brittan Ave Unit 11 is a home located in San Mateo County with nearby schools including Tierra Linda Middle School, Carlmont High School, and Heather Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 24, 2017

Sold by

Casey Thomas F and Casey Betty

Bought by

Beetley Casey Thomas F and Beetley Casey Betty

Current Estimated Value

Purchase Details

Closed on

Aug 24, 2010

Sold by

Casey Gigi Chi Tseng and Casey Joseph Michael

Bought by

Casey Thomas F and Casey Betty

Purchase Details

Closed on

Jan 26, 1999

Sold by

Casey Gigi Chi Tseng and Casey Joseph Michael

Bought by

Casey Gigi Chi Tseng and Casey Joseph Michael

Purchase Details

Closed on

Apr 8, 1997

Sold by

Gigi Tseng and Ping Tseng Wu

Bought by

Tseng Casey Joseph and Tseng Casey Gigi

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Beetley Casey Thomas F | -- | None Available | |

| Casey Thomas F | $455,000 | First American Title Company | |

| Casey Gigi Chi Tseng | -- | First American Title Co | |

| Tseng Casey Joseph | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,284 | $582,919 | $174,872 | $408,047 |

| 2023 | $8,284 | $560,286 | $168,083 | $392,203 |

| 2022 | $7,829 | $549,301 | $164,788 | $384,513 |

| 2021 | $7,702 | $538,531 | $161,557 | $376,974 |

| 2020 | $7,597 | $533,010 | $159,901 | $373,109 |

| 2019 | $7,407 | $522,560 | $156,766 | $365,794 |

| 2018 | $7,207 | $512,315 | $153,693 | $358,622 |

| 2017 | $7,095 | $502,271 | $150,680 | $351,591 |

| 2016 | $6,929 | $492,424 | $147,726 | $344,698 |

| 2015 | $6,908 | $485,029 | $145,508 | $339,521 |

| 2014 | $6,651 | $475,529 | $142,658 | $332,871 |

Source: Public Records

Map

Nearby Homes

- 3334 Brittan Ave Unit 9

- 3374 Brittan Ave Unit 13

- 3295 La Mesa Dr Unit 7

- 3271 Brittan Ave

- 3372 La Mesa Dr Unit 2

- 3350 La Mesa Dr Unit 9

- 115 Crestview Ct

- 3161 La Mesa Dr

- 1 Lewis Ranch Rd

- 5 El Vanada Rd

- 2 El Vanada Rd

- 4 El Vanada Rd

- 438 Portofino Dr Unit 101

- 438 Portofino Dr Unit 102

- 9 Lilly Ln

- 760 Loma Ct

- 758 Loma

- 416 Palomar Dr

- 15 Calypso Ln

- 10 Azalea Ln

- 3316 Brittan Ave

- 3314 Brittan Ave

- 3314 Brittan Ave Unit 1

- 3322 Brittan Ave Unit 3

- 3314 Brittan Ave

- 3334 Brittan Ave Unit 10

- 3336 Brittan Ave Unit 8

- 3336 Brittan Ave Unit 7

- 3332 Brittan Ave Unit 6

- 3332 Brittan Ave Unit 5

- 3334 Brittan Ave Unit 4

- 3334 Brittan Ave Unit 3

- 3336 Brittan Ave Unit 2

- 3336 Brittan Ave Unit 1

- 3328 Brittan Ave Unit 12

- 3330 Brittan Ave Unit 10

- 3330 Brittan Ave Unit 9

- 3328 Brittan Ave Unit 8

- 3328 Brittan Ave Unit 7

- 3314 Brittan Ave Unit 8