345 Willard Rd Ardmore, OK 73401

Estimated Value: $205,000 - $301,000

3

Beds

2

Baths

1,485

Sq Ft

$171/Sq Ft

Est. Value

About This Home

This home is located at 345 Willard Rd, Ardmore, OK 73401 and is currently estimated at $253,346, approximately $170 per square foot. 345 Willard Rd is a home located in Carter County with nearby schools including Dickson Elementary School, Dickson Upper Elementary School, and Dickson Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 16, 2025

Sold by

Preston Carrol D and Preston Deborah J

Bought by

Carrol And Deborah Preston Family Trust and Preston

Current Estimated Value

Purchase Details

Closed on

Jul 31, 2012

Sold by

Welch Linda L and Browne Linda L

Bought by

Preston Carrol D and Preston Deborah J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$114,835

Interest Rate

3.63%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 28, 1998

Sold by

Welch Raymond J and Welch Lin

Bought by

Welch Linda

Purchase Details

Closed on

Jun 26, 1998

Sold by

Welch Linda

Bought by

Browne Christopher and Browne L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Carrol And Deborah Preston Family Trust | -- | None Listed On Document | |

| Carrol And Deborah Preston Family Trust | -- | None Listed On Document | |

| Preston Carrol D | $125,333 | None Available | |

| Welch Linda | -- | -- | |

| Browne Christopher | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Preston Carrol D | $114,835 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,536 | $16,005 | $1,238 | $14,767 |

| 2024 | $1,536 | $15,539 | $1,238 | $14,301 |

| 2023 | $1,481 | $15,087 | $1,238 | $13,849 |

| 2022 | $1,345 | $14,647 | $1,238 | $13,409 |

| 2021 | $1,338 | $14,221 | $2,088 | $12,133 |

| 2020 | $1,318 | $14,221 | $2,088 | $12,133 |

| 2019 | $1,248 | $13,933 | $2,088 | $11,845 |

| 2018 | $1,225 | $13,527 | $2,088 | $11,439 |

| 2017 | $1,285 | $12,884 | $2,088 | $10,796 |

| 2016 | $1,201 | $12,270 | $2,088 | $10,182 |

| 2015 | $1,212 | $12,356 | $348 | $12,008 |

| 2014 | $1,298 | $13,228 | $348 | $12,880 |

Source: Public Records

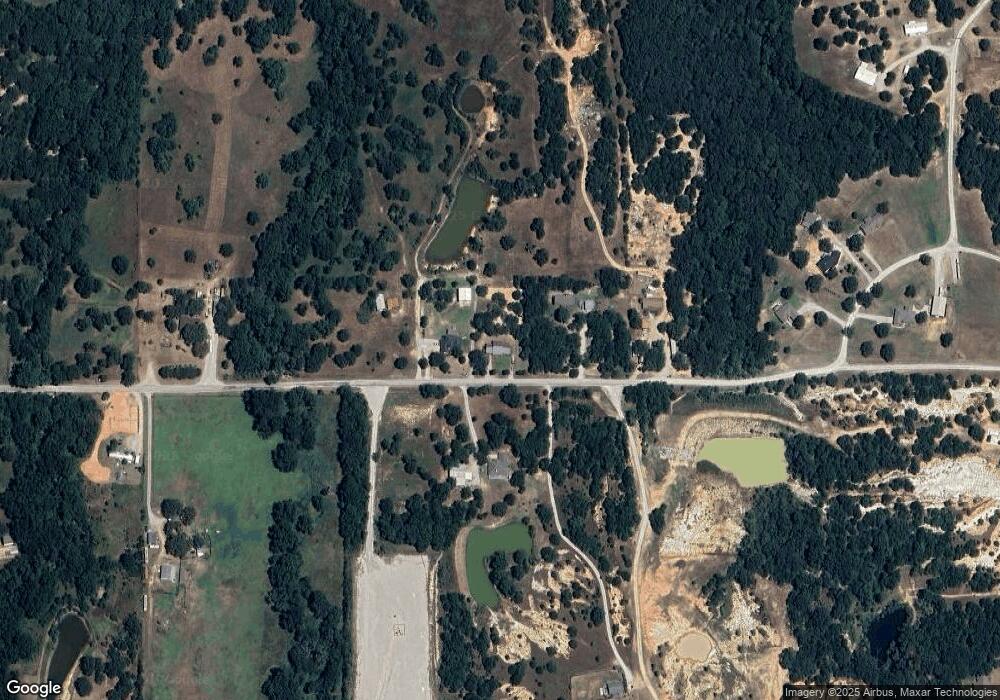

Map

Nearby Homes

- 6296 Dickson Rd

- 0 Highway 199

- 64 Crescent Ln

- 3419 State Highway 199

- 3484 State Highway 199

- 3376 Old Highway 70

- 3376 Old Hwy 70

- 4673 Highway 199

- 4695 Highway 199

- 268 Birch Rd

- 13 Titan Dr

- 2 Titan Dr

- 1 Titan Dr

- 24243 Tiny Chapel Rd

- 6389 Oklahoma 199

- 1114 Comet Rd

- 237 Killarney Dr

- 54 Pecan St

- 6 Grandview Rd

- 3 Grandview Rd

- 311 Willard Rd

- 387 Willard Rd

- 299 Willard Rd

- 324 Willard Rd

- 441 Willard Rd

- 420 Willard Rd

- 000 Willard Rd

- 376 Willard Rd

- 167 Willard Rd

- 208 Woodview Dr

- 156 Woodview Dr

- 150 Woodview Dr

- 191 Woodview Dr

- 176 Willard Rd

- 119 Northside Dr

- 0 Woodview Dr

- 693 Pinewood Trails Dr

- 7052 Dickson Rd

- 6884 Dickson Rd

- 246 Country Hill Rd