3421 Beaver Trail Unit 10B Aurora, OH 44202

Estimated Value: $145,265 - $160,000

2

Beds

2

Baths

968

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 3421 Beaver Trail Unit 10B, Aurora, OH 44202 and is currently estimated at $152,066, approximately $157 per square foot. 3421 Beaver Trail Unit 10B is a home located in Summit County with nearby schools including Wilcox Primary School, Samuel Bissell Elementary School, and Dodge Intermediate School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2021

Sold by

Selby Janiene Glasko and Selby Janiene

Bought by

Chancone Dennis and Chancone Carla A

Current Estimated Value

Purchase Details

Closed on

May 14, 2018

Sold by

Witner Jon

Bought by

Selby Janiene

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,900

Interest Rate

4.4%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 11, 2009

Sold by

Kelvington Realty Company

Bought by

Wither Jon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$76,095

Interest Rate

4.85%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 4, 2005

Sold by

Kelvington Diane L and Kelvington James P

Bought by

Kelvington Realty Co

Purchase Details

Closed on

Jun 9, 2004

Sold by

Bosetti Sherie

Bought by

Kelvington Diane L and Kelvington James P

Purchase Details

Closed on

Feb 4, 1997

Sold by

Gogan Paul L

Bought by

Bosetti Sherie

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Chancone Dennis | $110,000 | Chicago Title | |

| Selby Janiene | $849,000 | Ohio Real Title | |

| Wither Jon | $77,500 | Boulevard Title Agency | |

| Kelvington Realty Co | -- | -- | |

| Kelvington Diane L | $54,100 | -- | |

| Bosetti Sherie | $68,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Selby Janiene | $77,900 | |

| Previous Owner | Wither Jon | $76,095 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,951 | $35,938 | $4,459 | $31,479 |

| 2024 | $1,859 | $35,938 | $4,459 | $31,479 |

| 2023 | $1,951 | $35,938 | $4,459 | $31,479 |

| 2022 | $1,541 | $26,621 | $3,304 | $23,317 |

| 2021 | $1,548 | $26,621 | $3,304 | $23,317 |

| 2020 | $1,566 | $26,620 | $3,300 | $23,320 |

| 2019 | $1,262 | $19,780 | $3,040 | $16,740 |

| 2018 | $1,239 | $19,780 | $3,040 | $16,740 |

| 2017 | $1,278 | $19,780 | $3,040 | $16,740 |

| 2016 | $1,271 | $21,740 | $3,300 | $18,440 |

| 2015 | $1,278 | $21,740 | $3,300 | $18,440 |

| 2014 | $1,275 | $21,740 | $3,300 | $18,440 |

| 2013 | $1,414 | $24,210 | $3,300 | $20,910 |

Source: Public Records

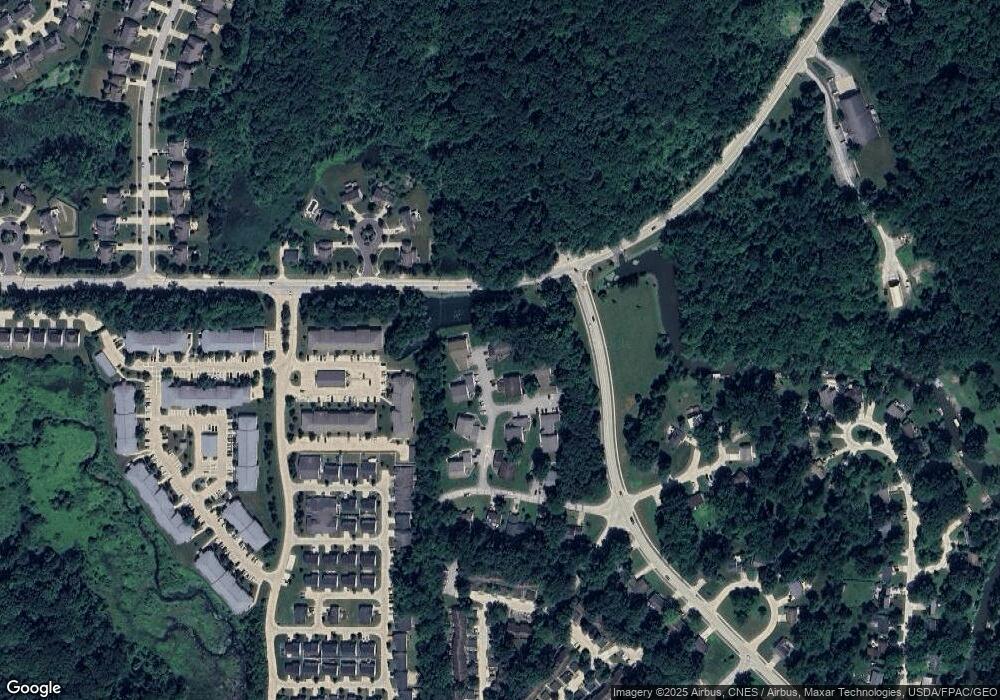

Map

Nearby Homes

- 10265 Beaver Trail

- 3336 Blossom Trail

- 10269 Smugglers Cove

- 3522 Castaway Cove

- 3624 Nautilus Trail

- 3660 Ivy Ct

- 3331 Shale Dr

- 3209 Fenmore Ln

- 3784 Firethorn Dr

- 3082 Willowbrook Dr

- 10358 Townley Ct

- 1174 Bryce Ave

- 2969 Country Club Ln Unit 14

- 11239 Stanley Ln

- 10202 Brighton Cir Unit 9

- 1085 Orchard Ave

- 9795 Burton Dr

- 1101 Lake Ave

- 3110 Blue Jaye Ln

- 1040 Moneta Ave

- 3413 Beaver Trail Unit D

- 3441 Beaver Trail Unit B

- 3425 Beaver Trail Unit C

- 3409 Beaver Trail

- 3441 Beaver Trail Unit C2

- 3441 Beaver Trail Unit 2B

- 3421 Beaver Trail

- 3445 Beaver Trail

- 3445 Beaver Trail Unit 1A

- 3405 Beaver Trail

- 3409 Beaver Trail Unit 6B

- 3417 Beaver Trail

- 3413 Beaver Trail Unit 9D

- 3425 Beaver Trail Unit 8A

- 3425 Beaver Trail Unit 8D

- 3405 Beaver Trail

- 3441 Beaver Trail Unit 2D

- 3429 Beaver Trail

- 3405 Beaver Trail

- 3417 Beaver Trail