3410 Emmanuel Way Alpine, CA 91901

Estimated Value: $659,959 - $802,000

3

Beds

2

Baths

1,430

Sq Ft

$510/Sq Ft

Est. Value

About This Home

This home is located at 3410 Emmanuel Way, Alpine, CA 91901 and is currently estimated at $729,490, approximately $510 per square foot. 3410 Emmanuel Way is a home located in San Diego County with nearby schools including Granite Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 4, 1999

Sold by

Kiesel James S and Kiesel Patricia E

Bought by

Hanson Richard and Hanson Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,200

Outstanding Balance

$36,687

Interest Rate

7.4%

Estimated Equity

$692,803

Purchase Details

Closed on

Nov 3, 1993

Sold by

Mitchell David J and Mitchell Jean E

Bought by

Kiesel James S and Kiesel Patricia E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,214

Interest Rate

7.15%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanson Richard | $165,000 | Commonwealth Land Title Co | |

| Kiesel James S | $55,000 | Orange Coast Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hanson Richard | $135,200 | |

| Previous Owner | Kiesel James S | $117,214 | |

| Closed | Hanson Richard | $25,300 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,182 | $285,489 | $130,634 | $154,855 |

| 2024 | $3,182 | $279,892 | $128,073 | $151,819 |

| 2023 | $3,246 | $274,405 | $125,562 | $148,843 |

| 2022 | $3,223 | $269,025 | $123,100 | $145,925 |

| 2021 | $3,313 | $263,751 | $120,687 | $143,064 |

| 2020 | $3,256 | $261,048 | $119,450 | $141,598 |

| 2019 | $3,196 | $255,930 | $117,108 | $138,822 |

| 2018 | $3,131 | $250,912 | $114,812 | $136,100 |

| 2017 | $511 | $245,993 | $112,561 | $133,432 |

| 2016 | $2,866 | $241,170 | $110,354 | $130,816 |

| 2015 | $2,851 | $237,549 | $108,697 | $128,852 |

| 2014 | $2,784 | $232,896 | $106,568 | $126,328 |

Source: Public Records

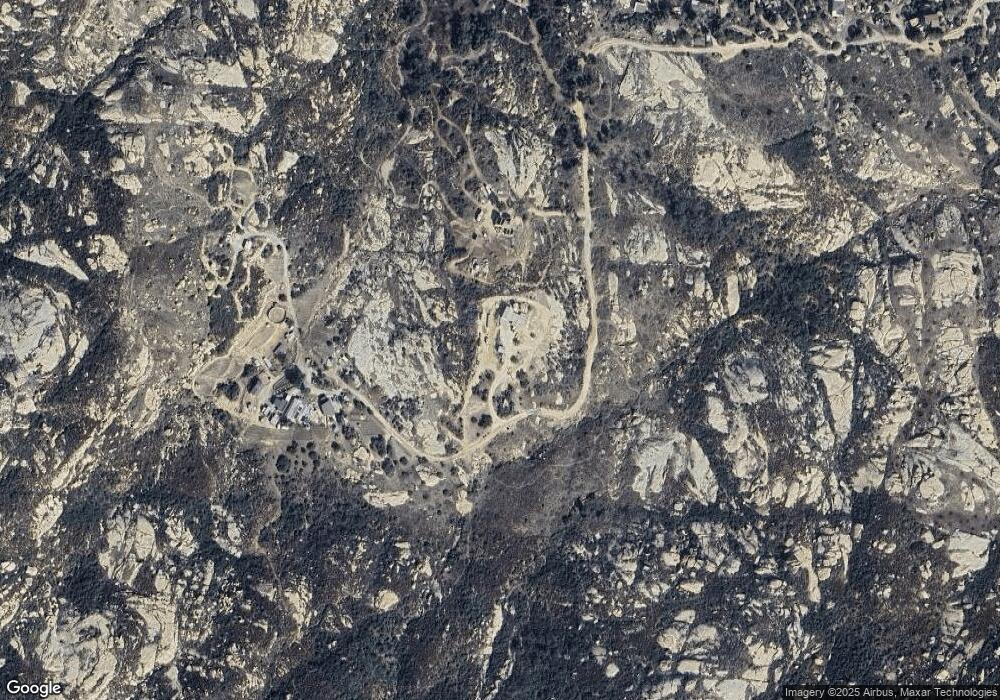

Map

Nearby Homes

- 19191 High Glen Rd Unit 4

- 19150 High Glen Rd

- 2413 ,2425 Oak Valley Trail

- 0000 High Glen Rd

- 2526 Forest Park Rd

- 4722 Park Ln

- 4826 Hidden Glen Dr

- 0 Bunny Dr Unit Sec 26-16-2E Nwq Neq

- 0 Bunny Dr Unit Sec 26-16-2E Nwq Doc

- Midway Drive

- 0 Lawson Valley Rd Unit 2

- 21908 Japatul Ln

- 21916 Japatul Ln

- 22750 Illahee Dr

- 4391 Montiel Truck Trail

- 22815 17 Illahee Dr

- 17368 Skyline Truck Trail

- 23002 Japatul Valley Rd

- 4065 Via Palo Verde Lago

- 17020 Skyline Truck Trail

- 3440 Emmanuel Way

- 3355 Emmanuel Way

- 3560 Emmanuel Way

- 3580 Emmanuel Way Unit B

- 3580 Emmanuel Way

- 3630 Emmanuel Way

- 3630 Emmanuel Way

- 3715 Gaskill Peak Rd

- 20419 Lost Trail

- 3674 Emmanuel Way

- 3320 Carveacre Rd

- 3320 Carveacre Rd

- 3735 Gaskill Peak Rd

- 3350 Carveacre Rd

- 3675 Emmanuel Way

- 3720 Emmanuel Way

- 20555 Lost Trail

- 3325 Carveacre Rd

- 3890 Gaskill Peak Rd

- 0 Lost Trail

Your Personal Tour Guide

Ask me questions while you tour the home.