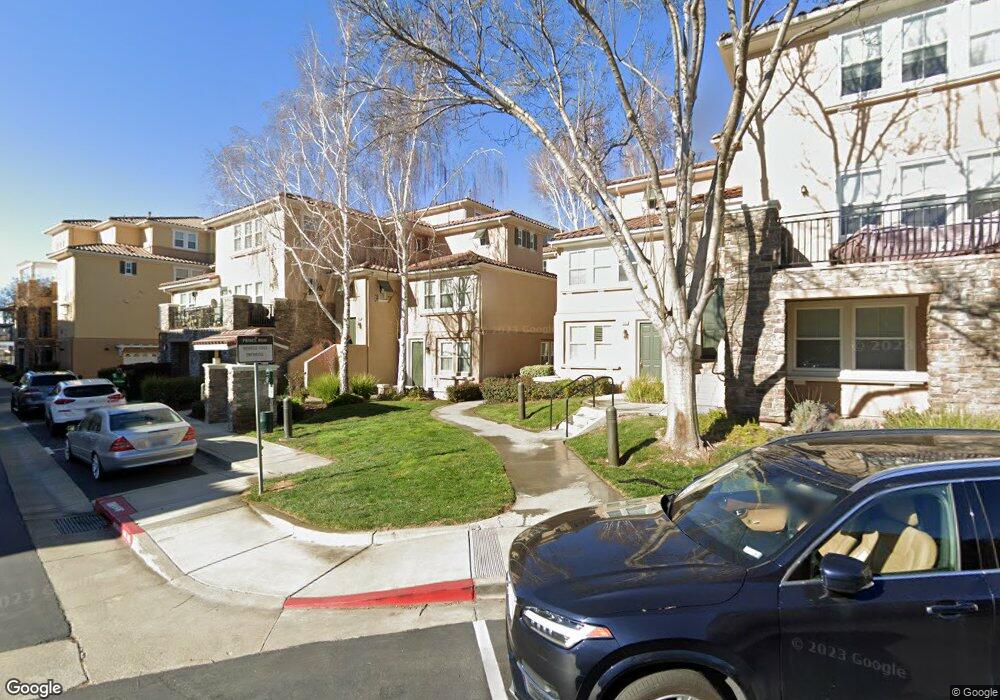

3417 Monaghan St Unit 95 Dublin, CA 94568

Dublin Ranch NeighborhoodEstimated Value: $688,752 - $791,000

2

Beds

2

Baths

1,292

Sq Ft

$582/Sq Ft

Est. Value

About This Home

This home is located at 3417 Monaghan St Unit 95, Dublin, CA 94568 and is currently estimated at $752,438, approximately $582 per square foot. 3417 Monaghan St Unit 95 is a home located in Alameda County with nearby schools including Harold William Kolb, Dublin High School, and SPRINGFIELD MONTESSORI SCHOOL.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 20, 2014

Sold by

Sim Eugene H

Bought by

Keswani Anita

Current Estimated Value

Purchase Details

Closed on

Jul 29, 2004

Sold by

Son Ji Eun

Bought by

Sim Eugene H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$298,983

Interest Rate

6.29%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 23, 2004

Sold by

Toll Dublin Llc

Bought by

Sim Eugene H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$298,983

Interest Rate

6.29%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Keswani Anita | $475,000 | Chicago Title Company | |

| Sim Eugene H | -- | Chicago Title Company | |

| Sim Eugene H | $471,000 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Sim Eugene H | $298,983 | |

| Closed | Sim Eugene H | $68,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,227 | $582,259 | $174,065 | $408,194 |

| 2024 | $8,227 | $570,844 | $170,652 | $400,192 |

| 2023 | $8,136 | $559,654 | $167,307 | $392,347 |

| 2022 | $8,000 | $548,681 | $164,027 | $384,654 |

| 2021 | $7,920 | $537,927 | $160,812 | $377,115 |

| 2020 | $7,416 | $532,412 | $159,163 | $373,249 |

| 2019 | $7,377 | $521,976 | $156,043 | $365,933 |

| 2018 | $7,192 | $511,745 | $152,985 | $358,760 |

| 2017 | $7,092 | $501,713 | $149,986 | $351,727 |

| 2016 | $6,477 | $491,876 | $147,045 | $344,831 |

| 2015 | $6,251 | $484,490 | $144,837 | $339,653 |

| 2014 | $6,369 | $485,000 | $145,500 | $339,500 |

Source: Public Records

Map

Nearby Homes

- 4363 Fitzwilliam St Unit 146

- 3225 Central Pkwy

- 3251 Monaghan St

- 3420 Finnian Way Unit 328

- 3360 Maguire Way Unit 201

- 3290 Maguire Way Unit 208

- 3290 Maguire Way Unit 118

- 3465 Dublin Blvd Unit 206

- 3385 Dublin Blvd Unit 308

- 3710 Central Pkwy Unit 165

- 3240 Maguire Way Unit 318

- 3240 Maguire Way Unit 401

- 3727 Central Pkwy Unit 28

- 3275 Dublin Blvd Unit 407

- 3613 Whitworth Dr

- 3769 Finnian Way Unit 52

- 3744 Whitworth Dr Unit 93

- 4126 Clarinbridge Cir

- 4433 Cherico Ln

- 4585 Brannigan St

- 3415 Monaghan St Unit 94

- 3413 Monaghan St Unit 93

- 3411 Monaghan St

- 3409 Monaghan St

- 3407 Monaghan St

- 3405 Monaghan St

- 3403 Monaghan St Unit 88

- 3401 Monaghan St Unit 87

- 3397 Monaghan St

- 3395 Monaghan St Unit 85

- 3393 Monaghan St

- 3391 Monaghan St

- 3389 Monaghan St

- 3387 Monaghan St

- 3385 Monaghan St Unit 80

- 3383 Monaghan St Unit 79

- 3381 Monaghan St

- 3419 Monaghan St

- 3421 Monaghan St

- 3423 Monaghan St Unit 103

Your Personal Tour Guide

Ask me questions while you tour the home.