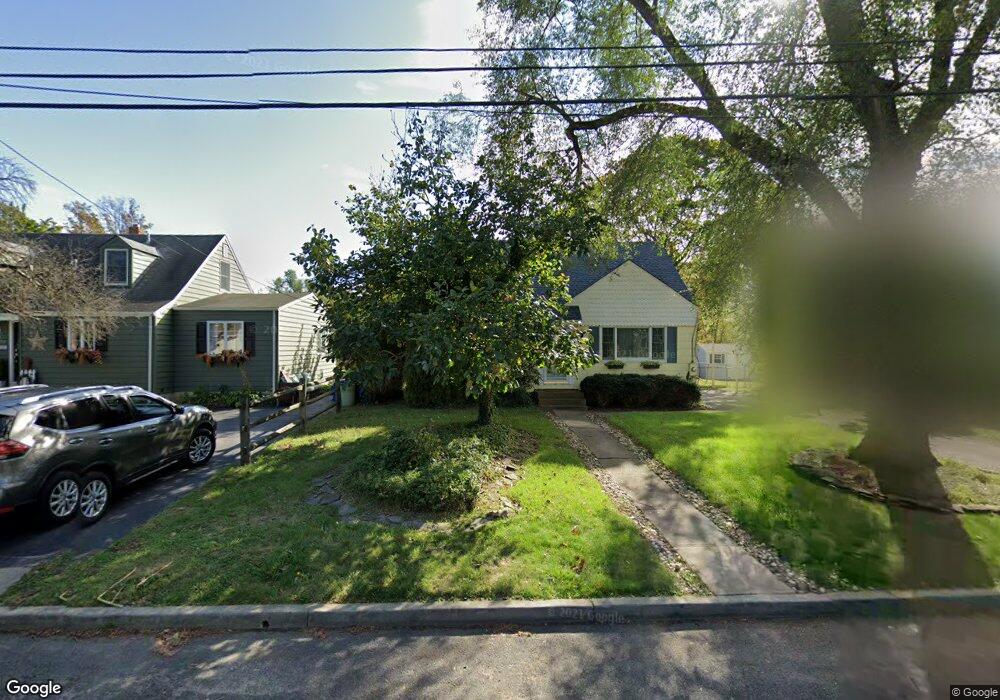

35 Waldron Dr Allentown, NJ 08501

Estimated Value: $460,000 - $568,000

3

Beds

1

Bath

1,075

Sq Ft

$482/Sq Ft

Est. Value

About This Home

This home is located at 35 Waldron Dr, Allentown, NJ 08501 and is currently estimated at $518,624, approximately $482 per square foot. 35 Waldron Dr is a home located in Monmouth County with nearby schools including Newell Elementary School, Stonebridge Middle School, and Allentown High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 2, 2025

Sold by

Blatter Gedalya

Bought by

Episcopo Kelsey

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$323,000

Outstanding Balance

$322,713

Interest Rate

6.58%

Mortgage Type

New Conventional

Estimated Equity

$195,911

Purchase Details

Closed on

May 19, 2025

Sold by

Csmc 2017-Rpl3 Trust

Bought by

Blatter Gedalya

Purchase Details

Closed on

Jan 9, 2025

Sold by

Sheriff Of The County Of Monmouth

Bought by

Csmc 2017-Rpl3 Trust

Purchase Details

Closed on

Jul 31, 2006

Sold by

Didomenico John F

Bought by

Wade Heather

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$319,500

Interest Rate

2.25%

Mortgage Type

Adjustable Rate Mortgage/ARM

Purchase Details

Closed on

Nov 12, 2003

Sold by

Scott Donna

Bought by

Didomenico John

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$156,000

Interest Rate

5.62%

Purchase Details

Closed on

May 7, 1999

Sold by

Rankin Herbert

Bought by

Didomenico John and Scott Donna

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,200

Interest Rate

6.85%

Purchase Details

Closed on

Jan 19, 1995

Sold by

Lang Timothy

Bought by

Rankin Herbert and Rankin Yvette

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Interest Rate

7.13%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Episcopo Kelsey | $553,000 | Shepherd Title | |

| Blatter Gedalya | $312,000 | Servicelink | |

| Blatter Gedalya | $312,000 | Servicelink | |

| Csmc 2017-Rpl3 Trust | $1,000 | None Listed On Document | |

| Csmc 2017-Rpl3 Trust | $1,000 | None Listed On Document | |

| Wade Heather | $355,000 | -- | |

| Didomenico John | $40,000 | -- | |

| Didomenico John | $154,000 | -- | |

| Rankin Herbert | $150,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Episcopo Kelsey | $323,000 | |

| Previous Owner | Wade Heather | $319,500 | |

| Previous Owner | Didomenico John | $156,000 | |

| Previous Owner | Didomenico John | $123,200 | |

| Previous Owner | Rankin Herbert | $117,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,636 | $206,200 | $120,000 | $86,200 |

| 2024 | $5,934 | $206,200 | $120,000 | $86,200 |

| 2023 | $5,934 | $206,200 | $120,000 | $86,200 |

| 2022 | $5,714 | $206,200 | $120,000 | $86,200 |

| 2021 | $5,714 | $206,200 | $120,000 | $86,200 |

| 2020 | $6,085 | $206,200 | $120,000 | $86,200 |

| 2019 | $6,246 | $206,200 | $120,000 | $86,200 |

| 2018 | $6,302 | $206,900 | $120,000 | $86,900 |

| 2017 | $6,306 | $206,900 | $120,000 | $86,900 |

| 2016 | $6,294 | $206,900 | $120,000 | $86,900 |

| 2015 | $5,823 | $205,700 | $120,000 | $85,700 |

| 2014 | $5,757 | $205,100 | $120,000 | $85,100 |

Source: Public Records

Map

Nearby Homes

- 34 N Main St

- 22 Route 524

- 35 Church St

- 11 Probasco Dr

- 8 Coates Rd

- 30 Ridgeview Way

- 33 Bunker Hill Dr

- 40 Bunker Hill Dr

- 10 Powderhorn Way

- 16 Powderhorn Way

- 81 Potts Rd

- 79 Potts Rd

- 151 Walnford Rd

- 467 Gordon Rd

- 6 Meetinghouse Rd

- 8 Meetinghouse Rd

- 10 Meetinghouse Rd

- 3 Dartmouth Ct

- 9 Meetinghouse Rd

- STONEHAVEN II Plan at Old York Estates