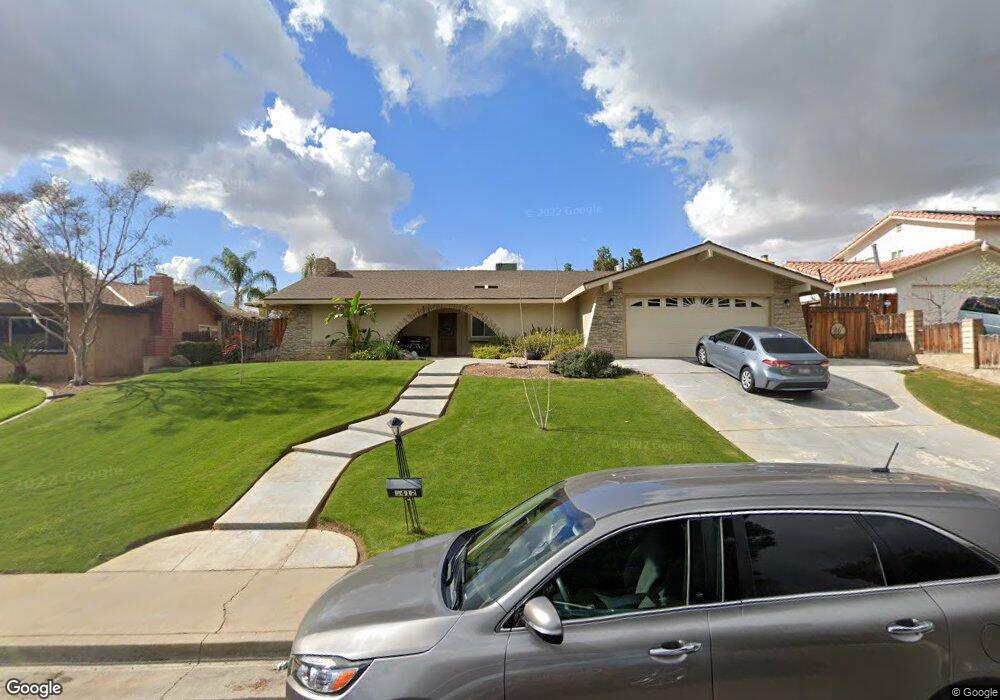

3412 Janene Way Bakersfield, CA 93306

Bakersfield Country Club NeighborhoodEstimated Value: $367,511 - $418,000

4

Beds

2

Baths

1,819

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 3412 Janene Way, Bakersfield, CA 93306 and is currently estimated at $395,878, approximately $217 per square foot. 3412 Janene Way is a home located in Kern County with nearby schools including Harding Elementary School, Compton Junior High School, and Highland High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 3, 2011

Sold by

Mendez Macario T and Mendez Norma E

Bought by

Baxter Terry L and Terry L Baxter Trust

Current Estimated Value

Purchase Details

Closed on

Feb 16, 2004

Sold by

Sims Catherine W and Estate Of Samantha Wemyss Hopp

Bought by

Mendez Macario T and Mendez Norma E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$184,775

Interest Rate

5.57%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 17, 1997

Sold by

Hopper Francis A

Bought by

Hopper Francis A and Hopper Samantha W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,000

Interest Rate

7.23%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Baxter Terry L | $135,000 | Placer Title Company | |

| Mendez Macario T | $194,500 | Chicago Title | |

| Hopper Francis A | -- | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mendez Macario T | $184,775 | |

| Previous Owner | Hopper Francis A | $51,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,766 | $169,553 | $50,235 | $119,318 |

| 2024 | $2,700 | $166,229 | $49,250 | $116,979 |

| 2023 | $2,700 | $162,971 | $48,285 | $114,686 |

| 2022 | $2,610 | $159,777 | $47,339 | $112,438 |

| 2021 | $2,511 | $156,645 | $46,411 | $110,234 |

| 2020 | $2,461 | $155,040 | $45,936 | $109,104 |

| 2019 | $2,413 | $155,040 | $45,936 | $109,104 |

| 2018 | $2,343 | $149,021 | $44,153 | $104,868 |

| 2017 | $2,294 | $146,100 | $43,288 | $102,812 |

| 2016 | $2,108 | $143,237 | $42,440 | $100,797 |

| 2015 | $2,103 | $141,086 | $41,803 | $99,283 |

| 2014 | $2,043 | $138,324 | $40,985 | $97,339 |

Source: Public Records

Map

Nearby Homes

- 5904 Medio Luna Ave

- 2705 Puder St

- 3201 La Entrada Ct

- 0 Country Club Dr

- 4265 Country Club Dr

- 2605 Puder St

- 0 Claremont Dr

- 2713 Mcnutt St

- 3946 Claremont Dr

- 4120 Flintridge Dr

- 4303 Country Club Dr

- 5205 Lansdale Dr

- 3133 Caliente St

- 3112 Ridgedale St

- 3819 Mitchell Ave

- 3815 Mitchell Ave Unit A,B,C

- 3826 Oregon St

- 1011 Mccurdy Dr

- 6617 Dorva Ave

- 5008 College Ave

- 3416 Janene Way

- 3408 Janene Way

- 3431 Rayburn Way

- 3404 Janene Way

- 3504 Janene Way

- 3501 Rayburn Way

- 3425 Rayburn Way

- 3409 Janene Way

- 3507 Rayburn Way

- 3501 Janene Way

- 3400 Janene Way

- 3508 Janene Way

- 3405 Janene Way

- 3505 Janene Way

- 3513 Rayburn Way

- 3413 Rayburn Way

- 3401 Janene Way

- 3512 Janene Way

- 3312 Janene Way

- 5613 Malden Ct