35183 Cutter Rd Coarsegold, CA 93614

Estimated Value: $398,000 - $442,000

3

Beds

2

Baths

2,080

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 35183 Cutter Rd, Coarsegold, CA 93614 and is currently estimated at $425,642, approximately $204 per square foot. 35183 Cutter Rd is a home located in Madera County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 27, 2022

Sold by

Ewert Steven N and Ewert Sophia L

Bought by

Ewert Steven N and Ewert Sophia L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Outstanding Balance

$47,575

Interest Rate

5.27%

Mortgage Type

Credit Line Revolving

Estimated Equity

$378,067

Purchase Details

Closed on

Oct 4, 2016

Sold by

Ewert Steven N and Ewert Sophia L

Bought by

Ewert Steve N and Ewert Sophia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$145,000

Interest Rate

3.46%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 17, 2002

Sold by

Mitchell John V and Mitchell Susan E

Bought by

Ewert Steven N and Ewert Sophia L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,000

Interest Rate

5.96%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ewert Steven N | -- | Placer Title | |

| Ewert Steve N | -- | Chicago Title Company | |

| Ewert Steven N | $225,000 | Chicago Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ewert Steven N | $50,000 | |

| Previous Owner | Ewert Steve N | $145,000 | |

| Previous Owner | Ewert Steven N | $175,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,288 | $325,852 | $108,613 | $217,239 |

| 2023 | $3,288 | $313,201 | $104,397 | $208,804 |

| 2022 | $3,213 | $307,060 | $102,350 | $204,710 |

| 2021 | $3,147 | $301,041 | $100,344 | $200,697 |

| 2020 | $3,135 | $297,956 | $99,316 | $198,640 |

| 2019 | $3,078 | $292,115 | $97,369 | $194,746 |

| 2018 | $3,011 | $286,388 | $95,460 | $190,928 |

| 2017 | $2,965 | $280,774 | $93,589 | $187,185 |

| 2016 | $2,865 | $275,269 | $91,754 | $183,515 |

| 2015 | $2,821 | $271,135 | $90,376 | $180,759 |

| 2014 | $2,644 | $252,622 | $82,541 | $170,081 |

Source: Public Records

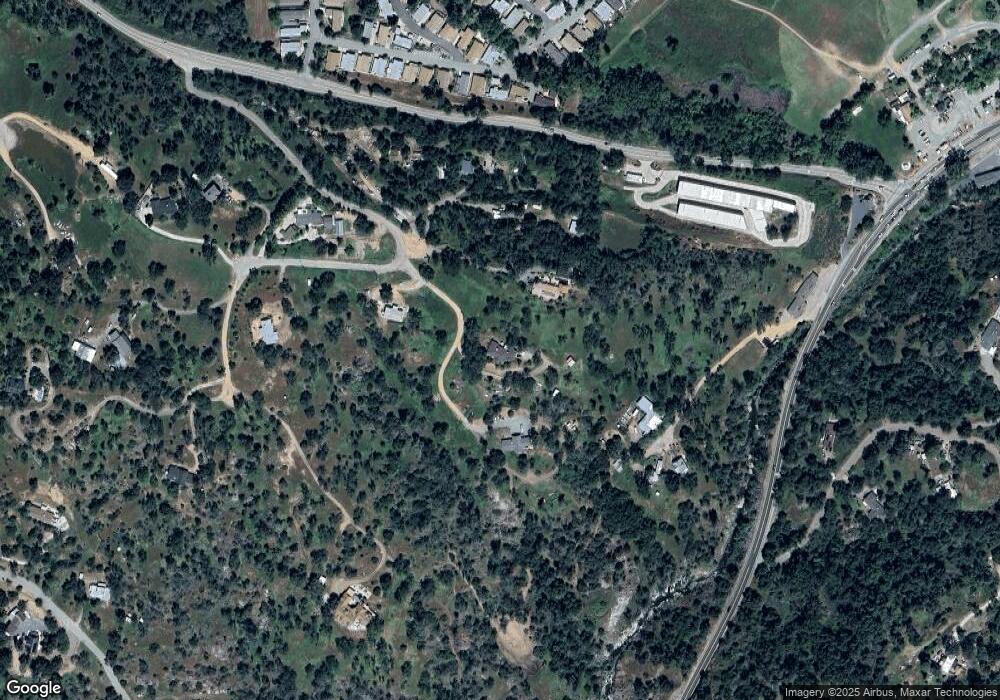

Map

Nearby Homes

- 46455 Konklin Rd

- 0 0 Unit IV24173054

- 0 Veater Ranch Rd

- 46041 Road 415 Unit 27

- 46041 Road 415 Unit 179

- 46041 Road 415 Unit 140

- 0 Farmstead Rd

- 35441 Highway 41

- 35680 Forest Dr

- 0 Stone Ridge Ln

- 45318 Road 415

- 3 Acres Serendipity Ln

- 56 Serendipity Ln Unit Lot56

- 47180 Lookout Mountain Dr

- 2 Buggy Whip Ln

- 1 Buggy Whip Ln

- 54544 Sunshine Terrace Dr

- 0 Sunshine Terrace Dr Unit FR24180116

- 2 Summerhill Ln

- 46304 Skyline Ridge Rd

- 35215 Cutter Rd

- 35235 Cutter Rd

- 35135 Cutter Rd

- 35241 Cutter Rd

- 5 Strawberry Rd

- 46961 Raymond Rd Unit 189

- 46027 Strawberry Rd

- 46022 Strawberry Rd

- 35262 Highway 41

- 5 Raymond Road 415

- 35161 Highway 41

- 46005 Strawberry Rd

- 46061 Road 415 Unit 26

- 46061 Road 415 Unit 189

- 45806 Strawberry Rd

- 35115 Highway 41

- 46001 Strawberry Rd

- 45911 Farmstead Rd

- 45865 Strawberry Rd

- 45967 Strawberry Rd