33646 Scottys Cove Dr Unit 114 Dana Point, CA 92629

Del Obispo NeighborhoodEstimated Value: $1,138,371 - $1,257,000

3

Beds

2

Baths

1,672

Sq Ft

$708/Sq Ft

Est. Value

About This Home

This home is located at 33646 Scottys Cove Dr Unit 114, Dana Point, CA 92629 and is currently estimated at $1,183,093, approximately $707 per square foot. 33646 Scottys Cove Dr Unit 114 is a home located in Orange County with nearby schools including Del Obispo Elementary School, Marco Forster Middle School, and Dana Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 20, 2024

Sold by

Copp Trust and Copp James R

Bought by

Kimmel Virginia

Current Estimated Value

Purchase Details

Closed on

Jan 20, 2010

Sold by

Copp Rosaura

Bought by

Copp Rosaura and The Copp Trust

Purchase Details

Closed on

Mar 9, 2005

Sold by

Copp James R and Copp Rosaura

Bought by

Copp James R and Copp Rosaura

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

5.61%

Mortgage Type

Credit Line Revolving

Purchase Details

Closed on

Mar 21, 1995

Sold by

Copp James R and Copp Rosaura

Bought by

Copp James R and Copp Rosaura

Purchase Details

Closed on

Jan 28, 1994

Sold by

Mockett Horace and Mockett Patricia D

Bought by

Copp James R and Copp Rosaura

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$65,000

Interest Rate

7%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kimmel Virginia | -- | None Listed On Document | |

| Copp Rosaura | -- | None Available | |

| Copp James R | -- | Ticor Title Company Of Ca | |

| Copp James R | -- | Ticor Title Company Of Ca | |

| Copp James R | -- | -- | |

| Copp James R | $170,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Copp James R | $250,000 | |

| Previous Owner | Copp James R | $65,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,442 | $288,934 | $76,579 | $212,355 |

| 2024 | $4,442 | $283,269 | $75,077 | $208,192 |

| 2023 | $4,231 | $277,715 | $73,605 | $204,110 |

| 2022 | $4,129 | $272,270 | $72,162 | $200,108 |

| 2021 | $3,417 | $266,932 | $70,747 | $196,185 |

| 2020 | $3,484 | $264,195 | $70,021 | $194,174 |

| 2019 | $3,406 | $259,015 | $68,648 | $190,367 |

| 2018 | $3,151 | $253,937 | $67,302 | $186,635 |

| 2017 | $3,059 | $248,958 | $65,982 | $182,976 |

| 2016 | $3,017 | $244,077 | $64,688 | $179,389 |

| 2015 | $2,879 | $240,411 | $63,716 | $176,695 |

| 2014 | $2,836 | $235,702 | $62,468 | $173,234 |

Source: Public Records

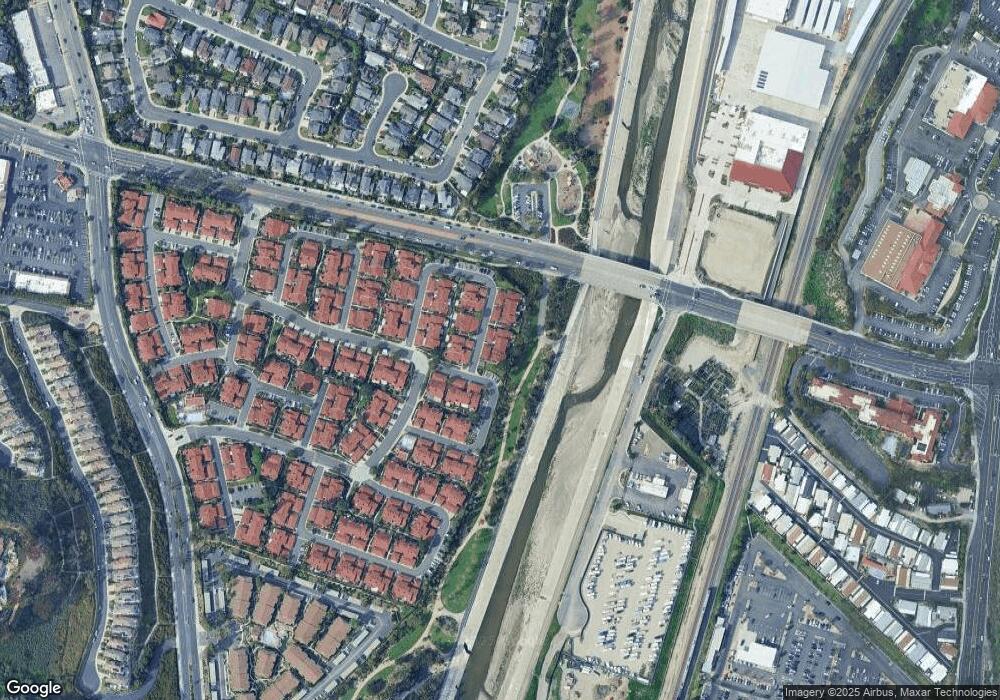

Map

Nearby Homes

- 33651 Surfside Dr Unit 41

- 33852 Del Obispo St Unit 80

- 33852 Del Obispo St Unit 2

- 33852 Del Obispo St Unit 117

- 33852 Del Obispo St Unit 112

- 33831 Camino Capistrano Unit 50

- 25611 Quail Run Unit 131

- 25611 Quail Run Unit 88

- 25382 Sea Bluffs Dr Unit 8205

- 18 Indigo Way

- 33582 Bremerton St

- 25422 Sea Bluffs Dr Unit 207

- 25432 Sea Bluffs Dr Unit 302

- 26000 Avenida Aeropuerto Unit 55

- 33095 Regatta Ct

- 33095 Southwind Ct

- 33901 Paseo Eternidad

- 33491 Sea Bright Dr

- 26000 Avenida Aeropuerto Unit 155

- 26000 Avenida Aeropuerto Unit 148

- 33642 Scottys Cove Dr Unit 113

- 33652 Scottys Cove Dr

- 33662 Scottys Cove Dr Unit 117

- 33662 Scottys Cove Dr Unit 114

- 33666 Scottys Cove Dr Unit 118

- 33651 Scottys Cove Dr

- 33645 Scottys Cove Dr

- 33655 Scottys Cove Dr Unit 107

- 33672 Scottys Cove Dr Unit 119

- 33661 Scottys Cove Dr

- 33676 Scottys Cove Dr Unit 12

- 33671 Scottys Cove Dr Unit 110

- 33671 Scottys Cove Dr

- 33681 Scottys Cove Dr

- 33685 Scottys Cove Dr

- 33656 Scottys Cove Dr

- 33621 Port Marine Dr Unit 61

- 33666 Breakwater Dr

- 33656 Breakwater Dr Unit 99

- 33652 Breakwater Dr Unit 100