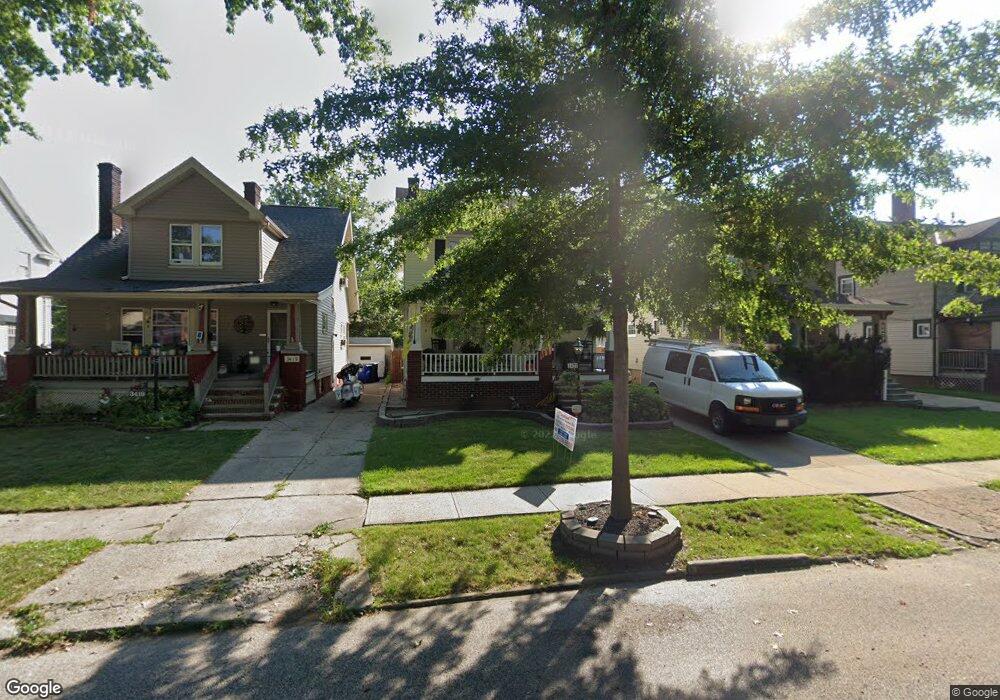

3423 W 129th St Cleveland, OH 44111

Jefferson NeighborhoodEstimated Value: $129,912 - $170,000

3

Beds

1

Bath

1,232

Sq Ft

$125/Sq Ft

Est. Value

About This Home

This home is located at 3423 W 129th St, Cleveland, OH 44111 and is currently estimated at $153,478, approximately $124 per square foot. 3423 W 129th St is a home located in Cuyahoga County with nearby schools including Almira Academy, Artemus Ward School, and Anton Grdina School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 21, 1998

Sold by

Popow Daniel P and Popow Pamela Ann

Bought by

Wright Dana T and Wright Stephanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,851

Outstanding Balance

$17,621

Interest Rate

6.99%

Mortgage Type

FHA

Estimated Equity

$135,857

Purchase Details

Closed on

May 8, 1986

Sold by

Sekic Asim

Bought by

Popow Daniel P

Purchase Details

Closed on

May 22, 1985

Sold by

Biasiotta Lou

Bought by

Sekic Asim

Purchase Details

Closed on

Apr 15, 1985

Bought by

Biasiotta Lou

Purchase Details

Closed on

Dec 26, 1984

Sold by

Sekic Diane Lynn

Bought by

Carlozzi Frank J - Trustee

Purchase Details

Closed on

May 22, 1984

Sold by

Sekic Asim

Bought by

Sekic Diane Lynn

Purchase Details

Closed on

Dec 14, 1982

Sold by

Bevelacqua Kathleen D

Bought by

Sekic Asim

Purchase Details

Closed on

Jan 1, 1975

Bought by

Bevelacqua Kathleen D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wright Dana T | $81,900 | Guardian Title | |

| Popow Daniel P | $30,000 | -- | |

| Sekic Asim | -- | -- | |

| Biasiotta Lou | $20,000 | -- | |

| Carlozzi Frank J - Trustee | $35,000 | -- | |

| Sekic Diane Lynn | -- | -- | |

| Sekic Asim | $19,000 | -- | |

| Bevelacqua Kathleen D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wright Dana T | $81,851 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,352 | $35,175 | $7,035 | $28,140 |

| 2023 | $1,940 | $25,030 | $4,480 | $20,550 |

| 2022 | $1,929 | $25,030 | $4,480 | $20,550 |

| 2021 | $1,911 | $25,030 | $4,480 | $20,550 |

| 2020 | $1,714 | $19,390 | $3,470 | $15,930 |

| 2019 | $1,587 | $55,400 | $9,900 | $45,500 |

| 2018 | $1,582 | $19,390 | $3,470 | $15,930 |

| 2017 | $1,858 | $21,980 | $3,920 | $18,060 |

| 2016 | $1,844 | $21,980 | $3,920 | $18,060 |

| 2015 | $1,949 | $21,980 | $3,920 | $18,060 |

| 2014 | $1,949 | $23,140 | $4,130 | $19,010 |

Source: Public Records

Map

Nearby Homes

- 12722 Lorain Ave

- 12718 Lorain Ave

- 3350 W 127th St

- 3434 W 129th St

- 3319 W 127th St

- 3502 W 128th St

- 3445 W 123rd St

- 3517 W 127th St

- 3303 W 123rd St

- 3329 W 131st St

- 3250 W 127th St

- 12413 Triskett Rd

- 3407 W 133rd St

- 3549 W 126th St

- 3404 W 119th St

- 3629 W 130th St

- 3582 W 126th St

- 3596 W 128th St

- 3597 W 126th St

- 3452 W 135th St

- 3419 W 129th St

- 3427 W 129th St

- 3415 W 129th St

- 3431 W 129th St

- 3418 W 128th St

- 3414 W 128th St

- 3411 W 129th St

- 3433 W 129th St

- 3420 W 128th St

- 3410 W 128th St

- 3422 W 128th St

- 3406 W 128th St

- 3407 W 129th St

- 3422 W 129th St

- 3426 W 129th St

- 3418 W 129th St

- 3402 W 128th St

- 3430 W 129th St

- 3414 W 129th St

- 3403 W 129th St