35 Theo Foster Rd Eastman, GA 31023

Estimated Value: $67,000 - $101,000

2

Beds

1

Bath

938

Sq Ft

$92/Sq Ft

Est. Value

About This Home

This home is located at 35 Theo Foster Rd, Eastman, GA 31023 and is currently estimated at $86,203, approximately $91 per square foot. 35 Theo Foster Rd is a home located in Dodge County with nearby schools including Dodge County High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 12, 2019

Sold by

Elizalde Juvencio

Bought by

Gonzalez Yesenia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$37,244

Outstanding Balance

$32,534

Interest Rate

3.6%

Estimated Equity

$53,669

Purchase Details

Closed on

Nov 3, 2009

Sold by

Yancey Dana Lynn

Bought by

Elizalde Juvencio

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,566

Interest Rate

4.92%

Mortgage Type

FHA

Purchase Details

Closed on

Sep 6, 2002

Sold by

Crooks Betty Est

Bought by

Yancey Dana

Purchase Details

Closed on

Sep 10, 1993

Bought by

Crooks Joe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzalez Yesenia | $39,206 | -- | |

| Elizalde Juvencio | $51,500 | -- | |

| Yancey Dana | $15,000 | -- | |

| Crooks Betty | -- | -- | |

| Crooks Joe | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gonzalez Yesenia | $37,244 | |

| Previous Owner | Elizalde Juvencio | $50,566 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $583 | $22,438 | $1,400 | $21,038 |

| 2023 | $579 | $22,438 | $1,400 | $21,038 |

| 2022 | $551 | $21,417 | $1,400 | $20,017 |

| 2021 | $542 | $20,979 | $1,400 | $19,579 |

| 2020 | $411 | $20,979 | $1,400 | $19,579 |

| 2019 | $482 | $18,181 | $1,400 | $16,781 |

| 2018 | $465 | $18,181 | $1,400 | $16,781 |

| 2017 | $465 | $18,181 | $1,400 | $16,781 |

| 2016 | $443 | $17,340 | $1,400 | $15,940 |

| 2015 | -- | $17,340 | $1,400 | $15,940 |

| 2014 | -- | $17,340 | $1,400 | $15,940 |

| 2013 | -- | $17,340 | $1,400 | $15,940 |

Source: Public Records

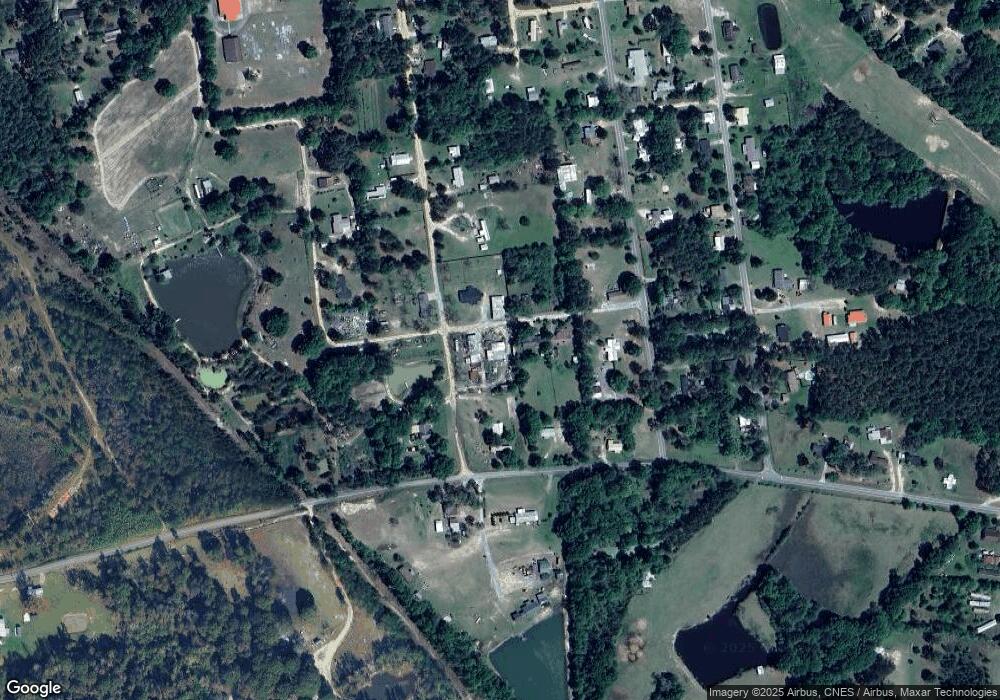

Map

Nearby Homes

- 6515 Fred Bohannon Rd

- 0 Shady Oaks Rd Unit 10400925

- 0 Shady Oaks Rd Unit 246471

- 534 Soperton Hwy

- 0 Windy Way

- 0 Forest Ave Unit 10588959

- 5533 Russell Ave

- 5616 Beulah Ave

- 5811 5th Ave

- 0 Williams Dr Unit 10632909

- 5422 1st Ave

- 220 Page St

- 0 Jim Pruett Rd Unit 25211863

- 0 Jim Pruett Rd Unit 10540625

- 5859 8th Ave

- 5218 4th Ave

- 619 Cooper Ave

- 1348 Minter Ridge

- 139 Magnolia St

- 0 7th Ave Unit 10632904

- 29 Theo Foster Rd

- 34 Theo Foster Rd

- 50 Theo Foster Rd

- 146 Charlie Singletary Rd

- 153 Charlie Singletary Rd

- 120 King Rd

- 6409 Fred Bohannon Rd

- 314 Charlie Singletary Rd

- 127 King Rd

- 6451 Fred Bohannon Rd

- 90 King Rd

- 6364 Fred Bohannon Rd

- 81 Charlie Singletary Rd

- 163 King Rd

- 97 King Rd

- 122 Theo Foster Rd

- 130 Wp Lowery Rd

- 77 King Rd

- 150 W P Lowery Rd

- 122 W P Lowery Rd