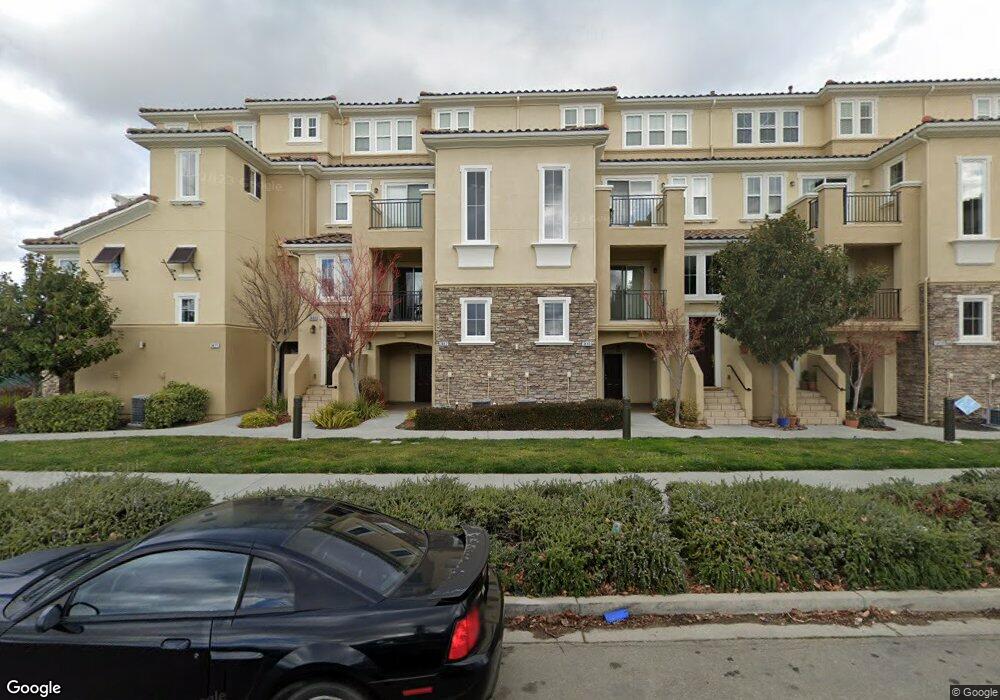

3467 Finnian Way Unit 258 Dublin, CA 94568

Dublin Ranch NeighborhoodEstimated Value: $850,000 - $897,000

3

Beds

3

Baths

1,897

Sq Ft

$456/Sq Ft

Est. Value

About This Home

This home is located at 3467 Finnian Way Unit 258, Dublin, CA 94568 and is currently estimated at $865,731, approximately $456 per square foot. 3467 Finnian Way Unit 258 is a home located in Alameda County with nearby schools including Harold William Kolb, Dublin High School, and The Quarry Lane School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 20, 2009

Sold by

Bo Joh Koh and Ko Whe Jan

Bought by

Clarke Janine Kelly

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Outstanding Balance

$211,243

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$654,488

Purchase Details

Closed on

Aug 26, 2009

Sold by

Castillo Jose Carmelo D and Castillo Augienette C

Bought by

Bo Joh Koh and Ko Whe Jan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$324,000

Outstanding Balance

$211,243

Interest Rate

5.05%

Mortgage Type

New Conventional

Estimated Equity

$654,488

Purchase Details

Closed on

Feb 2, 2006

Sold by

Toll Dublin Llc

Bought by

Castillo Jose Carmelo D and Castillo Augienette C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$483,500

Interest Rate

1.55%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Clarke Janine Kelly | $405,000 | Fidelity National Title Co | |

| Bo Joh Koh | $320,600 | None Available | |

| Castillo Jose Carmelo D | $604,500 | Chicago Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Clarke Janine Kelly | $324,000 | |

| Previous Owner | Castillo Jose Carmelo D | $483,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,414 | $515,744 | $156,823 | $365,921 |

| 2024 | $7,414 | $505,498 | $153,749 | $358,749 |

| 2023 | $7,328 | $502,450 | $150,735 | $351,715 |

| 2022 | $7,200 | $485,601 | $147,780 | $344,821 |

| 2021 | $7,123 | $475,945 | $144,883 | $338,062 |

| 2020 | $6,671 | $477,997 | $143,399 | $334,598 |

| 2019 | $6,624 | $468,624 | $140,587 | $328,037 |

| 2018 | $6,453 | $459,440 | $137,832 | $321,608 |

| 2017 | $6,360 | $450,432 | $135,129 | $315,303 |

| 2016 | $5,809 | $441,603 | $132,481 | $309,122 |

| 2015 | $5,606 | $434,973 | $130,492 | $304,481 |

| 2014 | $5,604 | $426,456 | $127,937 | $298,519 |

Source: Public Records

Map

Nearby Homes

- 3420 Finnian Way Unit 228

- 4353 Fitzwilliam St

- 3391 Monaghan St

- 3465 Dublin Blvd Unit 206

- 3290 Maguire Way Unit 101

- 3290 Maguire Way Unit 322

- 3275 Dublin Blvd Unit 306

- 3275 Dublin Blvd Unit 217

- 3240 Maguire Way Unit 103

- 3240 Maguire Way Unit 420

- 4258 Clarinbridge Cir

- 3783 Dunmore Ln

- 4222 Clarinbridge Cir

- 3933 Eminence St

- 3493 Capoterra Way

- 4153 Clarinbridge Cir Unit 127

- 4379 Brannigan St Unit 113

- 3730 Whitworth Dr

- 4585 Brannigan St

- 3056 Threecastles Way

- 3463 Finnian Way

- 3461 Finnian Way

- 3459 Finnian Way

- 3457 Finnian Way Unit 253

- 3455 Finnian Way Unit 252

- 3473 Finnian Way Unit 261

- 3471 Finnian Way

- 3469 Finnian Way

- 3465 Finnian Way

- 3453 Finnian Way Unit 251

- 4252 Fitzwilliam St

- 4234 Fitzwilliam St

- 4230 Fitzwilliam St Unit 249

- 4232 Fitzwilliam St

- 4236 Fitzwilliam St

- 4238 Fitzwilliam St Unit 245

- 4240 Fitzwilliam St Unit 244

- 4242 Fitzwilliam St Unit 243

- 4244 Fitzwilliam St

- 4248 Fitzwilliam St Unit 240